Net Pay Tasks Answer Sheet Form

What is the Net Pay Tasks Answer Sheet

The Net Pay Tasks Answer Sheet is a structured document designed to assist individuals in calculating their net pay after deductions such as taxes and benefits. This sheet typically includes sections for gross pay, various deductions, and the final net pay amount. Understanding this document is essential for employees to accurately assess their take-home pay and for employers to ensure compliance with payroll regulations.

How to use the Net Pay Tasks Answer Sheet

Using the Net Pay Tasks Answer Sheet involves several steps. First, gather all necessary information, including gross pay and applicable deductions. Next, enter the gross pay into the designated section of the sheet. Then, calculate each deduction, such as federal and state taxes, Social Security, and Medicare contributions. Finally, subtract the total deductions from the gross pay to determine the net pay. This process helps ensure accuracy in payroll calculations.

Steps to complete the Net Pay Tasks Answer Sheet

Completing the Net Pay Tasks Answer Sheet requires a systematic approach. Start by listing your gross pay at the top of the sheet. Follow these steps:

- Identify all deductions applicable to your situation, including taxes and retirement contributions.

- Calculate the amount for each deduction based on current rates.

- Sum all deductions to find the total deduction amount.

- Subtract the total deductions from your gross pay to arrive at your net pay.

Ensure to double-check your calculations for accuracy.

Legal use of the Net Pay Tasks Answer Sheet

The legal use of the Net Pay Tasks Answer Sheet is crucial for compliance with employment and tax laws. This document must accurately reflect all deductions and calculations as required by federal and state regulations. Employers should maintain records of completed sheets for audit purposes and ensure that employees understand their pay structure. Proper use of this sheet can help prevent disputes regarding pay discrepancies.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines that impact how net pay is calculated, including tax rates and allowable deductions. It is important to stay updated on these guidelines to ensure compliance. Employees should refer to IRS publications or consult tax professionals for specific questions regarding their individual tax situations. Understanding these guidelines can help in accurately filling out the Net Pay Tasks Answer Sheet and ensuring correct tax withholding.

Examples of using the Net Pay Tasks Answer Sheet

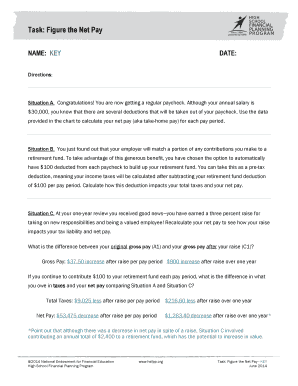

Examples of using the Net Pay Tasks Answer Sheet can illustrate its practical application. For instance, an employee with a gross pay of $3,000 may have deductions including $300 for federal tax, $150 for state tax, and $200 for Social Security. By entering these amounts into the sheet, the employee would calculate their net pay as follows:

- Gross Pay: $3,000

- Total Deductions: $300 + $150 + $200 = $650

- Net Pay: $3,000 - $650 = $2,350

This example demonstrates how the sheet can simplify the calculation process and ensure accuracy.

Quick guide on how to complete net pay tasks answer sheet

Complete Net Pay Tasks Answer Sheet effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Net Pay Tasks Answer Sheet on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Net Pay Tasks Answer Sheet without hassle

- Obtain Net Pay Tasks Answer Sheet and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive details with features that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tiring form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Net Pay Tasks Answer Sheet while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the net pay tasks answer sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of activity 2 1 calculate net pay answers?

Activity 2 1 calculate net pay answers helps individuals understand how to determine their take-home pay after deductions. This concept is crucial for financial planning and ensuring that you know your actual income. By mastering this, you can make informed decisions about budgeting and spending.

-

How can airSlate SignNow help businesses with document signing related to payroll?

AirSlate SignNow simplifies the document signing process for payroll with its electronic signature solutions. Users can securely send and sign payroll documents, including statements related to activity 2 1 calculate net pay answers. This streamlines the workflow, ensuring timely and accurate payroll management.

-

What features does airSlate SignNow offer for enhancing my signing process?

AirSlate SignNow provides a range of features, including customizable signing workflows and templates. These tools equip you to manage documentation more effectively, making it easier to incorporate details such as activity 2 1 calculate net pay answers. This enhances overall productivity and accuracy in the signing process.

-

Is there a cost associated with using airSlate SignNow for calculating net pay?

Yes, while airSlate SignNow offers various pricing plans, the cost depends on the features you choose. Invest in a plan that suits your business needs to streamline processes, including those involving activity 2 1 calculate net pay answers. Evaluating pricing can help you maximize ROI for your document management solutions.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! AirSlate SignNow offers seamless integrations with popular accounting software. This helps you streamline financial workflows, including those that utilize activity 2 1 calculate net pay answers, allowing for efficient data transfer and management across platforms.

-

What benefits can I expect from using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, such as faster turnaround times and reduced paperwork. Its platform ensures that processes related to activity 2 1 calculate net pay answers are handled efficiently, improving productivity and ensuring compliance with legal standards.

-

How secure is airSlate SignNow when handling sensitive payroll documents?

AirSlate SignNow prioritizes security by implementing advanced encryption and compliance measures. When dealing with sensitive documents related to activity 2 1 calculate net pay answers, you can trust that your information is protected. This ensures peace of mind for businesses focusing on secure electronic transactions.

Get more for Net Pay Tasks Answer Sheet

Find out other Net Pay Tasks Answer Sheet

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple