Ar941a Form

What is the AR941A Form

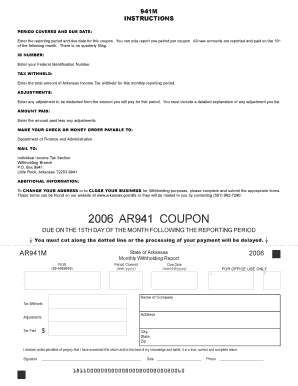

The AR941A form, also known as the Arkansas Annual Withholding Tax Return, is a crucial document for businesses operating in Arkansas. This form is used to report the amount of state income tax withheld from employees' wages throughout the year. Employers must submit this form annually to ensure compliance with state tax regulations and to provide accurate information to the Arkansas Department of Finance and Administration.

How to Use the AR941A Form

Using the AR941A form involves several steps to ensure accurate reporting of withheld taxes. Employers should start by gathering all relevant payroll records for the year, including total wages paid and the amount of state tax withheld. The form requires specific details such as the employer's identification number, business name, and address. After filling out the necessary information, employers must submit the form to the appropriate state agency by the designated deadline.

Steps to Complete the AR941A Form

Completing the AR941A form involves a systematic approach:

- Gather payroll records for the year, including total wages and withholdings.

- Fill in the employer's identification number, business name, and address.

- Report the total amount of state tax withheld during the year.

- Review the form for accuracy and completeness.

- Submit the form by mail or electronically, depending on state requirements.

Legal Use of the AR941A Form

The AR941A form is legally required for employers in Arkansas to report withheld income taxes. Failure to file this form can lead to penalties and interest on unpaid taxes. The form must be completed accurately to ensure compliance with state tax laws, and it serves as a record of the employer's tax obligations for the reporting year.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the AR941A form to avoid penalties. The form is typically due on January 31 of the following year for the previous calendar year's withholdings. It is essential to mark this date on the calendar and ensure that all information is submitted on time to maintain compliance with Arkansas tax regulations.

Form Submission Methods

The AR941A form can be submitted through various methods, providing flexibility for employers:

- Online submission via the Arkansas Department of Finance and Administration's website.

- Mailing a paper copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete ar941a form 16625149

Prepare Ar941a Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, amend, and electronically sign your documents swiftly without setbacks. Handle Ar941a Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The simplest method to modify and eSign Ar941a Form with ease

- Locate Ar941a Form and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you'd like to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Ar941a Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar941a form 16625149

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ar941a?

airSlate SignNow is a powerful eSignature solution designed to streamline document workflows. The ar941a is a key feature in our platform that enhances document management capabilities, enabling users to send and sign documents efficiently, ensuring compliance and security.

-

How much does airSlate SignNow cost for ar941a features?

airSlate SignNow offers competitive pricing plans that cater to various business needs. The cost for accessing the ar941a features is designed to fit within budgets, making it a cost-effective option for businesses looking to optimize their eSigning processes.

-

What are the key features of ar941a in airSlate SignNow?

The ar941a feature in airSlate SignNow includes advanced document tracking, secure storage, and automated workflows. These functionalities allow users to manage their documents seamlessly while enhancing security and compliance during the signing process.

-

What benefits does ar941a provide to businesses using airSlate SignNow?

By utilizing the ar941a capabilities, businesses can signNowly reduce turnaround times for document signings, increase efficiency, and improve overall customer satisfaction. This results in faster deal closures and better resource management.

-

Can airSlate SignNow integrate with other software and apps along with ar941a?

Yes, airSlate SignNow, including the ar941a features, offers robust integrations with various software applications. This allows users to connect with CRM systems, cloud storage solutions, and other business tools, creating a cohesive and streamlined workflow.

-

How secure is the ar941a feature in airSlate SignNow?

Security is a top priority for airSlate SignNow, especially concerning the ar941a feature. Our platform uses advanced encryption and compliance protocols to ensure that documents are handled safely, protecting sensitive information from unauthorized access.

-

Is it easy to use airSlate SignNow and the ar941a functionality?

Absolutely! airSlate SignNow is designed with user-friendliness in mind. The ar941a functionality is intuitive, allowing users of all tech levels to quickly grasp how to send and sign documents without any steep learning curve.

Get more for Ar941a Form

- Kitchen ampamp laundry appliancesfisher ampamp paykel usa form

- Qanonresearch q research general 9443 john durham form

- Petitioner in propria persona check applicable box form

- In the matter of the petition of type or print name of person whose name is being changed form

- Proof of service by personal service change of name form

- Pretrial services division los angeles county probation form

- Fillable online ibc no fax email print pdffiller form

- Attachment for each minor whose name is to be changed form

Find out other Ar941a Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors