CT 945, Connecticut Annual Reconciliation of CT Gov Form

What is the CT 945, Connecticut Annual Reconciliation Of Withholding

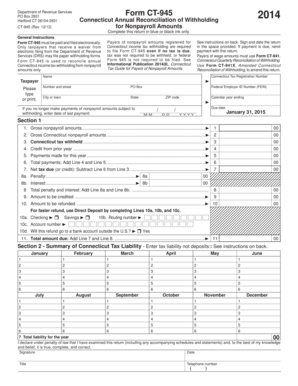

The CT 945 form, officially known as the Connecticut Annual Reconciliation of Withholding, is a crucial document for businesses in Connecticut. It serves to reconcile the amount of state income tax withheld from employees throughout the year. Employers must report the total amount withheld and ensure that it aligns with the payments made to the state. This form is essential for maintaining compliance with state tax laws and ensuring that employees’ tax contributions are accurately reflected.

Steps to Complete the CT 945

Completing the CT 945 involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll records for the year, including the total wages paid and the amount of state tax withheld. Next, fill out the form by entering the total withholding amounts in the designated fields. It is important to double-check all figures for accuracy. After completing the form, review it for any errors before submitting it to the Connecticut Department of Revenue Services. Finally, retain a copy for your records, as it may be needed for future reference or audits.

Legal Use of the CT 945

The CT 945 form is legally recognized as a valid means of reporting state income tax withholding. To ensure its legal standing, employers must comply with the requirements set forth by the Connecticut Department of Revenue Services. This includes accurately reporting all necessary information and submitting the form by the specified deadlines. Failure to comply with these requirements can result in penalties or fines, making it essential for businesses to understand the legal implications of the CT 945.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the CT 945 to avoid penalties. The form is typically due by the last day of February following the end of the tax year. For example, for the 2023 tax year, the form would be due by February 29, 2024. It is advisable to mark this date on your calendar and prepare the necessary documentation in advance to ensure timely submission.

Form Submission Methods

The CT 945 can be submitted through various methods to accommodate different preferences. Employers have the option to file the form online through the Connecticut Department of Revenue Services website, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate address provided by the state. In-person submissions may also be possible, depending on the current regulations and office hours of the Department of Revenue Services.

Key Elements of the CT 945

Understanding the key elements of the CT 945 is essential for accurate completion. The form requires specific information, including the employer’s name, address, and federal employer identification number (FEIN). Additionally, it requires the total amount of Connecticut income tax withheld during the year, as well as any adjustments that may be necessary. Employers must also certify that the information provided is accurate and complete, which is a critical component of the submission process.

Quick guide on how to complete ct 945 connecticut annual reconciliation of ct gov

Finish CT 945, Connecticut Annual Reconciliation Of CT gov effortlessly on any gadget

Digital document administration has gained traction with businesses and individuals alike. It offers an ideal eco-friendly solution to conventional printed and signed forms, as you can easily locate the necessary document and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents quickly without delays. Manage CT 945, Connecticut Annual Reconciliation Of CT gov on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign CT 945, Connecticut Annual Reconciliation Of CT gov without hassle

- Access CT 945, Connecticut Annual Reconciliation Of CT gov and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign function, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign CT 945, Connecticut Annual Reconciliation Of CT gov and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct 945 connecticut annual reconciliation of ct gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct 945, and how does it relate to airSlate SignNow?

ct 945 is a unique identifier for legal documents processed through airSlate SignNow. This tool enables businesses to send and eSign important documents efficiently, ensuring they comply with legal standards. By understanding how ct 945 integrates with our solution, users can better manage their document workflows.

-

What are the pricing options for airSlate SignNow with respect to ct 945 transactions?

Our pricing plans for airSlate SignNow vary based on the number of ct 945 transactions you need. We offer flexible subscription options that cater to different business sizes, ensuring you only pay for what you use. For comprehensive pricing details, please refer to our pricing page.

-

What features does airSlate SignNow offer for documents labeled with ct 945?

airSlate SignNow provides several features for documents associated with ct 945, including customizable templates, real-time tracking, and secure eSigning capabilities. These features help streamline the process, reducing the time it takes to finalize agreements. Moreover, users can integrate additional functionalities for enhanced document management.

-

How can airSlate SignNow benefit my business when managing ct 945 documents?

Using airSlate SignNow for managing ct 945 documents can greatly enhance your business efficiency. Our platform simplifies the signing process, reducing turnaround times and improving collaboration between team members and clients. Additionally, with secure storage and easy access, you can manage your documents with peace of mind.

-

Does airSlate SignNow support integration with other software for ct 945 transactions?

Yes, airSlate SignNow supports integration with various software applications to manage ct 945 transactions seamlessly. Whether you use CRM systems, document management tools, or ERP software, our platform can connect with these systems, ensuring a cohesive workflow. This integration allows for enhanced productivity and data management.

-

Is eSigning a legal process for ct 945 documents using airSlate SignNow?

Yes, eSigning through airSlate SignNow is a legally recognized process for ct 945 documents. Our platform adheres to global eSignature laws, ensuring that all signed documents are valid and enforceable. This compliance provides users with assurance when electronically signing critical agreements.

-

Can I customize my airSlate SignNow experience for managing ct 945 documents?

Absolutely! airSlate SignNow allows extensive customization options for managing ct 945 documents. Users can create personalized templates and workflows that align with their specific business needs. This flexibility ensures that your signing process is optimized for maximum efficiency.

Get more for CT 945, Connecticut Annual Reconciliation Of CT gov

- Rule 100 forms montana legislature

- Certificate of service i hereby certify that i have this form

- Petitioner name address city state zip telephone fax form

- Army mediation handbook united states army form

- Das form itb template code 3 1 05 clatsop yumpucom

- Unauthorized practice rules professional guidelines and form

- Form 8 form 8 mca montana legislature

- Failure to appear in court present your case to legalmatch form

Find out other CT 945, Connecticut Annual Reconciliation Of CT gov

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later