29 4364 Form

What is the 29 4364 Form

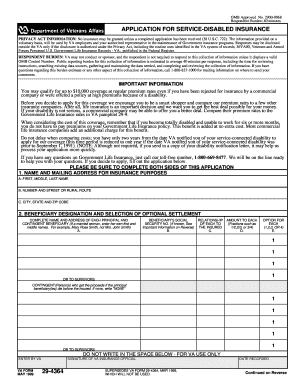

The 29 4364 Form is a specific document used primarily for tax purposes in the United States. It serves as a declaration or application for certain tax benefits or adjustments. Understanding the purpose and requirements of this form is crucial for individuals and businesses seeking to ensure compliance with IRS regulations. The form typically includes sections for personal information, tax identification numbers, and details relevant to the specific tax situation being addressed.

How to use the 29 4364 Form

Using the 29 4364 Form involves several key steps to ensure that it is filled out correctly and submitted on time. First, gather all necessary information, including personal identification and any relevant financial documents. Next, carefully complete each section of the form, ensuring accuracy in reporting income and deductions. After filling out the form, review it for any errors before submission. It can be submitted electronically or via mail, depending on the specific instructions provided by the IRS.

Steps to complete the 29 4364 Form

Completing the 29 4364 Form requires attention to detail. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Fill in your personal information accurately.

- Provide your tax identification number and any other requested details.

- Complete the sections related to your tax situation, including income and deductions.

- Double-check all entries for accuracy to avoid delays.

- Sign and date the form before submission.

Legal use of the 29 4364 Form

The 29 4364 Form is legally binding when completed and submitted according to IRS guidelines. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or audits. The form must be signed by the individual or authorized representative, affirming the validity of the information. Compliance with the legal requirements surrounding this form helps protect against potential legal issues.

Filing Deadlines / Important Dates

Timely filing of the 29 4364 Form is critical to avoid penalties. The specific deadlines may vary based on the tax year and the type of tax benefit being claimed. Generally, forms must be submitted by the tax filing deadline, which is typically April fifteenth for individual taxpayers. It is advisable to check the IRS website or consult a tax professional for the most current deadlines related to the 29 4364 Form.

Form Submission Methods (Online / Mail / In-Person)

The 29 4364 Form can be submitted through various methods, depending on the preferences of the filer and the requirements of the IRS. Options include:

- Online Submission: Many taxpayers choose to file electronically using IRS-approved software, which can streamline the process and reduce errors.

- Mail: The form can be printed and mailed to the appropriate IRS address, as indicated in the instructions.

- In-Person: Some individuals may opt to submit the form in person at designated IRS offices, although this method is less common.

Quick guide on how to complete 29 4364 form

Prepare 29 4364 Form effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents quickly and without complications. Manage 29 4364 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and electronically sign 29 4364 Form with ease

- Obtain 29 4364 Form and then select Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign 29 4364 Form and ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 29 4364 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 29 4364 Form and how can airSlate SignNow help with it?

The 29 4364 Form is a specific document often used in various industries for compliance or internal processes. With airSlate SignNow, you can easily send, eSign, and manage your 29 4364 Form securely online, streamlining your workflow and reducing paperwork.

-

How much does it cost to eSign a 29 4364 Form using airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to fit various budgets. By choosing our solution, you can eSign the 29 4364 Form at a fraction of the cost compared to traditional methods, with flexible payment options to cater to your needs.

-

Are there any features specifically for managing the 29 4364 Form?

Yes, airSlate SignNow includes a range of features designed to enhance the management of the 29 4364 Form. These features include customizable templates, automated reminders, and secure storage, ensuring that your documents are always organized and easily accessible.

-

Can I integrate airSlate SignNow with other applications when using the 29 4364 Form?

Absolutely! airSlate SignNow seamlessly integrates with a variety of applications and tools, facilitating a smoother process for the 29 4364 Form. Whether it's CRM systems or cloud storage, our integrations help streamline your document workflow.

-

What benefits can businesses gain from using airSlate SignNow for the 29 4364 Form?

Using airSlate SignNow for the 29 4364 Form can signNowly reduce turnaround time for document approvals, enhance security with encrypted eSignatures, and improve overall efficiency in your operations. These benefits help businesses save time and resources while ensuring compliance.

-

Is the airSlate SignNow platform easy to use for the 29 4364 Form?

Yes, the airSlate SignNow platform is designed to be user-friendly, making it easy for anyone to eSign the 29 4364 Form without any technical expertise. The intuitive interface allows users to navigate through the process smoothly, ensuring a quick and hassle-free experience.

-

How does airSlate SignNow ensure the security of the 29 4364 Form?

Security is a top priority at airSlate SignNow. We employ robust encryption methods and compliance with industry standards to protect your 29 4364 Form and any sensitive information it contains, providing peace of mind to our users.

Get more for 29 4364 Form

- Warrant and confirm unto and husband and form

- First report of injury or occupational disease montana state form

- State of montana to wit form

- Adjuster change form

- Helena mt 59604 8011 form

- Quitclaim unto a corporation organized under the laws of the state form

- A corporation organized under the laws of the state grant bargain form

- Hereinafter referred to as grantor does release remise and forever form

Find out other 29 4364 Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online