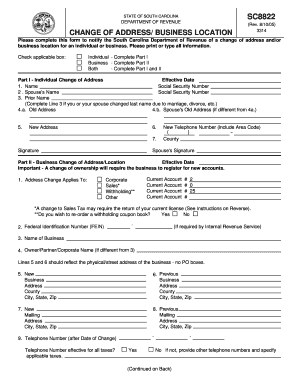

Sc 8822 Form

What is the SC 8822?

The SC 8822 form is a document used by individuals to request a change of address with the Internal Revenue Service (IRS). This form is essential for ensuring that taxpayers receive important tax documents and correspondence at their current address. By submitting the SC 8822, individuals can maintain accurate records with the IRS and avoid potential issues related to missed notifications or tax returns. The form is particularly useful for those who have recently moved or changed their residency status.

How to use the SC 8822

Using the SC 8822 form involves a straightforward process. First, download the form from the IRS website or obtain a physical copy. Next, fill out the required fields, including your old address, new address, and personal information such as your name and Social Security number. After completing the form, review it for accuracy. Finally, submit the SC 8822 to the IRS via mail to the address specified in the form’s instructions. It is advisable to keep a copy of the completed form for your records.

Steps to complete the SC 8822

Completing the SC 8822 form requires careful attention to detail. Follow these steps:

- Download the SC 8822 form from the IRS website.

- Provide your full name, Social Security number, and the old address from which you are moving.

- Enter your new address accurately, ensuring all information is correct.

- Sign and date the form to certify that the information is true and complete.

- Mail the completed form to the appropriate IRS address as indicated in the instructions.

Legal use of the SC 8822

The SC 8822 form is legally binding when completed and submitted according to IRS guidelines. It is crucial to provide accurate information to avoid legal complications. The IRS relies on the information provided in this form to update their records, which can affect your tax filings and any correspondence you may receive. Misrepresentation or failure to submit the form can lead to penalties or delays in processing your tax-related documents.

Filing Deadlines / Important Dates

When using the SC 8822 form, it is essential to be aware of any relevant deadlines. Generally, it is recommended to submit the form as soon as you change your address to ensure that the IRS has your updated information. While there are no specific filing deadlines for the SC 8822, timely submission helps avoid complications during tax season. Keeping track of important tax dates, such as filing deadlines for tax returns, can also aid in maintaining compliance with IRS regulations.

Form Submission Methods

The SC 8822 form can be submitted to the IRS through traditional mail. After completing the form, ensure that it is sent to the correct address specified in the form's instructions. Currently, there are no options for electronic submission of the SC 8822. Therefore, it is important to account for mailing time when submitting the form, especially close to tax deadlines.

Quick guide on how to complete sc 8822

Effortlessly Prepare Sc 8822 on Any Device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly and without hold-ups. Manage Sc 8822 on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Sc 8822 with Ease

- Find Sc 8822 and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes requiring new document printouts. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Sc 8822 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc 8822

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SC 8822 and how does it relate to airSlate SignNow?

SC 8822 refers to a specific document or form that can be easily managed through airSlate SignNow. This platform allows businesses to send, receive, and eSign SC 8822 documents efficiently, streamlining the process and ensuring compliance.

-

What are the pricing options for using airSlate SignNow for SC 8822 documents?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs. Whether you are a small business or a large enterprise, you can find a cost-effective solution for managing SC 8822 documents and more. For detailed pricing, visit our website for the latest information.

-

What features does airSlate SignNow provide for SC 8822 management?

airSlate SignNow provides features like document templates, customizable workflows, and secure eSigning specifically for managing SC 8822 files. Additionally, it allows file tracking and collaboration, ensuring everyone involved in the process is on the same page.

-

How can using airSlate SignNow benefit my business in regards to SC 8822?

Using airSlate SignNow for SC 8822 can signNowly increase efficiency and reduce turnaround time for document signing. The platform’s user-friendly interface makes it easy for employees and clients to manage documents, ultimately enhancing productivity and customer satisfaction.

-

Does airSlate SignNow integrate with other software for handling SC 8822 documents?

Yes, airSlate SignNow seamlessly integrates with various platforms such as CRM systems and cloud storage services to streamline the handling of SC 8822 documents. This integration helps in reducing data entry errors and enhances overall workflow efficiency.

-

Is airSlate SignNow secure for signing SC 8822 documents?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure user authentication, to protect your SC 8822 documents. This ensures that all signed documents are safe and meets industry compliance standards.

-

Who can benefit from using airSlate SignNow for SC 8822?

Various professionals and organizations can benefit from airSlate SignNow for SC 8822, including legal firms, businesses managing contracts, and any entity that requires efficient document signing. Its versatility allows it to cater to a wide range of industries.

Get more for Sc 8822

- Alaska commercial form

- Contractor formsconstruction contract formsus legal

- Control number ak p052 pkg form

- Control number ak p054 pkg form

- Demolition contractors forms packageus legal forms

- Security contractors form

- Construction contract forms and agreements us legal forms

- Control number ak p059 pkg form

Find out other Sc 8822

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment