Form 590

What is the Form 590

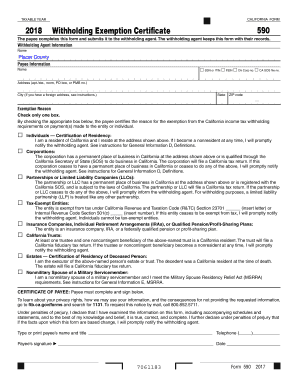

The 2018 Form 590, also known as the California Withholding Exemption Certificate, is a tax document used by individuals and entities in California to claim an exemption from withholding on certain types of income. This form is essential for ensuring that the correct amount of state income tax is withheld from payments made to individuals, particularly those who qualify for exemptions based on specific criteria. The form must be completed accurately to avoid any issues with tax compliance and to ensure that the withholding aligns with the taxpayer's financial situation.

How to use the Form 590

Using the California Form 590 involves several key steps. First, individuals must determine their eligibility for withholding exemptions based on their income and tax situation. Once eligibility is established, the form should be filled out with accurate personal information, including the taxpayer's name, address, and social security number. After completing the form, it should be submitted to the payer or withholding agent, who will use it to adjust the amount of state income tax withheld from payments. It is crucial to keep a copy of the submitted form for personal records.

Steps to complete the Form 590

Completing the 2018 Form 590 requires careful attention to detail. Here are the steps to follow:

- Review the eligibility criteria for withholding exemptions.

- Gather necessary personal information, such as your name, address, and social security number.

- Fill out the form, ensuring all sections are completed accurately.

- Sign and date the form to certify the information provided.

- Submit the completed form to the payer or withholding agent.

Key elements of the Form 590

The 2018 Form 590 includes several important elements that taxpayers must understand. Key sections of the form include:

- Personal Information: This section requires the taxpayer's name, address, and social security number.

- Exemption Clauses: Taxpayers must indicate the specific reasons for claiming an exemption from withholding.

- Signature: The form must be signed and dated by the taxpayer to validate the information provided.

Legal use of the Form 590

The legal use of the 2018 Form 590 is governed by California tax laws. To be considered valid, the form must be filled out accurately and submitted to the appropriate withholding agent. Failure to comply with the legal requirements may result in penalties or incorrect withholding, which could lead to tax liabilities in the future. It is important for taxpayers to understand their rights and responsibilities when using this form to ensure compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The 2018 Form 590 can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the withholding agent. The available submission methods include:

- Online Submission: Some withholding agents may allow electronic submission of the form through secure online platforms.

- Mail: Taxpayers can print the completed form and mail it directly to the payer or withholding agent.

- In-Person: The form can also be delivered in person to the relevant office of the withholding agent.

Quick guide on how to complete form 590

Complete Form 590 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, as you can obtain the correct format and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form 590 on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

The simplest way to modify and electronically sign Form 590 with ease

- Find Form 590 and then select Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred delivery method for your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Form 590 to guarantee effective communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 590

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 form 590, and why is it important?

The 2018 form 590 is a document used by California residents to report withholding on certain income types. It is important for ensuring compliance with state tax laws and avoiding penalties. Completing this form accurately helps streamline tax filing and reporting processes.

-

How can airSlate SignNow help me manage the 2018 form 590?

AirSlate SignNow simplifies the process of preparing and eSigning the 2018 form 590 by providing an intuitive platform for document management. You can easily upload, edit, and share the form, ensuring that all necessary parties can sign it quickly. This not only saves time but also enhances compliance.

-

What features does airSlate SignNow offer for eSigning the 2018 form 590?

AirSlate SignNow offers robust eSigning features that allow you to sign the 2018 form 590 from any device. The platform supports in-person and remote signing options, ensuring flexibility and convenience for users. Additionally, document tracking and reminders help keep the signing process organized.

-

Is airSlate SignNow a cost-effective solution for managing the 2018 form 590?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing all your document needs, including the 2018 form 590. With a variety of pricing plans available, businesses can choose a package that suits their budget without sacrificing functionality. This makes it an excellent choice for both small businesses and larger organizations.

-

Can I integrate airSlate SignNow with other software for handling the 2018 form 590?

Absolutely! AirSlate SignNow supports integrations with various applications, allowing you to seamlessly manage the 2018 form 590 alongside your existing workflows. Whether you use accounting software or project management tools, these integrations help streamline your document processes efficiently.

-

What are the benefits of using airSlate SignNow for the 2018 form 590?

Using airSlate SignNow for the 2018 form 590 offers numerous benefits, including increased efficiency and improved accuracy in document handling. The platform's user-friendly interface and automated workflows reduce the likelihood of errors, ensuring that your tax compliance is met confidently. It also enhances collaboration by allowing multiple users to access and sign the document remotely.

-

Do I need any technical skills to use airSlate SignNow for the 2018 form 590?

No, you do not need any technical skills to use airSlate SignNow for the 2018 form 590. The platform is designed for users of all skill levels, featuring a straightforward interface that guides you through the document preparation and signing process. This makes it accessible for everyone, from beginners to advanced users.

Get more for Form 590

- For use by executors trustees trustors form

- Control number de sdeed 8 1 form

- Secured partys name or name of assignee of assignor secured party provide only one secured party name 3a or 3b form

- Ucc financing statement addendum ucc 1ad form

- Ucc financing statement putnam county recorder form

- Information options relating to ucc filings and other notices on file in the filing office that include as a debtor name the

- B e mail contact at filer optional form

- Additional debtors name provide only one debtor name 21a or 21b use exact full name do not omit modify or abbreviate any part form

Find out other Form 590

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself