Form 720 Dhhs

What is the Form 720 Dhhs

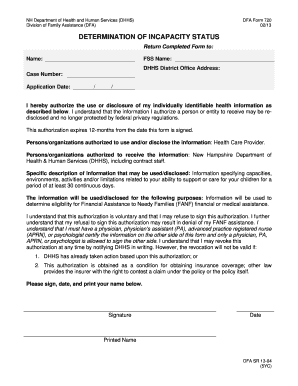

The Form 720 Dhhs is a document used for reporting specific health-related information to the Department of Health and Human Services (DHHS). This form is essential for compliance with various health regulations and ensures that organizations meet federal standards. It is typically utilized by healthcare providers, institutions, and other entities that operate within the healthcare sector. Understanding the purpose and requirements of this form is crucial for maintaining compliance and avoiding potential penalties.

How to use the Form 720 Dhhs

Using the Form 720 Dhhs involves several key steps to ensure accurate completion and submission. First, gather all necessary information related to the health services provided or received. This may include patient data, service details, and any relevant financial information. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once the form is filled, review it for any errors or omissions before submission. Finally, submit the form according to the specified guidelines, whether online, by mail, or in person, as required by the DHHS.

Steps to complete the Form 720 Dhhs

Completing the Form 720 Dhhs requires a systematic approach to ensure all information is accurately reported. Follow these steps:

- Step One: Gather necessary documentation, including patient records and financial statements.

- Step Two: Carefully read the instructions provided with the form to understand each section's requirements.

- Step Three: Fill in the required fields, ensuring accuracy and completeness.

- Step Four: Review the completed form for any errors or missing information.

- Step Five: Submit the form according to the specified method: online, by mail, or in person.

Legal use of the Form 720 Dhhs

The legal use of the Form 720 Dhhs is governed by federal regulations that dictate how health information must be reported and maintained. Compliance with these regulations is essential for organizations to avoid legal repercussions. The form must be completed truthfully and accurately, as any false information can lead to penalties, including fines or legal action. Understanding the legal implications of this form helps ensure that organizations operate within the law and maintain their credibility.

Filing Deadlines / Important Dates

Filing deadlines for the Form 720 Dhhs are critical to ensure compliance with DHHS regulations. It is important to be aware of specific dates for submission, as late filings can result in penalties. Typically, these deadlines are set annually or quarterly, depending on the nature of the reporting required. Organizations should maintain a calendar of important dates to ensure timely submissions and avoid any disruptions in compliance.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form 720 Dhhs can be done through various methods, depending on the preferences of the organization and the requirements set by the DHHS. The available submission methods include:

- Online Submission: Many organizations prefer to submit the form electronically through the DHHS portal, which allows for quicker processing.

- Mail Submission: For those who prefer traditional methods, the form can be printed and mailed to the appropriate DHHS office.

- In-Person Submission: Some entities may choose to deliver the form in person, ensuring immediate confirmation of receipt.

Quick guide on how to complete form 720 dhhs

Prepare Form 720 Dhhs seamlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Form 720 Dhhs on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Form 720 Dhhs effortlessly

- Find Form 720 Dhhs and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to store your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, laborious form navigation, or errors that require printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any chosen device. Edit and eSign Form 720 Dhhs and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 720 dhhs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 720 Dhhs and how can airSlate SignNow help?

The Form 720 Dhhs is a document used for specific reporting purposes within organizations. With airSlate SignNow, you can easily fill, sign, and send this form electronically, ensuring a smooth and efficient process. Our platform simplifies the management of Form 720 Dhhs, making compliance easier than ever.

-

Is there a cost associated with using airSlate SignNow for Form 720 Dhhs?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans provide cost-effective solutions for managing forms like the Form 720 Dhhs, ensuring that you only pay for the features you require. You can check our pricing page for detailed options that fit your budget.

-

What features does airSlate SignNow offer for Form 720 Dhhs?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage tailored for managing the Form 720 Dhhs. These features streamline your workflow, allowing you to complete and send forms quickly. Additionally, our user-friendly interface ensures that anyone can use it without technical expertise.

-

How does airSlate SignNow ensure the security of the Form 720 Dhhs?

We prioritize security with robust encryption, ensuring that your Form 720 Dhhs and other documents are safe during transfer and storage. airSlate SignNow complies with industry standards and regulations to protect sensitive information. You can confidently manage your forms knowing they are secure.

-

Can I integrate airSlate SignNow with other software for Form 720 Dhhs?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing the workflow for managing the Form 720 Dhhs. This includes popular tools like Google Drive, Dropbox, and CRM systems, allowing for smooth operation across your business. Integration ensures you can access and manage your documents efficiently.

-

What benefits does airSlate SignNow provide for completing Form 720 Dhhs?

Using airSlate SignNow to complete Form 720 Dhhs offers numerous benefits, including time savings, reduced paperwork, and increased productivity. Our electronic process eliminates the need for print and manual signatures, streamlining approval. This leads to quicker turnaround times and a more efficient workflow overall.

-

Is airSlate SignNow user-friendly for filling out Form 720 Dhhs?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to fill out the Form 720 Dhhs. The intuitive interface guides users through the process, even if they have limited technical skills. Our aim is to make document management accessible to everybody.

Get more for Form 720 Dhhs

- Forth in the plans and specifications signed by both owner and contractor project form

- Paint adhesive products from windows floors ceramic tile and bathroom fixtures site form

- Outletfixture blocks form

- Insulated spaces temperature insulation air conditioning units systems or coolers ducts form

- Particular area or worksite form

- Slump form

- City of laguna niguel plumbing contract services request for form

- Garages walls floors or other structures form

Find out other Form 720 Dhhs

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors