Cuna Truth in Lending Disclosure Form

What is the Cuna Truth In Lending Disclosure Form

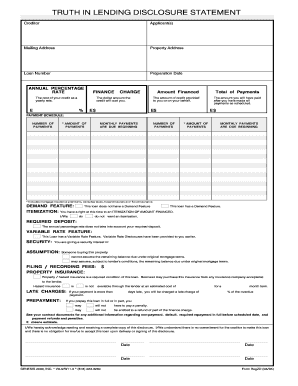

The Cuna Truth In Lending Disclosure Form is a crucial document designed to provide borrowers with essential information regarding the terms and conditions of their loans. This form outlines key details such as the annual percentage rate (APR), finance charges, total payments, and repayment schedule. By presenting this information clearly, the form ensures that borrowers can make informed decisions about their financial commitments.

How to use the Cuna Truth In Lending Disclosure Form

Using the Cuna Truth In Lending Disclosure Form involves several straightforward steps. First, borrowers should carefully review the information provided in the form to understand the loan's terms. Next, it is essential to compare these terms with other loan offers to ensure the best possible deal. Once the borrower decides to proceed, they must sign the form, indicating their agreement to the terms outlined. This signed document then serves as a record of the loan agreement.

Steps to complete the Cuna Truth In Lending Disclosure Form

Completing the Cuna Truth In Lending Disclosure Form requires attention to detail. Follow these steps:

- Read the entire form thoroughly to understand all terms and conditions.

- Fill in your personal information, including name, address, and contact details.

- Provide the loan amount and any other relevant financial information.

- Review the APR, finance charges, and total payment sections to ensure accuracy.

- Sign and date the form to confirm your acceptance of the terms.

Key elements of the Cuna Truth In Lending Disclosure Form

Several key elements are essential to the Cuna Truth In Lending Disclosure Form. These include:

- Annual Percentage Rate (APR): This represents the cost of borrowing on an annual basis, including interest and fees.

- Finance Charges: This section details the total cost of credit, including interest and any additional fees.

- Total Payments: This indicates the total amount the borrower will pay over the life of the loan.

- Payment Schedule: This outlines when payments are due and the amount of each payment.

Legal use of the Cuna Truth In Lending Disclosure Form

The legal use of the Cuna Truth In Lending Disclosure Form is governed by the Truth in Lending Act (TILA). This federal law requires lenders to provide clear and accurate information about loan terms, ensuring transparency in lending practices. Compliance with TILA is essential for the form to be legally valid. Borrowers should retain a copy of the signed form for their records, as it may be needed for future reference or in case of disputes.

Examples of using the Cuna Truth In Lending Disclosure Form

Examples of using the Cuna Truth In Lending Disclosure Form include various loan scenarios. For instance, when applying for a mortgage, the lender provides this form to explain the loan's terms, allowing the borrower to understand their financial obligations. Similarly, personal loans and auto loans also require this disclosure, ensuring that borrowers are fully informed before committing to the loan agreement.

Quick guide on how to complete cuna truth in lending disclosure form

Effortlessly Prepare Cuna Truth In Lending Disclosure Form on Any Device

Digital document management has become popular among enterprises and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed files, allowing you to access the necessary template and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents rapidly without delays. Manage Cuna Truth In Lending Disclosure Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric workflow today.

The simplest way to modify and electronically sign Cuna Truth In Lending Disclosure Form with ease

- Obtain Cuna Truth In Lending Disclosure Form and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using the features that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Cuna Truth In Lending Disclosure Form to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cuna truth in lending disclosure form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Cuna Truth In Lending Disclosure Form?

The Cuna Truth In Lending Disclosure Form is a mandatory document designed to provide borrowers with clear and concise information about loan terms and costs. This form helps ensure transparency and compliance with lending laws. Using airSlate SignNow, you can easily create and send this form to streamline the loan process.

-

How can airSlate SignNow help with the Cuna Truth In Lending Disclosure Form?

airSlate SignNow simplifies the process of creating and sending the Cuna Truth In Lending Disclosure Form. Our platform allows you to easily customize the form, obtain eSignatures, and securely store documents. This not only saves time but also enhances efficiency in your lending processes.

-

Is there a cost associated with using airSlate SignNow for the Cuna Truth In Lending Disclosure Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. You can choose a subscription that allows you to manage the Cuna Truth In Lending Disclosure Form along with other essential documents. Our plans are designed to be cost-effective, ensuring you get the best value for your investment.

-

What features does airSlate SignNow provide for managing the Cuna Truth In Lending Disclosure Form?

airSlate SignNow offers features like customizable templates, eSignature capabilities, and document tracking specifically for the Cuna Truth In Lending Disclosure Form. You can also collaborate with team members in real-time, ensuring everyone is aligned and informed throughout the lending process.

-

Can I integrate airSlate SignNow with other platforms for managing the Cuna Truth In Lending Disclosure Form?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and productivity tools, allowing for streamlined workflows. This means you can efficiently manage the Cuna Truth In Lending Disclosure Form alongside your existing software solutions.

-

What are the benefits of using airSlate SignNow for the Cuna Truth In Lending Disclosure Form?

Using airSlate SignNow for the Cuna Truth In Lending Disclosure Form increases efficiency by reducing paperwork and eliminating delays associated with traditional signing methods. Additionally, it enhances the customer experience by providing a quick and easy way for customers to understand their loan terms and complete signings electronically.

-

Is airSlate SignNow secure for sending the Cuna Truth In Lending Disclosure Form?

Yes, airSlate SignNow implements top-notch security features to protect your documents, including the Cuna Truth In Lending Disclosure Form. Our platform features encryption, secure access controls, and compliance with industry standards to ensure that your sensitive information remains protected.

Get more for Cuna Truth In Lending Disclosure Form

Find out other Cuna Truth In Lending Disclosure Form

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed