APPLICATION for HEARING on EXEMPT STATUS of FUNDS Jud Ct 2002-2026

Understanding the application for hearing on exempt status of funds

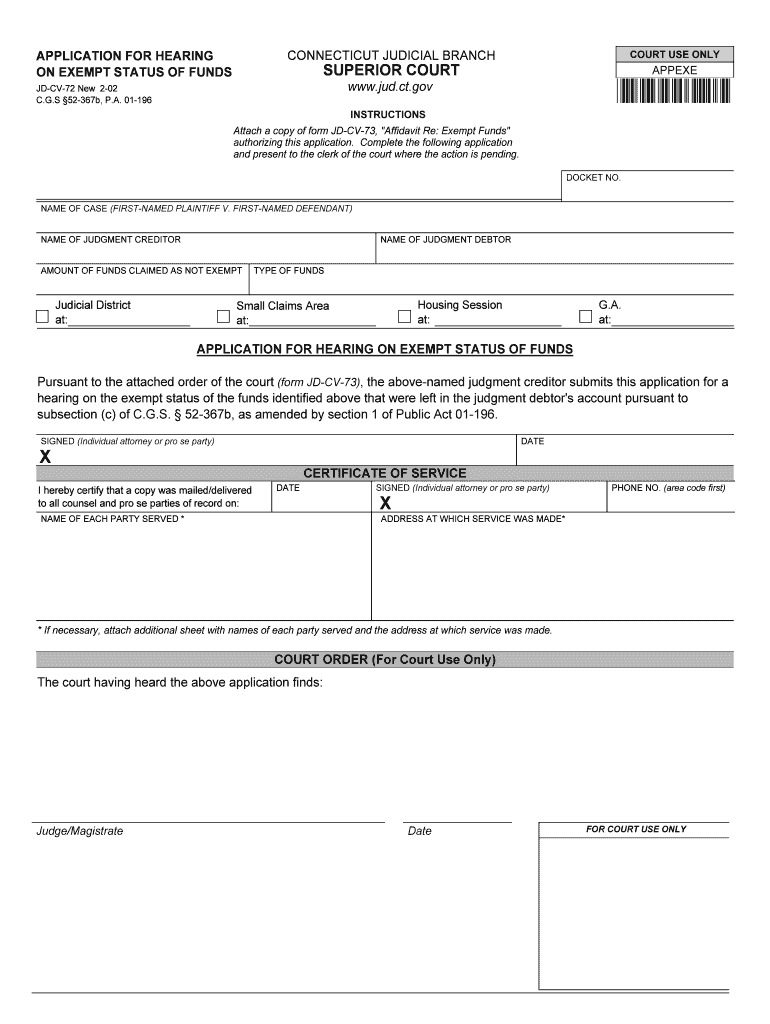

The application for hearing on exempt status of funds, often referred to as the CT application exempt status, is a legal document used in Connecticut. This form allows individuals to request a hearing regarding the exempt status of certain funds from legal actions such as garnishments or collections. The purpose of this application is to protect specific assets from being seized, ensuring that individuals can maintain access to necessary funds for living expenses and other essential needs.

Steps to complete the application for hearing on exempt status of funds

Completing the application for hearing on exempt status of funds involves several important steps. Begin by obtaining the official form, which can be accessed through court websites or legal resources. Next, fill out the required information accurately, including personal details and specifics about the funds in question. It is crucial to provide clear and concise explanations for why these funds should be considered exempt. After completing the form, review it for accuracy and completeness before submitting it to the appropriate court.

Key elements of the application for hearing on exempt status of funds

Several key elements must be included in the application for hearing on exempt status of funds. These elements typically consist of:

- Personal Information: Full name, address, and contact details of the applicant.

- Details of the Funds: Description of the funds being claimed as exempt, including their source and amount.

- Legal Basis: A clear statement of the legal grounds for claiming the exemption, referencing relevant laws or statutes.

- Signature: The applicant's signature, affirming the truthfulness of the information provided.

Legal use of the application for hearing on exempt status of funds

The application for hearing on exempt status of funds serves a critical legal function. It allows individuals to assert their rights regarding certain assets that should not be subject to legal claims. By filing this application, individuals can seek judicial review of their claims, providing a structured process to protect their financial interests. This legal recourse is essential for those facing financial hardship or legal actions that threaten their essential resources.

Eligibility criteria for the application for hearing on exempt status of funds

To be eligible to file the application for hearing on exempt status of funds, individuals typically must meet specific criteria. These may include:

- Being a resident of Connecticut.

- Having funds or assets that are legally recognized as exempt under state law.

- Demonstrating that the funds are necessary for basic living expenses or essential needs.

Meeting these criteria is crucial for the successful consideration of the application by the court.

Application process and approval time

The application process for the hearing on exempt status of funds involves submitting the completed form to the appropriate court. After submission, the court will review the application and may schedule a hearing to discuss the claims made. The approval time can vary based on the court's schedule and the complexity of the case. Generally, applicants should expect to wait several weeks for a decision, depending on the court's workload and the specific circumstances surrounding the application.

Quick guide on how to complete application for hearing on exempt status of funds jud ct

Finalize and submit your APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct swiftly

Comprehensive tools for digital document interchange and validation are currently essential for enhancing processes and the ongoing refinement of your forms. When managing legal documents and signing a APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct, the appropriate signing solution can conserve considerable time and reduce paper use with every submission.

Locate, complete, modify, endorse, and distribute your legal paperwork with airSlate SignNow. This service provides all the features you require to establish streamlined paper submission workflows. Its vast repository of legal forms and intuitive interface will assist you in obtaining your APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct quickly, and the editor equipped with our signing feature will enable you to finalize and validate it immediately.

Authorize your APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct in a few straightforward steps

- Access the APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct you need in our library through search or catalog sections.

- Examine the form details and preview it to ensure it meets your requirements and state regulations.

- Select Get form to open it for modification.

- Complete the form using the all-encompassing toolbar.

- Verify the information you've entered and click the Sign tool to authorize your document.

- Choose one of three options to insert your signature.

- Conclude the editing process and save the document to your files, then download it on your device or share it right away.

Streamline every phase of your document preparation and validation with airSlate SignNow. Explore a more effective online option that considers every aspect of managing your documents.

Create this form in 5 minutes or less

FAQs

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

-

On which other websites of medical colleges would a candidate have to register even after filling out the NEET application form for 2017?

Hello.Register yourself for IPU, BHU , AMU , Manipal KMC, COMEDK , CMC Vellore, Kalinga Institute of Medical Sciences (KIMS),Bharati Vidyapeeth's,Medical College, Hospital, BVDU,Pune.Plus you can also register for private colleges of different States.Good luck

-

On which other websites of medical colleges would a candidate have to register even after filling out the NEET application form for 2018?

The NEET 2018 Application form is the only registration you need to do for the exam.After clearing the exam you will need to fill counselling preference on MCC official website.

-

Do I need to send a physical copy of the application form for a PAN card if I had filled it out online on NSDL using e-Sign/e-KYC?

Refer the following link for detail process for online pan application.How to apply for PAN card

-

How do I fill out the N-600 certificate of citizenship application if you already received a US passport from the state department and returned your Greencard as the questions seem to assume one is still on immigrant status?

In order to file N-600 to apply for a Certificate of Citizenship, you must already be a US citizen beforehand. (The same is true to apply for a US passport — you must already be a US citizen beforehand.) Whether you applied for a passport already is irrelevant; it is normal for a US citizen to apply for a US passport; applying for a passport never affects your immigration status, as you must already have been a US citizen before you applied for a passport.The form’s questions are indeed worded poorly. Just interpret the question to be asking about your status before you became a citizen, because otherwise the question would make no sense, as an applicant of N-600 must already be a US citizen at the time of filing the application.(By the way, why are you wasting more than a thousand dollars to apply for a Certificate of Citizenship anyway? It basically doesn’t serve any proof of citizenship purposes that a US passport doesn’t already serve as.)

Create this form in 5 minutes!

How to create an eSignature for the application for hearing on exempt status of funds jud ct

How to make an eSignature for your Application For Hearing On Exempt Status Of Funds Jud Ct online

How to generate an eSignature for the Application For Hearing On Exempt Status Of Funds Jud Ct in Google Chrome

How to create an eSignature for putting it on the Application For Hearing On Exempt Status Of Funds Jud Ct in Gmail

How to generate an electronic signature for the Application For Hearing On Exempt Status Of Funds Jud Ct right from your smart phone

How to make an electronic signature for the Application For Hearing On Exempt Status Of Funds Jud Ct on iOS devices

How to generate an eSignature for the Application For Hearing On Exempt Status Of Funds Jud Ct on Android

People also ask

-

What is the APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct. and why is it important?

The APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct. is a legal document that allows individuals or entities to request an exemption for certain funds from being subject to collection actions. It's crucial for protecting specific funds from creditors, ensuring that individuals can maintain access to necessary resources.

-

How can airSlate SignNow assist with the APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct.?

airSlate SignNow simplifies the process of preparing and signing the APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct. With our user-friendly platform, you can easily create, edit, and eSign your documents securely, ensuring compliance with legal standards.

-

What are the pricing options for using airSlate SignNow for my APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct.?

airSlate SignNow offers flexible pricing plans tailored to fit your needs, whether you are an individual or a business. Our cost-effective solutions ensure you have access to all the necessary tools to manage your APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct. without breaking the bank.

-

Can I integrate airSlate SignNow with other applications when working on the APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct.?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to streamline your workflow while preparing the APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct. You can connect with popular platforms such as Google Drive, Dropbox, and more to enhance your document management.

-

What are the benefits of using airSlate SignNow for legal documents like the APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct.?

Using airSlate SignNow for legal documents like the APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct. offers numerous benefits, including enhanced security, quick turnaround times, and easy collaboration. Our platform ensures that your documents are legally binding and compliant with all regulations.

-

Is it safe to eSign the APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct. using airSlate SignNow?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your data when eSigning the APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct. Your information is encrypted, and we comply with all legal standards to ensure your documents are secure.

-

Can I track the status of my APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct. when using airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your documents, including the APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct. You can monitor who has viewed or signed the document, giving you complete control and visibility throughout the process.

Get more for APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct

- Sioux lookout zone nihb expense claim form

- Sc1065 form

- Bank transmittal form

- Credit application apartment form

- Be it known that for payment in the sum of the full receipt of which is acknowledged the undersigned seller hereby sells and form

- Afrs 1397 form

- 20152016 verification worksheet ventura college form

- Casa verde weatherization program application form

Find out other APPLICATION FOR HEARING ON EXEMPT STATUS OF FUNDS Jud Ct

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer