Payment Voucher Form

What is the Payment Voucher

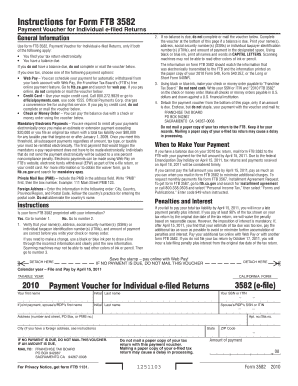

The electronic voucher payment form IRS is a document used by taxpayers to submit payments for various tax obligations. This form serves as a record of payment and helps ensure that taxpayers meet their financial responsibilities to the Internal Revenue Service. It is essential for individuals and businesses alike, as it facilitates accurate tracking of payments and compliance with tax regulations.

How to use the Payment Voucher

Using the electronic voucher payment form IRS is straightforward. Taxpayers must first determine the specific tax obligation they are addressing, such as income tax or estimated tax payments. After identifying the appropriate payment type, the form can be filled out electronically. This includes entering necessary information such as taxpayer identification details, payment amounts, and any relevant tax periods. Once completed, the form can be submitted electronically or printed for mailing, depending on the taxpayer's preference.

Steps to complete the Payment Voucher

Completing the electronic voucher payment form IRS involves several key steps:

- Gather all necessary information, including your taxpayer identification number and payment details.

- Access the electronic form through a reliable platform that supports e-signatures.

- Fill in the required fields accurately, ensuring all information is correct.

- Review the form for any errors or omissions.

- Submit the form electronically or print it for mailing.

Legal use of the Payment Voucher

The electronic voucher payment form IRS is legally binding when completed and submitted according to IRS guidelines. To ensure its validity, taxpayers must adhere to the stipulations set forth by the IRS regarding electronic submissions. This includes using a secure platform that complies with eSignature regulations, such as those outlined in the ESIGN Act and UETA. By following these guidelines, taxpayers can be confident that their payment voucher is legally recognized.

IRS Guidelines

The IRS provides specific guidelines for using the electronic voucher payment form. These guidelines include instructions on how to fill out the form, submission methods, and deadlines for payments. Taxpayers are encouraged to familiarize themselves with these guidelines to avoid penalties and ensure compliance. Additionally, the IRS updates its requirements periodically, so staying informed about any changes is crucial for accurate and timely submissions.

Filing Deadlines / Important Dates

Filing deadlines for the electronic voucher payment form IRS vary depending on the type of tax obligation. Generally, estimated tax payments are due quarterly, while annual tax returns have specific filing dates. It is essential for taxpayers to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar of important dates related to tax payments can help ensure compliance and timely submissions.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the electronic voucher payment form IRS. The most efficient method is electronic submission through a secure platform that supports e-signatures. Alternatively, taxpayers can print the completed form and mail it to the appropriate IRS address. In-person submissions are also possible at designated IRS offices, although this option may require an appointment. Each method has its own advantages, and taxpayers should choose the one that best fits their needs.

Quick guide on how to complete payment voucher

Effortlessly Prepare Payment Voucher on Any Device

Digital document management has gained traction among businesses and individuals alike. It presents a superb eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the features required to create, edit, and electronically sign your documents promptly without any hold-ups. Manage Payment Voucher on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

The Easiest Method to Edit and Electronically Sign Payment Voucher Effortlessly

- Locate Payment Voucher and click on Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all details and then click the Finish button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or a sharing link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Payment Voucher and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payment voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an electronic voucher payment form IRS?

An electronic voucher payment form IRS is a digital document used to make payments to the IRS efficiently. It helps streamline the payment process, ensuring your transactions are processed quickly and securely. Using an electronic voucher can signNowly reduce the risk of errors compared to traditional paper forms.

-

How does airSlate SignNow facilitate the electronic voucher payment form IRS?

airSlate SignNow simplifies the process of creating and sending an electronic voucher payment form IRS. With user-friendly tools, businesses can easily customize their forms and send them for eSignature in a matter of minutes. This not only accelerates the payment process but also enhances compliance and record-keeping.

-

What are the pricing options for using airSlate SignNow with the electronic voucher payment form IRS?

airSlate SignNow offers various pricing plans designed to accommodate businesses of all sizes. Each plan provides access to the features necessary for effective management of an electronic voucher payment form IRS. You can choose a plan that best fits your business needs and budget, ensuring cost-effectiveness.

-

What features does airSlate SignNow provide for electronic voucher payment form IRS?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSignature capabilities for your electronic voucher payment form IRS. These features ensure that you can easily create, send, and manage your forms while adhering to IRS regulations. This helps to enhance overall productivity.

-

Are there any benefits of using airSlate SignNow for electronic voucher payment form IRS?

Yes, using airSlate SignNow for your electronic voucher payment form IRS offers several benefits including increased efficiency, improved accuracy, and enhanced security. The digital format minimizes administrative burdens, allowing your team to focus more on core business activities. Additionally, eSigning provides a secure method for verification.

-

Can I integrate airSlate SignNow with other applications for electronic voucher payment form IRS?

Absolutely! airSlate SignNow offers various integration options with popular applications and services. This allows you to seamlessly incorporate the electronic voucher payment form IRS into your existing workflows and systems, ensuring all your tools work together harmoniously for a smoother user experience.

-

Is using an electronic voucher payment form IRS beneficial for small businesses?

Definitely! Small businesses can signNowly benefit from using an electronic voucher payment form IRS. It reduces the time needed for payment processing, helping small enterprises manage their cash flow effectively. Plus, the ease of use ensures that even those with limited technical expertise can navigate the system effortlessly.

Get more for Payment Voucher

Find out other Payment Voucher

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy