Il 1040 Form

What is the IL 1040?

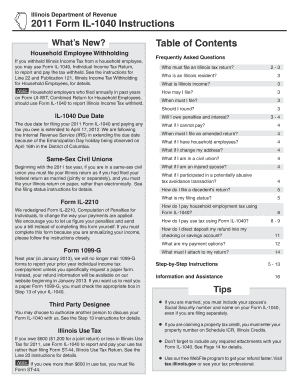

The IL 1040 is the individual income tax return form used by residents of Illinois to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state, as it helps ensure compliance with state tax laws. The IL 1040 includes various sections to report different types of income, deductions, and credits, ultimately determining the amount owed or refunded to the taxpayer.

Steps to Complete the IL 1040

Completing the IL 1040 involves several key steps to ensure accurate reporting and compliance. First, gather all necessary documentation, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and applicable deductions. Pay attention to the specific instructions for each section, as errors can lead to delays or penalties. Finally, review your completed form for accuracy before submitting it either online or via mail.

Legal Use of the IL 1040

The IL 1040 serves as a legally binding document when properly filled out and submitted. To ensure its legal standing, it must be signed and dated by the taxpayer. Additionally, compliance with state tax regulations is crucial. The form must be submitted by the designated deadline to avoid penalties. Utilizing a reliable eSignature solution can enhance the legal validity of the IL 1040 when filing online, as it provides necessary authentication and security measures.

Filing Deadlines / Important Dates

Filing deadlines for the IL 1040 are typically aligned with federal tax deadlines. Generally, individual income tax returns must be filed by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes to deadlines, especially during extraordinary circumstances, such as natural disasters or public health emergencies, which may prompt extensions.

Required Documents

To complete the IL 1040 accurately, several documents are essential. These include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductible expenses, such as medical bills or mortgage interest

- Proof of any tax credits claimed

- Previous year's tax return for reference

Having these documents ready can streamline the filing process and help ensure that all income and deductions are reported correctly.

Form Submission Methods

The IL 1040 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online filing through authorized e-filing services

- Mailing a paper copy to the Illinois Department of Revenue

- In-person submission at designated state tax offices

Each method has its advantages, such as immediate confirmation of receipt for online submissions or the ability to receive assistance in person.

Quick guide on how to complete il 1040 1502951

Effortlessly prepare Il 1040 on any device

Web-based document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the needed form and securely preserve it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Il 1040 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Il 1040 with ease

- Locate Il 1040 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Il 1040 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il 1040 1502951

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are IL 1040 instructions?

IL 1040 instructions refer to the guidelines provided by the Illinois Department of Revenue on how to complete the IL 1040 tax form. These instructions are crucial for ensuring accurate tax filing, allowing taxpayers to understand deductions, credits, and necessary documentation. Knowing the IL 1040 instructions can greatly simplify the income tax preparation process.

-

How can airSlate SignNow help with IL 1040 instructions?

airSlate SignNow facilitates the eSigning of tax documents, including any forms related to IL 1040 instructions. With our easy-to-use platform, users can quickly send and receive signed documents, streamlining the tax preparation process. Our solution saves time and reduces stress when dealing with important tax-related paperwork.

-

What are the features of airSlate SignNow relevant to IL 1040 instructions?

Key features of airSlate SignNow that support users with IL 1040 instructions include customizable templates for tax forms, secure eSigning, and cloud storage for easy access to documents. These tools help ensure compliance with state regulations while providing a simple, efficient way to handle tax filings. Our platform is designed to enhance your overall experience with tax documentation.

-

Is airSlate SignNow cost-effective for handling IL 1040 instructions?

Yes, airSlate SignNow offers a cost-effective solution for managing IL 1040 instructions and related documents. With flexible pricing plans, businesses can choose the option that best fits their needs and budget. The efficiency and ease of use of our platform translate to savings in time and resources, making it a smart investment for tax preparation.

-

Can airSlate SignNow integrate with accounting software for IL 1040 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing the efficiency of handling IL 1040 instructions. These integrations allow users to import data directly and eSign necessary documents without switching platforms. This capability streamlines the tax preparation process and reduces the chances of errors.

-

What benefits does airSlate SignNow provide for users needing IL 1040 instructions?

Using airSlate SignNow for IL 1040 instructions offers numerous benefits including enhanced efficiency, secure document management, and the convenience of eSigning. Users can easily track the status of documents, ensuring timely submissions. Furthermore, our intuitive interface simplifies the process, making it suitable for both individuals and businesses.

-

Is support available for questions about IL 1040 instructions using airSlate SignNow?

Yes, airSlate SignNow provides robust customer support for any queries related to IL 1040 instructions. Our team is available to help users navigate the eSigning process and ensure compliance with tax requirements. Whether you have questions about features or need assistance, our support resources are just a click away.

Get more for Il 1040

Find out other Il 1040

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile