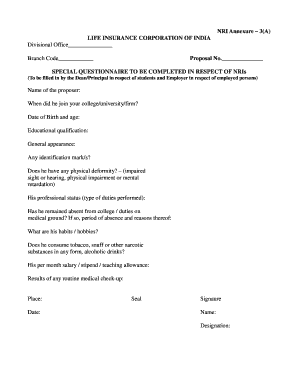

NRI Annexure 3A Form

What is the NRI Annexure 3A

The NRI Annexure 3A is a specific form utilized by non-resident Indians (NRIs) to declare their income and assets in India. This form is essential for tax compliance and is often required by financial institutions when NRIs engage in investment activities or property transactions in India. It helps in reporting income earned in India, ensuring that NRIs meet their tax obligations while availing benefits under the Double Taxation Avoidance Agreement (DTAA) if applicable.

How to use the NRI Annexure 3A

Using the NRI Annexure 3A involves several steps. First, gather all necessary financial documents, including details of income earned in India. Next, accurately fill out the form, ensuring that all information is complete and correct. Once the form is filled, it can be submitted to the relevant tax authorities or financial institutions, depending on the context of its use. Digital platforms can facilitate this process, allowing for electronic submission and eSigning, which enhances convenience and efficiency.

Steps to complete the NRI Annexure 3A

Completing the NRI Annexure 3A requires careful attention to detail. Follow these steps:

- Gather all necessary documents, such as bank statements, investment records, and proof of income.

- Provide personal details, including your name, address, and tax identification number.

- Declare all sources of income, including salary, rental income, and any other earnings from India.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or in person, depending on the requirements of the institution or authority.

Legal use of the NRI Annexure 3A

The NRI Annexure 3A is legally binding when filled out and submitted correctly. Compliance with tax regulations is crucial for NRIs to avoid penalties. The form must be completed with accurate information to ensure it meets legal standards. Additionally, utilizing digital solutions for signing and submitting the form can enhance its legal standing, as electronic signatures are recognized under U.S. and Indian law, provided they meet specific criteria.

Required Documents

To complete the NRI Annexure 3A, certain documents are necessary. These typically include:

- Proof of identity, such as a passport or driver's license.

- Tax identification number (TIN) or Permanent Account Number (PAN) in India.

- Financial statements that detail income sources.

- Any relevant certificates that support claims of tax residency or exemptions.

Form Submission Methods

The NRI Annexure 3A can be submitted through various methods, including:

- Online submission via the official tax authority's portal, which may require eSigning.

- Mailing a physical copy to the designated tax office.

- In-person submission at local tax offices or financial institutions that require the form.

Quick guide on how to complete nri annexure 3a

Complete NRI Annexure 3A effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage NRI Annexure 3A on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and electronically sign NRI Annexure 3A effortlessly

- Locate NRI Annexure 3A and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invite link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign NRI Annexure 3A and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nri annexure 3a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NRI Annexure 3A?

NRI Annexure 3A is a vital document required for Non-Resident Indians to report their financial information to the Indian government. It simplifies tax compliance and provides a clear framework for NRI financial declarations. Understanding NRI Annexure 3A can help ensure you meet all regulatory requirements efficiently.

-

How can airSlate SignNow assist with NRI Annexure 3A?

airSlate SignNow provides a secure and user-friendly platform to electronically sign and send NRI Annexure 3A documents. Our solution streamlines the document signing process, making it easier for NRIs to manage their compliance obligations. This efficient approach saves time and enhances the accuracy of submitted documents.

-

What are the pricing options for using airSlate SignNow for NRI Annexure 3A?

airSlate SignNow offers flexible pricing plans to cater to various needs, including options suitable for individual users and businesses handling NRI Annexure 3A documentation. You can choose from monthly or annual subscriptions that best fit your budget. By investing in our services, you'll gain access to a cost-effective way to manage your document signing needs.

-

Are there any features specific to NRI Annexure 3A in airSlate SignNow?

Yes, airSlate SignNow offers features tailored for NRI Annexure 3A, such as customizable templates and automated reminders. These tools ensure you stay organized and compliant while handling essential documentation. Additionally, our platform supports multi-language options, making it more accessible for NRIs worldwide.

-

What benefits does eSigning NRI Annexure 3A provide?

eSigning NRI Annexure 3A with airSlate SignNow offers numerous benefits, including faster processing times and reduced paper usage. Electronic signatures are legally binding and ensure that your documents are secure and trackable. This method enhances overall efficiency, allowing you to focus on more important aspects of your financial management.

-

Can airSlate SignNow integrate with other platforms for NRI Annexure 3A handling?

Yes, airSlate SignNow seamlessly integrates with various platforms such as CRM systems, document management solutions, and cloud storage services. This integration capability allows you to easily manage NRI Annexure 3A documents alongside other business processes. Such flexibility enhances productivity and ensures that your documents are always accessible.

-

What are the security measures in place for NRI Annexure 3A documents in airSlate SignNow?

airSlate SignNow prioritizes the security of your NRI Annexure 3A documents by employing industry-standard encryption and secure data storage practices. Our platform undergoes regular security audits to comply with data protection regulations. With robust authentication options, you can be confident that your financial information is safe and secure.

Get more for NRI Annexure 3A

Find out other NRI Annexure 3A

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free