SALES and USE TAX TECHNICAL BULLETINS SECTION 8 North Form

Understanding the SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North

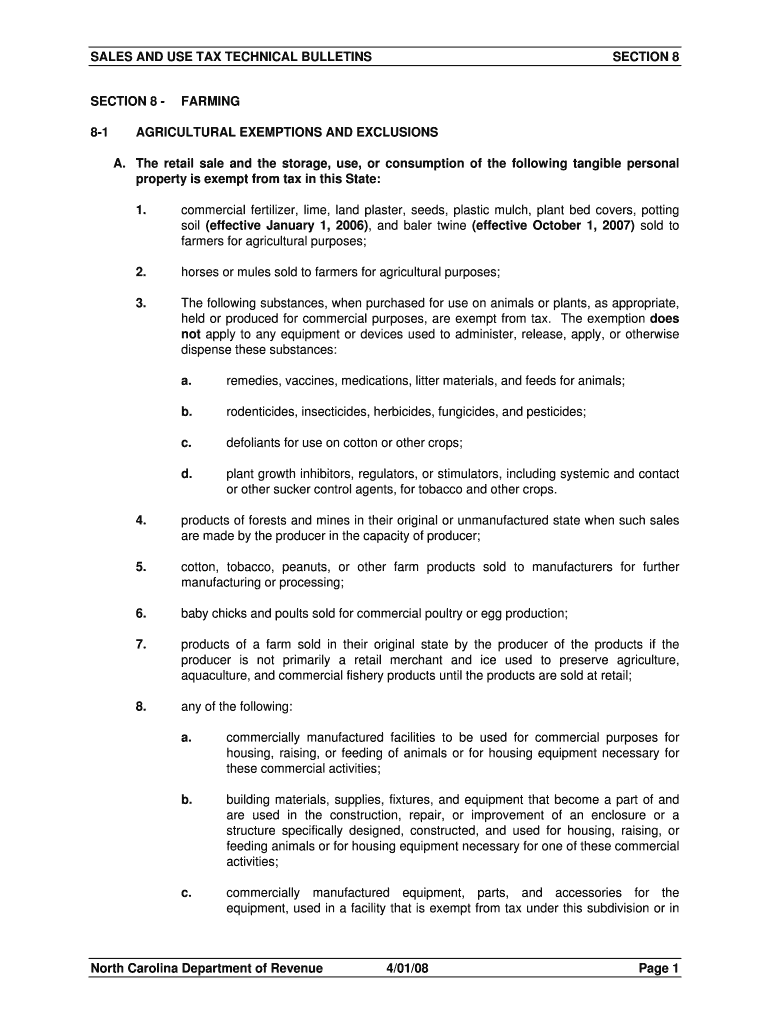

The SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North provides essential guidelines for understanding tax obligations related to sales and use tax in specific jurisdictions. This form serves as a reference for businesses and individuals to navigate the complexities of tax regulations. It outlines the necessary compliance measures and clarifications that taxpayers need to be aware of when engaging in transactions subject to sales and use tax. By familiarizing oneself with this bulletin, users can ensure they meet their legal obligations and avoid potential pitfalls.

Steps to Complete the SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North

Completing the SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North involves a series of straightforward steps to ensure accuracy and compliance. First, gather all relevant financial documents and transaction records that pertain to the sales and use tax. Next, carefully review the guidelines provided in the bulletin to understand the specific requirements applicable to your situation. Fill out the necessary sections of the form, ensuring that all information is accurate and complete. Finally, double-check your entries before submitting the form to ensure compliance with state regulations.

Legal Use of the SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North

The legal use of the SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North is crucial for ensuring that transactions are compliant with state tax laws. This form is recognized as a legitimate document that can support claims for tax exemptions or clarify tax liabilities. To be legally binding, it must be filled out accurately and submitted according to the guidelines outlined in the bulletin. Users should be aware of their rights and responsibilities under the law when utilizing this form, as improper use could lead to penalties or legal repercussions.

Key Elements of the SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North

Key elements of the SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North include definitions of taxable goods and services, exemptions, and specific instructions for completing the form. It also details the necessary documentation required to support claims made on the form. Understanding these elements is essential for ensuring that users can accurately report their sales and use tax obligations. Additionally, the bulletin may provide insights into recent changes in tax law that could affect compliance.

State-Specific Rules for the SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North

State-specific rules play a significant role in the application of the SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North. Each state may have unique regulations regarding what constitutes taxable transactions, exemptions, and filing requirements. It is important for users to familiarize themselves with their state's specific rules to ensure compliance. This knowledge can help avoid costly mistakes and ensure that all tax obligations are met in accordance with local laws.

Examples of Using the SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North

Examples of using the SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North can provide clarity on how to apply the guidelines in real-world scenarios. For instance, a business may refer to the bulletin to determine whether a specific product is taxable or if it qualifies for an exemption. Additionally, individuals may use the bulletin to understand their obligations when making purchases for business use. These examples illustrate the practical application of the form and highlight its importance in everyday transactions.

Quick guide on how to complete sales and use tax technical bulletins section 8 north

Effortlessly Prepare [SKS] on Any Device

Online document management has gained traction among businesses and individuals. It presents a perfect eco-friendly substitute for traditional printed and signed documents, enabling you to locate the right format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign [SKS] with Ease

- Locate [SKS] and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or redact sensitive information with tools specially provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then press the Done button to save your modifications.

- Select your preferred method to share your document, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searching, or mistakes that require printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

How illegal immigrants file taxes (presumably using ITIN) while paying taxes using fake SSN? How IRS accepts such forms as SSN used to pay tax and ITIN used for filling tax don't match?

Illegal immigrants are not authorized to work in the US and are not entitled to all the benefits of a citizen or legal resident, However, if they are here they are expected to pay taxes as any citizen would. If they choose to work, they are expected to pay income taxes.If they use a fake Social Security number to obtain work, it usually belongs to another person. This is illegal and could result in being ineligible to get a green card because any reported wages would be tracked to the account of the actual owner of the Social Security number along with any FICA/ Medicare taxes that the employer withholds.In order to isolate the tax reporting for the immigrant from that of the actual Social Security holder, the IRS issues an Individual Tax Identification Number (ITIN) to the immigrant under which he/she may report their earnings. When the copies of any W-2 or other withholding documents with fake SSN are included on the return, then the IRS now has the ability to segregate the wages that are incorrectly reported and notify Social Security Administration to segregate any reported FICA/ Medicare from the actual owner’s account.If the immigrant works “under the table” in either a cash-based transaction or self-employed status, it does not remove the obiligation to correctly report earnings. It just changes the forms required on the tax return and may incur penalties to worker and/or the employer.Disclaimer: Since you are not my client, the above message is not intended to constitute written tax advice,but general information for discussion purposes only. You should not, therefore, interpret the statements to be written tax advice or rely on the statements for any purpose.

-

How do I declare a short term capital gain tax in the ITR in India? I want to know about the ITR form number and where and what to fill in the details. This is my first time to pay a short term capital gain tax on an equity sale.

The selection of ITR form will depend upon the type of one's income.For Income from salary, house property, capital gains for ITR2 is suggestedHowever for income from above heads and business/profession ITR4 is suggestedIn both the forms under head CG, revenue from sale of equity shares are required to be mentioned along with purchase amount and expenses incurred on sale are also required to be mentioned.For short term and long term separate rows are there.Just fill up and it will take the net capital gain to respective cell in computation if income.

-

How do you use Quickbooks for dropshipping to keep your finances in check? How do I record all the sales and payments, keeping track of the finances and be ready to submit tax forms and all?

Hi Ricky,Drop shipping product affects how you would track inventory. Typically, one would invoice after the shipment is made. Do you produce inventory or just buy/sell/rep for products? If you produce the inventory yourself, you would want to capture the materials purchased, the assembly, the increase in inventory when built. Then when you ship, you can invoice and it decreases your inventory value and increases your Cost of Goods Sold.QuickBooks is a powerful tool to track all of the transactions that occur. From prepaying your vendor, customer deposits, receiving a vendor bill, invoicing your customer, receiving payments and making deposits. Can you tell I love my accounting software?

Related searches to SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax technical bulletins section 8 north

How to create an eSignature for the Sales And Use Tax Technical Bulletins Section 8 North online

How to generate an electronic signature for your Sales And Use Tax Technical Bulletins Section 8 North in Google Chrome

How to generate an electronic signature for putting it on the Sales And Use Tax Technical Bulletins Section 8 North in Gmail

How to make an electronic signature for the Sales And Use Tax Technical Bulletins Section 8 North right from your smartphone

How to make an eSignature for the Sales And Use Tax Technical Bulletins Section 8 North on iOS

How to generate an electronic signature for the Sales And Use Tax Technical Bulletins Section 8 North on Android devices

People also ask

-

What are SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North?

SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North provides businesses with crucial guidance on tax compliance. These technical bulletins interpret regulations and offer clarity on various tax-related processes, helping organizations to stay informed and compliant.

-

How can airSlate SignNow assist with the requirements of SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North?

AirSlate SignNow simplifies the process of obtaining necessary signatures on documents related to SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North. By digitizing your document workflow, it ensures that tax compliance documents are signed and stored efficiently.

-

Is airSlate SignNow cost-effective for businesses needing to comply with SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North?

Yes, airSlate SignNow offers an affordable solution for businesses needing to navigate SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North. With flexible pricing plans, it provides value by reducing paper costs and enhancing productivity.

-

What features does airSlate SignNow offer for managing SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North documents?

AirSlate SignNow includes features like customizable templates, automated workflows, and secure storage that are ideal for managing documents pertaining to SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North. This streamlined approach saves time and minimizes errors in document handling.

-

Can airSlate SignNow integrate with accounting software relevant to SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North?

Absolutely! AirSlate SignNow offers integrations with various accounting software, enabling seamless tracking and management of documents related to SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North. This ensures that you can handle all your financial documentation efficiently.

-

What are the benefits of using airSlate SignNow for SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North compliance?

Using airSlate SignNow for SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North compliance enhances efficiency and accuracy in document management. It reduces the turnaround time for obtaining signatures and helps maintain organized records for audits.

-

How secure is airSlate SignNow when dealing with SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North documents?

AirSlate SignNow prioritizes security with advanced encryption protocols, ensuring that all documents, including those relating to SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North, are safe. This commitment to security protects sensitive information during the signing process.

Get more for SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North

Find out other SALES AND USE TAX TECHNICAL BULLETINS SECTION 8 North

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free