New York Assumption Agreement of Mortgage and Release of Original Mortgagors Form

What is the mortgage assumption agreement?

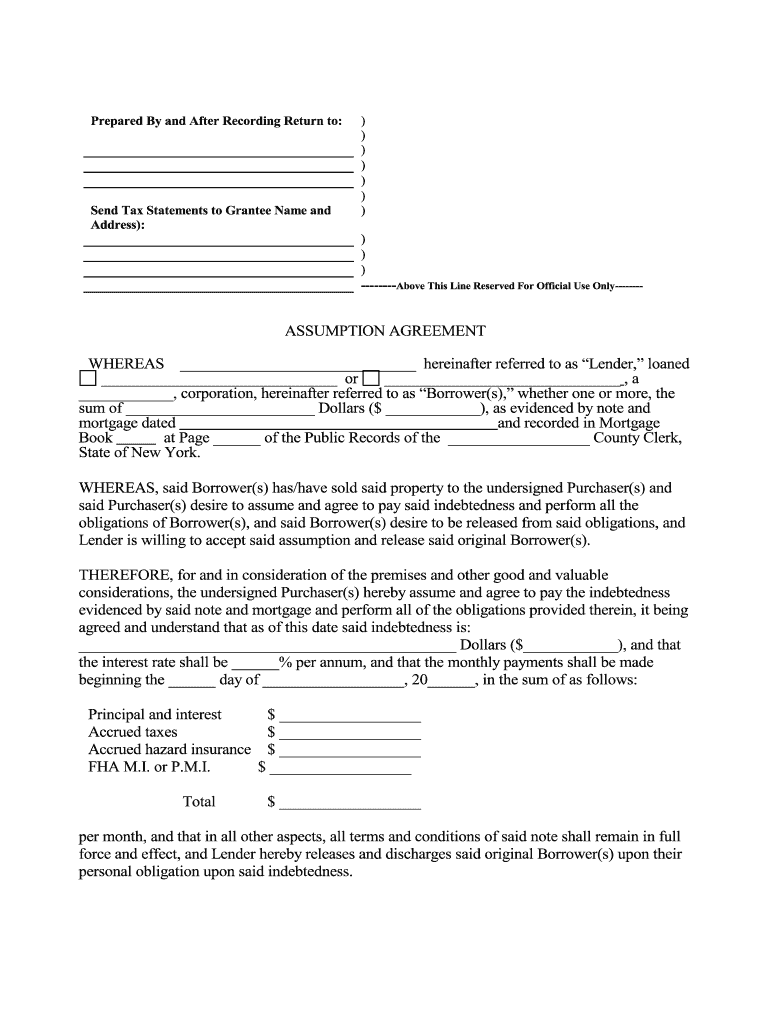

The mortgage assumption agreement is a legal document that allows a buyer to take over the seller's existing mortgage under specific terms. This agreement can be beneficial for buyers who want to assume a mortgage with a lower interest rate or favorable terms compared to current market rates. In the context of New York, this document may also include the release of original mortgagors, ensuring that the original borrower is no longer liable for the mortgage once it is assumed by the new buyer.

Key elements of the mortgage assumption agreement

Several critical elements must be included in a mortgage assumption agreement to ensure its validity. These elements typically include:

- Identification of parties: Clearly state the names and addresses of the original borrower, the new borrower, and the lender.

- Property description: Provide a detailed description of the property involved in the agreement.

- Mortgage details: Include the original loan amount, interest rate, and remaining balance.

- Terms of assumption: Outline the terms under which the new borrower will assume the mortgage, including any fees or conditions.

- Signatures: Ensure that all parties sign the agreement to make it legally binding.

Steps to complete the mortgage assumption agreement

Completing a mortgage assumption agreement involves several important steps:

- Review the existing mortgage: Understand the terms of the original mortgage and whether it allows for assumption.

- Negotiate terms: Discuss and agree on the terms of the assumption with the lender and the seller.

- Draft the agreement: Prepare the mortgage assumption agreement, ensuring all key elements are included.

- Obtain necessary approvals: Submit the agreement to the lender for approval and ensure all parties sign.

- Record the agreement: File the signed agreement with the appropriate county office to make it public record.

Legal use of the mortgage assumption agreement

The legal use of a mortgage assumption agreement is crucial for protecting the interests of all parties involved. This document must comply with state and federal laws, including the requirements set forth by the Real Estate Settlement Procedures Act (RESPA) and the Truth in Lending Act (TILA). Proper execution of the agreement ensures that the new borrower assumes the mortgage without any liability falling back on the original borrower, provided that the lender agrees to the terms.

How to obtain the mortgage assumption agreement

Obtaining a mortgage assumption agreement typically involves contacting the lender to request the necessary forms. Many lenders provide templates or specific guidelines for completing the agreement. Additionally, legal professionals or real estate agents can assist in drafting a customized agreement that meets all legal requirements and addresses the unique circumstances of the transaction.

Digital vs. paper version of the mortgage assumption agreement

When considering the mortgage assumption agreement, both digital and paper versions are viable options. Digital versions offer the advantage of convenience, allowing for easy sharing and signing through secure platforms. They also facilitate faster processing times. In contrast, paper versions may be required for certain legal filings or when specific signatures are needed. Regardless of the format chosen, it is essential to ensure that the document is completed accurately and stored securely.

Quick guide on how to complete new york assumption agreement of mortgage and release of original mortgagors

Effortlessly Prepare New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors on Any Device

The management of documents online has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents promptly without any delays. Handle New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors with Ease

- Find New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all your details and click on the Done button to save your modifications.

- Choose your preferred method to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors to ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How will the just released New York Times story of Donald Trump participating in tax fraud and schemes to funnel millions from his father Fred's estate play out?

I have just read ALL of it… there was a LOT to read…it is quite a treatise on the subject.The details are RIVETING meaning that I could not stop reading and what I read gave me chills up and down my spine. The veracity, the depth of the investigation, the thoroughness the comparatives, the scale and scope… taken at any individual level is one thing taking in the totality of it… well below I will state my conclusion…My major in University was accounting my minor was economics, My first job out of university was for a public accounting firm, I did audit work, I prepared financial statements, tax returns, and I KNOW this stuff cold…This is a tale of lies, fraud, deceit, theft, criminal wrong doing of monumental proportions and the man masquerading as PRESIDENT of the United States was thick as a thief in the middle of it. I would not want to be one of the accountants who prepared those fraudulent tax returns - their licenses to practice could be in jeopardy. The ones who actually signed those returns… are however criminals. New York State has already said they are investigating these allegations.. The interest and penalties if assessed… well there is a line in Trading places that Eddie Murphy speaks to the effect “that the best way to hurt rich people is to turn them into poor people”.He lied to EVERYONE, the public, he stole from the American Taxpayer on a scale and with specific intentions to do so that organized crime never contemplated… This family’s theft from the American treasury is so VULGAR and obscene as to defy credulity. There is no innocent explanation what so ever possible for the actions taken. This is a damning conclusion.I do not shock easily.. I have seen many things in my life, this work from the Times is beyond question the most compelling case I have ever read.This one would have been a case for the RICO statutes…Opinion | Suzanne Garment: Trump and his family could owe millions for their decades-long con jobAppalling and disgusting …. and this criminal is the President? Really? So if America knew about how he inherited all his wealth, how he committed fraud on his Taxes and how he was an adulterous asshole with a porn star and a Playboy Playmate, how he dodged the draft…and then goes and attacks John McCain - would they have elected him President? Him hiding these facts - was a fraud upon the American People…. So please do not call him legitimate in my presence.As vile as his sexual peccadilloes are, his financial background and that of his Father and siblings is every bit as vile…reprehensible - the audacity of this man to stand as President is so wrong on so many levels… and he has the chutzpah to express his opinions on other peoples behaviour? How DARE he… He is not a judge of other people- he is to be judged, he is subject to America’s judgement.Just in case you wanted to know what I really thought…

-

If the New York legislature passes the bill to release Trump's New York State tax returns to Congress, would that release of forms also include copies of federal pages that were originally filed with New York's tax agency?

I dont think so - but the point is what they will find !They will find basically what they could read about in his past books and TV interviews. He spent - make - lost - regained hundreds of millions of dollars. He went bankrupt and came back every time. He pulled off lucrative deals by the skin of his teeth.If thats illegal - two thirds of our businessmen and investors would be jailed.How about we see the taxes and finances of every Congress person and Senators ! Lets learn about their Foundations, investment foreign and domestic and direct family members. It would be a bit confusing at first because so many dont even use their married names ! Why do you think that is - like Nancy Pelosi - look up her Daddy !

-

How many people are moving into New York and how many are choosing to move out of New York?

Don't know the answer to this question. I assume you are referring to New York City. I would assume that anybody moving to New York City now would have a lot of money. Either they are independently wealthy or they have been offered a very high-paying job in New York City. Or they are a young person and they have a come to live with their parents or another family member.

-

If a resident of Colorado moved to New York and promised to contribute to a mortgage you took out for them and then decided to move back to Colorado without contributing to that mortgage, would you sue them in Colorado or New York?

If the property that has a mortgage on it is located in New York, you need to file suit in New York, in my opinion (not a legal opinion). You can have the suit served on the person in Colorado but I think I would hustle and try to get it filed before they move, it will save you time and money. One time when I was working for a lawyer we had to sue someone in another state and had to send the papers to the Secretary of State and then have them route it for service on the defendant. Again, just my experience.However, I hope you have very good proof. Please find a lawyer and discuss this with him/her. Again, hopefully before the person moves back to Colorado. If it can’t be done that quickly, then you can still have it served on them. And if you obtain a judgment, you can attach property they own in Colorado - again, just a little bit harder to do and you may end up needing a lawyer in that state to find any property they have which could be attached. Good luck!

-

How should I respond to this assertion: "everything that comes out of California and New York makes communist China look good"?

It's tricky. To start on their ground, consider this.Answer not a fool according to his folly, lest thou also be like unto him.Answer a fool according to his folly, lest he be wise in his own conceit.Proverbs 26:4-5One approach, if you can stand it, is to say, "Really?" and let the person rant. This makes you seem, and perhaps be, much more sympathetic to the other person, who may become more open to what you have to say next, which could be, "So how would you solve those problems?" It often happens that hearing themselves say their policies out loud starts to show them how untenable they are. But they won't get that effect from listening to your arguments. Don't make any. They already know the answers, but some feel that something else is more important than the truth.Of course, if they don't like fruits and vegetables, California rice, movies, TV shows, the stock market, our biggest banks, higher-mileage and safer cars, computers, or consumer electronics, or the legacy of Ronald Reagan, they are free to do without them.

Create this form in 5 minutes!

How to create an eSignature for the new york assumption agreement of mortgage and release of original mortgagors

How to create an eSignature for your New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors in the online mode

How to make an electronic signature for the New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors in Chrome

How to generate an eSignature for signing the New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors in Gmail

How to make an electronic signature for the New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors from your mobile device

How to make an eSignature for the New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors on iOS

How to generate an electronic signature for the New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors on Android

People also ask

-

What is a mortgage assumption agreement?

A mortgage assumption agreement is a legal document that allows a buyer to take over the seller's mortgage. This agreement can facilitate a smoother transition in real estate transactions, making it easier for buyers to move into their new property without acquiring new financing. Understanding this agreement can save time and potentially lower costs involved.

-

How does airSlate SignNow help with mortgage assumption agreements?

airSlate SignNow streamlines the process of creating and signing mortgage assumption agreements. With its easy-to-use platform, businesses can quickly prepare and send necessary documents for eSigning. This helps save time, reduce errors, and ensure that all legal obligations are met efficiently.

-

What are the benefits of using a mortgage assumption agreement?

Using a mortgage assumption agreement can benefit both buyers and sellers by simplifying the transfer of property. It allows buyers to take over existing mortgage terms, which may result in lower interest rates or payment requirements. Additionally, sellers can avoid the hassle of early loan payoff penalties, benefiting both parties in a transaction.

-

Are there any costs associated with creating a mortgage assumption agreement using airSlate SignNow?

AirSlate SignNow offers a cost-effective pricing model for creating mortgage assumption agreements. The platform features various plans that cater to different needs and budgets, ensuring you only pay for what you require. By using airSlate SignNow, businesses can minimize document preparation costs while maximizing efficiency.

-

Can I customize my mortgage assumption agreement in airSlate SignNow?

Yes, airSlate SignNow allows users to fully customize their mortgage assumption agreements. You can tailor the document to fit specific transaction details and legal requirements. This feature ensures that your agreements accurately reflect the terms of the mortgage being assumed.

-

What integrations does airSlate SignNow support for mortgage assumption agreements?

AirSlate SignNow integrates seamlessly with various applications that may assist in managing mortgage assumption agreements. This includes CRM tools, cloud storage solutions, and document management platforms. These integrations provide a holistic approach to document handling, ensuring you can access and manage your agreements efficiently.

-

Is airSlate SignNow secure for handling mortgage assumption agreements?

Absolutely, airSlate SignNow prioritizes the security of all documents, including mortgage assumption agreements. The platform employs industry-standard encryption and security measures to protect sensitive data. Users can confidently eSign and share documents knowing their information is secure.

Get more for New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors

Find out other New York Assumption Agreement Of Mortgage And Release Of Original Mortgagors

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple