Gst495 Form

What is the GST495?

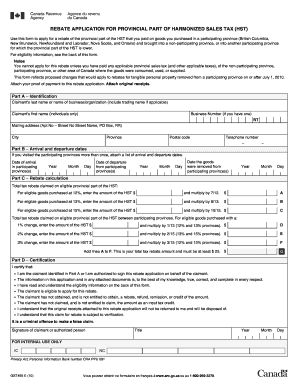

The GST495 is a specific form used for the rebate application related to the provincial part of the Harmonized Sales Tax (HST). This form is essential for businesses and individuals seeking to reclaim a portion of the HST they have paid on eligible goods and services. Understanding the GST495 is crucial for ensuring compliance with tax regulations and maximizing potential rebates.

How to Use the GST495

Using the GST495 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation that supports your claim, such as receipts and invoices. Next, fill out the form with precise information regarding your purchases and the HST paid. It is important to double-check all entries for accuracy before submission. Finally, submit the completed form according to the specified guidelines, either online or via mail.

Steps to Complete the GST495

Completing the GST495 requires careful attention to detail. Follow these steps:

- Collect all relevant receipts and invoices that detail HST payments.

- Download or access the GST495 form from the appropriate tax authority's website.

- Fill in your personal and business information accurately.

- Detail the HST amounts paid for each eligible purchase.

- Review the form for completeness and accuracy.

- Submit the form as directed, ensuring you keep copies for your records.

Legal Use of the GST495

The GST495 must be used in accordance with specific legal guidelines to ensure its validity. It is essential to comply with the regulations set forth by the Internal Revenue Service (IRS) and other relevant tax authorities. This includes ensuring that all claims are substantiated with proper documentation and that the form is submitted within the designated deadlines. Failure to adhere to these guidelines may result in penalties or denial of the rebate claim.

Required Documents

To successfully complete the GST495, certain documents are required. These typically include:

- Receipts for all eligible purchases that include HST.

- Invoices that clearly show the HST charged.

- Any additional documentation that supports your rebate claim.

Having these documents ready will streamline the process and help avoid delays in processing your application.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for the successful submission of the GST495. Typically, the deadlines for submitting the form are set by the tax authority and may vary depending on the fiscal year or specific circumstances. It is advisable to check the official guidelines regularly to ensure timely submission and avoid potential penalties for late filing.

Quick guide on how to complete gst495

Complete Gst495 seamlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary forms and safely store them online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without interruptions. Manage Gst495 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and electronically sign Gst495 with ease

- Obtain Gst495 and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight key sections of the documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more issues with lost or misplaced documents, tedious form searches, or errors that require new printed copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Gst495 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gst495

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is gst495 and how does it benefit my business?

GST495 refers to airSlate SignNow's unique offering that enables businesses to efficiently manage electronic signatures and document workflows. This solution streamlines the signing process, reduces turnaround times, and minimizes paper usage, ultimately contributing to cost savings and improved productivity.

-

How much does the gst495 plan cost?

The gst495 plan is competitively priced to ensure businesses of all sizes can access its powerful features. We offer flexible pricing options, tailored to your needs, ensuring you get unparalleled value for your investment in efficient document management and eSigning.

-

What features are included in the gst495 package?

The gst495 package includes robust features such as customizable templates, audit trails, and integrations with popular applications. These tools are designed to enhance your document workflow, making it easier to send documents for signature and track their status.

-

Can I integrate gst495 with other software tools?

Yes, the gst495 plan offers seamless integrations with various software tools like CRM systems, cloud storage services, and productivity applications. This ensures that you can incorporate airSlate SignNow into your existing workflow without disruption.

-

Is gst495 secure for handling sensitive documents?

Absolutely! The gst495 solution prioritizes security, utilizing advanced encryption and compliance standards to protect your sensitive documents. This commitment ensures that your data remains confidential and secure throughout the eSigning process.

-

What types of documents can I sign using gst495?

You can use gst495 to sign a wide variety of documents including contracts, agreements, and forms. The versatility of airSlate SignNow allows it to handle virtually any document type that requires an electronic signature, simplifying your workflow.

-

How does gst495 improve collaboration among team members?

The gst495 platform enhances team collaboration by allowing multiple users to collaboratively edit and sign documents in real-time. This feature reduces delays and helps ensure that everyone is on the same page during the signing process.

Get more for Gst495

- Free idaho eviction notice formsprocess and laws pdf

- Injured workersif idaho state insurance fund form

- Box 83720 boise idaho 83720 0041 form

- Workers compensationfirst report of injury or illness njcrib form

- Ic52 election of coverage election revocation justia form

- Section 72 212idaho state legislature form

- Id inc cr form

- Usually made form

Find out other Gst495

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe