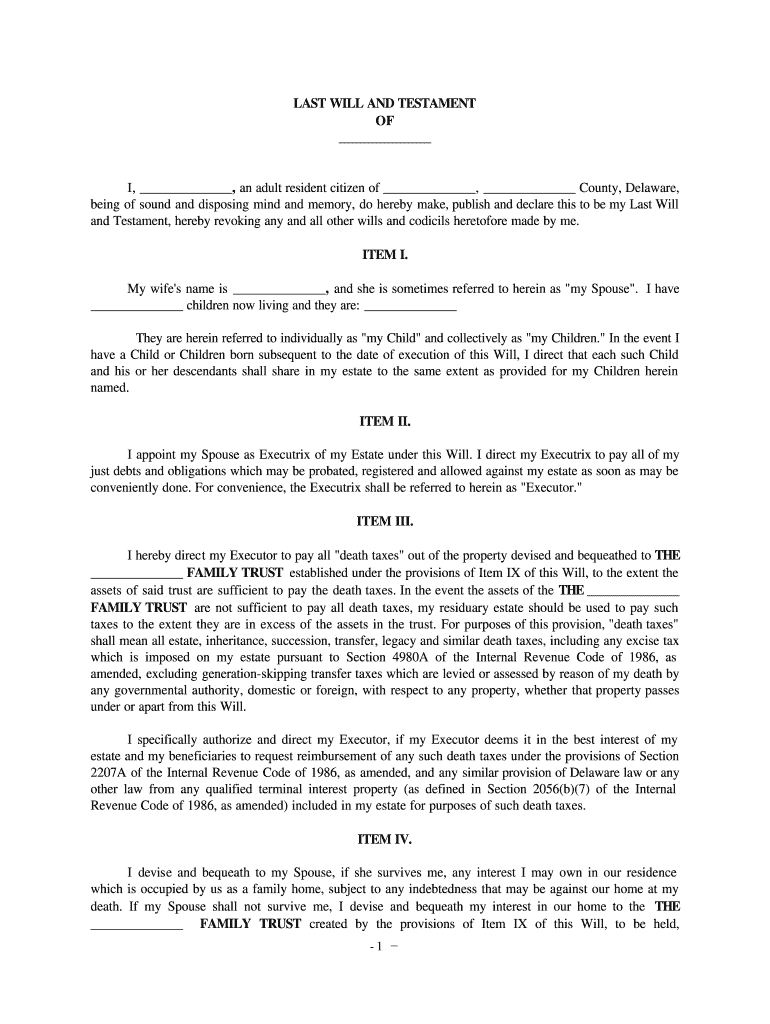

Delaware Complex Will with Credit Shelter Marital Trust for Large Estates Form

What is the Delaware Complex Will With Credit Shelter Marital Trust For Large Estates

The Delaware Complex Will with Credit Shelter Marital Trust for large estates is a legal document designed to manage and protect assets for married couples, particularly those with significant wealth. This trust allows for the strategic allocation of assets to minimize estate taxes while ensuring that the surviving spouse has access to necessary funds during their lifetime. By utilizing this trust, individuals can preserve wealth for future generations while adhering to state and federal tax laws.

Key Elements of the Delaware Complex Will With Credit Shelter Marital Trust For Large Estates

Several essential components define the Delaware Complex Will with Credit Shelter Marital Trust. These include:

- Trustee Designation: The individual or institution responsible for managing the trust's assets.

- Beneficiary Provisions: Clear identification of beneficiaries, including the surviving spouse and any children or other heirs.

- Asset Allocation: Specific instructions on how assets are to be divided between the marital trust and the credit shelter trust.

- Tax Considerations: Provisions that address estate tax implications and strategies for minimizing tax liabilities.

Steps to Complete the Delaware Complex Will With Credit Shelter Marital Trust For Large Estates

Completing the Delaware Complex Will with Credit Shelter Marital Trust involves several important steps:

- Consult a Legal Professional: Engage an estate planning attorney familiar with Delaware laws to ensure compliance and effectiveness.

- Gather Financial Information: Compile a comprehensive list of assets, liabilities, and any existing estate planning documents.

- Draft the Trust Document: Work with your attorney to create a trust document that reflects your wishes and meets legal requirements.

- Review and Sign: Carefully review the document with your attorney and sign it in the presence of a notary public.

Legal Use of the Delaware Complex Will With Credit Shelter Marital Trust For Large Estates

The legal use of the Delaware Complex Will with Credit Shelter Marital Trust is governed by state and federal laws. This trust is particularly beneficial for high-net-worth individuals seeking to minimize estate taxes while ensuring that their spouse and heirs are provided for. Proper execution of the trust ensures that it is recognized by courts and tax authorities, thus safeguarding the intended benefits.

Examples of Using the Delaware Complex Will With Credit Shelter Marital Trust For Large Estates

There are various scenarios in which the Delaware Complex Will with Credit Shelter Marital Trust can be effectively utilized:

- A couple with substantial assets wishes to ensure that their estate is passed on to their children while minimizing tax liabilities.

- A surviving spouse needs access to funds during their lifetime, while also protecting the inheritance of their children from previous marriages.

- Individuals looking to maintain control over how their assets are distributed after death, ensuring that specific conditions are met before beneficiaries receive their inheritance.

Required Documents for the Delaware Complex Will With Credit Shelter Marital Trust For Large Estates

To establish the Delaware Complex Will with Credit Shelter Marital Trust, several documents are typically required:

- Proof of Identity: Government-issued identification for all parties involved.

- Financial Statements: Detailed records of assets, liabilities, and income sources.

- Existing Estate Planning Documents: Any prior wills, trusts, or powers of attorney that may affect the new trust.

- Tax Returns: Recent tax returns to assess financial standing and tax implications.

Quick guide on how to complete delaware complex will with credit shelter marital trust for large estates

Complete Delaware Complex Will With Credit Shelter Marital Trust For Large Estates effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents promptly and without delays. Handle Delaware Complex Will With Credit Shelter Marital Trust For Large Estates on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven operation today.

The easiest method to modify and eSign Delaware Complex Will With Credit Shelter Marital Trust For Large Estates with ease

- Locate Delaware Complex Will With Credit Shelter Marital Trust For Large Estates and select Get Form to commence.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your selected device. Modify and eSign Delaware Complex Will With Credit Shelter Marital Trust For Large Estates and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Someone is impersonating my Instagram. How long will it take for the impersonation account to be deleted? Do I get a notification? I filled out the form and sent a photo of myself with my ID, but received no confirmation it was received.

This would be in keeping with the idea of individual freedom, in that, each person should be free to define his own thinking and his own life absent those real actions, not opinions, that are detrimental to another or to society.In keeping with the tradition of American freedom to think independently as noted here with a Thomas Jefferson quote from 1802 in a letter to the Baptist Bishops of Danbury CT. The Bishops were intent on making the Baptist Church the default religion of the new“Believing with you that religion is a matter which lies solely between Man & his God, that he owes account to none other for his faith or his worship, that the legitimate powers of government signNow actions only, & not opinions, I contemplate with sovereign reverence that act of the whole American people which declared that their legislature should "make no law respecting an establishment of religion, or prohibiting the free exercise thereof," thus building a wall of separation between Church & State.”Freedom of religion is a great deal more that deciding what god one may or may not believe in; it is the freedom to think independently, to hold with value those opinions that may differ from others or from government as opposed to a government sponsored and centered belief, which in itself may become intellectually stifling and oppressive to the imaginative mind.Freedom of Religion is also freedom from a religious mandate to believe or to hold one religious belief above all others. The definition of religion is simply the claim that my belief is of “supreme importance” which may also apply to that secular or political ideology and even to that atheistic belief or opinion that gods do not exist. Religious belief is not exclusive to the supernatural, but, rather, inclusive of all opinion.As an Atheist, my Atheism is my opinion of life and living, my religious belief, and I consider it of “supreme Importance” to me, and do I believe that others should think the same, yes, I do. Do I believe that I should make or force others to believe as I do, no.Hopefully there will come a day, in keeping with the thought, the wish and the dream of Martin Luther King, that we are judged not by the god one may or may not belief in, ”—- but by the content of their character.”“I have a dream that my four little children will one day live in a nation where they will not be judged by the color of their skin, but by the content of their character.” Martin Luther King, Jr.To respond directly to the question of what religion is best for America and in keeping with the definition of religion as something of supreme importance, I would say that the American Constitution is, by far, the best religion for American

Create this form in 5 minutes!

How to create an eSignature for the delaware complex will with credit shelter marital trust for large estates

How to make an electronic signature for your Delaware Complex Will With Credit Shelter Marital Trust For Large Estates online

How to make an electronic signature for your Delaware Complex Will With Credit Shelter Marital Trust For Large Estates in Chrome

How to generate an electronic signature for signing the Delaware Complex Will With Credit Shelter Marital Trust For Large Estates in Gmail

How to generate an electronic signature for the Delaware Complex Will With Credit Shelter Marital Trust For Large Estates straight from your smart phone

How to make an electronic signature for the Delaware Complex Will With Credit Shelter Marital Trust For Large Estates on iOS

How to make an eSignature for the Delaware Complex Will With Credit Shelter Marital Trust For Large Estates on Android devices

People also ask

-

What is a marital trust?

A marital trust is a trust designed to benefit a surviving spouse, allowing them to manage the trust’s assets while potentially reducing estate taxes. This type of trust ensures that the surviving spouse has financial security after the death of their partner. Understanding the mechanisms of a marital trust can help you make informed decisions about your estate planning.

-

How does airSlate SignNow facilitate signing marital trust agreements?

AirSlate SignNow simplifies the process of signing marital trust agreements by providing a user-friendly platform for eSigning documents. With advanced security features and seamless integration, users can ensure their marital trust agreements are signed promptly and securely. This efficient process saves time and reduces the hassle associated with traditional paper signatures.

-

What are the benefits of using airSlate SignNow for managing marital trusts?

Using airSlate SignNow to manage marital trusts offers several benefits, including increased efficiency in document handling and better tracking of signatures. The platform is also cost-effective, allowing users to save on printing and mailing costs associated with traditional methods. Additionally, enhanced security measures ensure that sensitive financial information remains protected.

-

Can I integrate airSlate SignNow with other tools for managing my marital trust?

Yes, airSlate SignNow can be integrated with various applications and platforms to streamline the management of your marital trust. Integrations with popular tools like Google Drive, Dropbox, and CRM systems enable seamless workflows for document storage and retrieval. This flexibility enhances your ability to manage your marital trust efficiently.

-

What pricing options does airSlate SignNow offer for businesses managing marital trusts?

airSlate SignNow provides various pricing plans tailored to businesses managing marital trusts, ensuring affordability for every budget. These plans include features suited for document management, eSigning, and user collaboration. You can choose a plan that best meets your needs while ensuring you have access to the essential tools for handling your marital trust.

-

Is electronic signing of marital trust documents legally binding?

Yes, electronic signing of marital trust documents via airSlate SignNow is legally binding and compliant with eSignature laws. This means that you can confidently execute your marital trust agreements without concern about their validity. The platform ensures that all signed documents are securely stored and accessible for future reference.

-

How secure is airSlate SignNow for handling marital trust documents?

AirSlate SignNow employs advanced security protocols to protect your marital trust documents, including encryption and secure access controls. This high level of security helps safeguard sensitive information from unauthorized access. You can trust airSlate SignNow to ensure that your marital trust documentation is both confidential and secure.

Get more for Delaware Complex Will With Credit Shelter Marital Trust For Large Estates

- Army registretion form

- Evalueringsskema skabelon form

- Arizona warranty deed to community property with rights of survivorship form

- Maryland form 502ae subtraction for income derived within arts and entertainment districts

- St louis county hazardous materials response team form

- Cloud computing agreement template form

- Cloud service level agreement template form

- Cloud service agreement template form

Find out other Delaware Complex Will With Credit Shelter Marital Trust For Large Estates

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form