Form P46 Notification to Revenue of Particulars of a New Employee Revenue

What is the Form P46 Notification To Revenue Of Particulars Of A New Employee

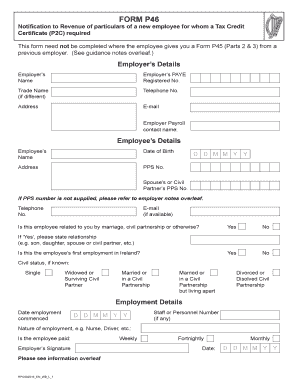

The P46 form serves as a notification to the revenue authorities regarding the particulars of a new employee. This document is essential for employers to report the necessary information about new staff members, ensuring compliance with tax regulations. The form collects details such as the employee's name, address, and tax identification number, which are crucial for proper tax processing. By submitting this form, employers help facilitate accurate tax withholding and reporting for their new hires.

Steps to complete the Form P46 Notification To Revenue Of Particulars Of A New Employee

Completing the P46 form involves several key steps to ensure accuracy and compliance. First, gather the necessary information about the new employee, including their full name, address, and tax identification number. Next, fill out the form carefully, ensuring that all sections are completed accurately. It is important to double-check the information for any errors before submission. Once the form is completed, it can be submitted electronically or via traditional mail, depending on the preferred method of the employer.

Legal use of the Form P46 Notification To Revenue Of Particulars Of A New Employee

The legal use of the P46 form is governed by tax regulations that require employers to report new employees to the revenue authorities. This form must be filled out truthfully and submitted in a timely manner to comply with legal obligations. Failure to submit the P46 form or providing inaccurate information can result in penalties for the employer. Therefore, it is crucial to understand the legal implications and ensure that the form is completed correctly to avoid any compliance issues.

Key elements of the Form P46 Notification To Revenue Of Particulars Of A New Employee

The P46 form includes several key elements that are vital for accurate reporting. These elements typically consist of the employee's personal details, such as their full name, address, and tax identification number. Additionally, the form may require information regarding the employee's previous employment status and tax code. Understanding these key components is essential for employers to ensure that they provide all necessary information to the revenue authorities.

Form Submission Methods for the P46 Notification To Revenue Of Particulars Of A New Employee

Employers have multiple options for submitting the P46 form to the revenue authorities. The form can be submitted electronically through designated online platforms, which often provide a quicker processing time. Alternatively, employers may choose to submit the form via traditional mail. It is important to select the method that best suits the employer's needs while ensuring compliance with submission deadlines.

Examples of using the Form P46 Notification To Revenue Of Particulars Of A New Employee

Employers may encounter various scenarios in which the P46 form is utilized. For instance, when a business hires a new employee who has not previously been employed, the P46 form is necessary to report their details to the revenue authorities. Additionally, if an employee is returning to work after a break, the form may be required to update their tax information. Understanding these examples helps employers recognize the importance of the P46 form in different employment situations.

Quick guide on how to complete form p46 notification to revenue of particulars of a new employee revenue

Prepare Form P46 Notification To Revenue Of Particulars Of A New Employee Revenue seamlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the right form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Form P46 Notification To Revenue Of Particulars Of A New Employee Revenue on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form P46 Notification To Revenue Of Particulars Of A New Employee Revenue effortlessly

- Obtain Form P46 Notification To Revenue Of Particulars Of A New Employee Revenue and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your files or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal weight as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select how you prefer to send your document, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form P46 Notification To Revenue Of Particulars Of A New Employee Revenue and ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form p46 notification to revenue of particulars of a new employee revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the p46 form and how can airSlate SignNow help with it?

The p46 form is used by employers to gather information about their employees’ tax codes. airSlate SignNow simplifies the process by allowing businesses to easily send and eSign the p46, ensuring all necessary information is captured and processed quickly. By using airSlate SignNow, you can streamline your HR paperwork and reduce administrative burdens.

-

Is airSlate SignNow a cost-effective solution for managing p46 forms?

Yes, airSlate SignNow offers a cost-effective solution for managing p46 forms. With its competitive pricing plans, businesses can save both time and resources by efficiently handling document signing processes. This translates to greater productivity, as your team can focus on more strategic tasks.

-

What features does airSlate SignNow offer for p46 form management?

airSlate SignNow includes a range of features that enhance the management of the p46 form. Key features include customizable templates, secure storage, real-time tracking, and automated reminders. These tools not only make the completion of the p46 easier but also ensure compliance with legal requirements.

-

Can airSlate SignNow integrate with my existing systems for handling p46 forms?

Absolutely! airSlate SignNow offers integrations with various platforms, making it easy to incorporate p46 form management into your existing systems. Whether you're using CRM software or accounting tools, integrations help maintain seamless workflows and data accuracy.

-

How secure is the information provided in the p46 form with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs state-of-the-art encryption and security protocols to protect all information, including data from the p46 form. Your confidential documents are safe from unauthorized access, ensuring compliance with data protection regulations.

-

What are the benefits of using airSlate SignNow for p46 eSigning?

Using airSlate SignNow for eSigning p46 forms offers numerous benefits, including reduced turnaround time and increased accuracy. Electronic signatures eliminate the need for printing, scanning, or mailing, making the process faster and more efficient. Additionally, eSigning simplifies record-keeping and enhances accessibility.

-

Is there customer support available for issues related to p46 forms on airSlate SignNow?

Yes, airSlate SignNow provides robust customer support for any issues related to p46 forms. Users can access help through various channels, including chat, email, and phone support. This ensures you have the assistance you need to effectively manage your p46 processes without any hassle.

Get more for Form P46 Notification To Revenue Of Particulars Of A New Employee Revenue

- Oh 599ppdf form

- City ohio or a form

- To the clerk of the united states district court for the northern district of ohio form

- Consent to the jurisdiction of a magistrate judge form

- Judgment entry of dissolution of marriage supreme court of form

- Lake county ohio common pleas court general division site form

- Lessor shall pay the present charges for garbage collection and garbage form

- If the parties have any minor form

Find out other Form P46 Notification To Revenue Of Particulars Of A New Employee Revenue

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application