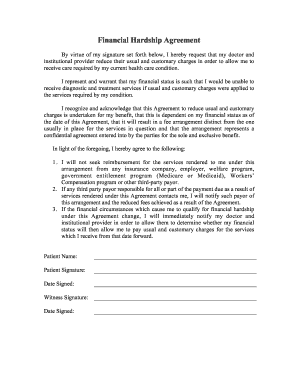

Financial Hardship Agreement Form

What is the VA Form 1100?

The VA Form 1100, also known as the VA Form 1100 Agreement to Pay Indebtedness, is a document used by veterans to formalize an agreement regarding repayment of debts owed to the Department of Veterans Affairs (VA). This form is essential for veterans who may have incurred overpayments or other debts that require resolution. By signing this form, veterans acknowledge their indebtedness and agree to a repayment plan, which can help prevent further collection actions.

Steps to Complete the VA Form 1100

Completing the VA Form 1100 involves several important steps to ensure accuracy and compliance. First, gather all relevant financial information, including income, expenses, and any other debts. Next, fill out the form with your personal details, including your name, Social Security number, and contact information. Clearly outline the amount owed and propose a repayment plan that reflects your financial situation. After completing the form, review it for accuracy before signing and dating it. Finally, submit the form to the appropriate VA office as instructed.

Legal Use of the VA Form 1100

The VA Form 1100 is a legally binding document once signed by the veteran and accepted by the VA. It is crucial to understand that this agreement outlines the terms of repayment and can affect your credit and future dealings with the VA. By submitting this form, veterans are committing to the repayment terms specified, and failure to adhere to these terms may result in further collection actions or legal consequences. It is advisable to keep a copy of the signed form for your records.

Key Elements of the VA Form 1100

Several key elements must be included in the VA Form 1100 to ensure it is valid and effective. These elements include:

- Veteran's Information: Full name, Social Security number, and contact details.

- Debt Details: A clear description of the debt, including the total amount owed.

- Repayment Terms: Proposed payment amounts and frequency.

- Signature: The veteran's signature and date to confirm agreement.

How to Obtain the VA Form 1100

The VA Form 1100 can be obtained directly from the Department of Veterans Affairs website or by visiting a local VA office. It is important to ensure that you are using the most current version of the form to avoid any processing delays. Additionally, veterans may request assistance from a VA representative if they have questions about completing the form or need help with the repayment process.

Form Submission Methods

Once the VA Form 1100 is completed, it can be submitted through various methods. Veterans have the option to send the form via mail, submit it in person at a local VA office, or, in some cases, submit it electronically if the VA provides that option. It is important to follow the specific submission guidelines provided by the VA to ensure timely processing of the agreement.

Quick guide on how to complete financial hardship agreement

Complete Financial Hardship Agreement effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, enabling you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents swiftly without interruptions. Manage Financial Hardship Agreement on any device with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Financial Hardship Agreement seamlessly

- Access Financial Hardship Agreement and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and then hit the Done button to store your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, laborious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Alter and eSign Financial Hardship Agreement and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the financial hardship agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the VA Form 1100 Agreement to Pay Indebtedness?

The VA Form 1100 Agreement to Pay Indebtedness is a document used by veterans and service members to formally acknowledge their indebtedness to the Department of Veterans Affairs. This form outlines the terms of the repayment agreement, ensuring that both parties are clear on their obligations. By utilizing airSlate SignNow, signing this important document becomes seamless and efficient.

-

How can airSlate SignNow help with the VA Form 1100 Agreement to Pay Indebtedness?

airSlate SignNow streamlines the signing process for the VA Form 1100 Agreement to Pay Indebtedness, allowing users to eSign documents securely and quickly. Our platform provides features that enable businesses and individuals to manage their documents electronically, reducing time and paperwork involved in agreements. This makes it easier to handle VA forms and keep processes organized.

-

Is there a cost associated with using airSlate SignNow for the VA Form 1100 Agreement to Pay Indebtedness?

Yes, airSlate SignNow offers various pricing plans tailored to fit different needs, with pricing that is competitive and cost-effective. Whether you are an individual or part of a larger organization, you can choose a plan that meets your requirements for handling documents like the VA Form 1100 Agreement to Pay Indebtedness. Check our website for detailed pricing options.

-

What features does airSlate SignNow offer for handling VA documents?

airSlate SignNow offers a variety of features designed to simplify the management of VA documents, including the VA Form 1100 Agreement to Pay Indebtedness. Key features include document templates, secure eSigning, and real-time tracking. These tools improve efficiency and ensure all parties can review and sign documents promptly.

-

Can I integrate airSlate SignNow with other software for processing the VA Form 1100 Agreement to Pay Indebtedness?

Absolutely! airSlate SignNow provides robust integration options with various platforms, making it easy to include the VA Form 1100 Agreement to Pay Indebtedness in your existing workflows. Integrations with CRM systems, cloud storage, and productivity tools enhance user experience and streamline the signing process further.

-

What are the benefits of eSigning the VA Form 1100 Agreement to Pay Indebtedness?

eSigning the VA Form 1100 Agreement to Pay Indebtedness using airSlate SignNow not only saves time but also enhances security and convenience. Documents are signed securely online, which decreases the chances of lost paperwork and speeds up the entire process. Additionally, eSigning is environmentally friendly, reducing paper usage while maintaining compliance.

-

Is the VA Form 1100 Agreement to Pay Indebtedness legally binding when signed electronically?

Yes, the VA Form 1100 Agreement to Pay Indebtedness is legally binding when signed electronically using a compliant eSignature platform like airSlate SignNow. Our platform adheres to eSignature laws, ensuring that all electronic signatures are valid and enforceable. This allows users to sign important VA documents with confidence.

Get more for Financial Hardship Agreement

- Itd 3551 rev form

- Vr 094 06 17 mva marylandgov form

- Get the the only official copy is online at the shsd ih group form

- Ih75190 surface wipe sampling procedure brookhaven national bnl form

- Balancing chemical equations worksheet form

- Application forms orthopedic foundation for animals

- Application for congenital cardiac database orthopedic form

- Cpl timesheet form

Find out other Financial Hardship Agreement

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template