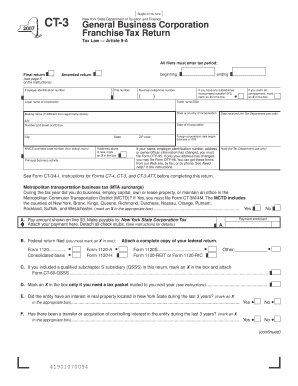

New York General Business Franchise Tax Return Fillable Form

What is the New York General Business Franchise Tax Return Fillable Form

The New York General Business Franchise Tax Return Fillable Form is a crucial document for businesses operating in New York. This form is used to report the income, deductions, and credits of corporations and limited liability companies (LLCs) that are subject to the franchise tax. It ensures compliance with state tax laws and helps determine the amount of tax owed. By utilizing a fillable format, businesses can easily complete and submit the form electronically, enhancing efficiency and accuracy in the filing process.

How to use the New York General Business Franchise Tax Return Fillable Form

Using the New York General Business Franchise Tax Return Fillable Form involves several straightforward steps. First, access the fillable form online, ensuring you have the latest version. Fill in the required fields with accurate information regarding your business's financials, including gross income, allowable deductions, and tax credits. After completing the form, review all entries for accuracy. Once confirmed, you can eSign the document using a digital signature solution, ensuring it meets legal standards for submission.

Steps to complete the New York General Business Franchise Tax Return Fillable Form

Completing the New York General Business Franchise Tax Return Fillable Form requires careful attention to detail. Follow these steps:

- Download the fillable form from a reliable source.

- Enter your business information, including name, address, and Employer Identification Number (EIN).

- Report your total gross income for the tax year.

- List any deductions you are eligible for, such as business expenses.

- Calculate your tax liability based on the provided guidelines.

- Review the form thoroughly to ensure all information is complete and accurate.

- Sign the form electronically to validate it before submission.

Legal use of the New York General Business Franchise Tax Return Fillable Form

The legal use of the New York General Business Franchise Tax Return Fillable Form is essential for ensuring compliance with state tax regulations. When filled out correctly and submitted on time, the form serves as a legally binding document that reflects your business's tax obligations. It is important to adhere to the guidelines set forth by the New York Department of Taxation and Finance, as failure to do so may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the New York General Business Franchise Tax Return Fillable Form are critical for maintaining compliance. Typically, the form is due on the fifteenth day of the fourth month following the close of your business's tax year. For corporations operating on a calendar year, this means the deadline is April 15. It is advisable to mark your calendar with important dates to avoid late submissions and potential penalties.

Required Documents

To complete the New York General Business Franchise Tax Return Fillable Form, you will need several key documents. These may include:

- Your business's financial statements, including income statements and balance sheets.

- Records of all income earned during the tax year.

- Documentation for any deductions claimed, such as receipts for business expenses.

- Previous tax returns, if applicable, for reference.

Form Submission Methods (Online / Mail / In-Person)

The New York General Business Franchise Tax Return Fillable Form can be submitted through various methods. The most efficient way is to file online using an eSignature solution, which ensures immediate processing. Alternatively, you can print the completed form and mail it to the appropriate tax office. In-person submissions are also possible, but online filing is recommended for speed and convenience. Always check the latest submission guidelines to ensure compliance with state requirements.

Quick guide on how to complete new york general business franchise tax return fillable form

Easily Prepare New York General Business Franchise Tax Return Fillable Form on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage New York General Business Franchise Tax Return Fillable Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-focused task today.

The Easiest Way to Edit and eSign New York General Business Franchise Tax Return Fillable Form Effortlessly

- Obtain New York General Business Franchise Tax Return Fillable Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or errors that necessitate the printing of new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and eSign New York General Business Franchise Tax Return Fillable Form to facilitate excellent communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york general business franchise tax return fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York General Business Franchise Tax Return Fillable Form?

The New York General Business Franchise Tax Return Fillable Form is a digital document designed for businesses to report their state taxes efficiently. With this fillable form, you can easily input your information, calculate your tax liabilities, and submit your return seamlessly. It simplifies the tax filing process while ensuring compliance with New York state regulations.

-

How can I access the New York General Business Franchise Tax Return Fillable Form?

You can access the New York General Business Franchise Tax Return Fillable Form through the airSlate SignNow platform. Simply create an account, navigate to the tax forms section, and select the fillable form you need. This user-friendly platform allows for easy navigation and immediate access to essential documents.

-

Is the New York General Business Franchise Tax Return Fillable Form user-friendly?

Yes, the New York General Business Franchise Tax Return Fillable Form is designed with user-friendliness in mind. The fillable fields make it easy to enter your data, and the platform provides prompts to assist you. This ensures you can complete your tax return without any hassle, saving you time and effort.

-

Are there any costs associated with the New York General Business Franchise Tax Return Fillable Form?

Using the New York General Business Franchise Tax Return Fillable Form through airSlate SignNow is cost-effective. While there may be a subscription fee for accessing premium features, the basic form is available at competitive pricing. You can choose from various plans that suit your business needs and budget.

-

What features does the New York General Business Franchise Tax Return Fillable Form offer?

The New York General Business Franchise Tax Return Fillable Form includes features such as easy data entry, automated calculations, and filing reminders. With airSlate SignNow, you can also benefit from secure e-signature options, ensuring your form is legally compliant. These features enhance your overall experience and streamline the tax filing process.

-

Can I integrate the New York General Business Franchise Tax Return Fillable Form with other applications?

Yes, the New York General Business Franchise Tax Return Fillable Form can be integrated with other applications via airSlate SignNow. This allows seamless data transfer and enhances your workflow by linking with tools like CRM systems, accounting software, and more. Integration options help simplify your business processes further.

-

What are the benefits of using the New York General Business Franchise Tax Return Fillable Form?

Using the New York General Business Franchise Tax Return Fillable Form offers numerous benefits, including improved accuracy in reporting and reduced filing times. The form is designed to help you avoid common mistakes, ensuring compliance with tax law. Additionally, the convenience of e-signatures speeds up the submission process and enhances security.

Get more for New York General Business Franchise Tax Return Fillable Form

- Control number oh p083 pkg form

- Control number oh p084 pkg form

- Identity theft ohio attorney general dave yost form

- Control number oh p086 pkg form

- Control number oh p088 pkg form

- This form is a template for a letter of recommendation for an employment position and can be

- Oh p001 pkgdocx 2018 us legal forms inc ohio life

- Central ohios choice for community bankingheartland bank form

Find out other New York General Business Franchise Tax Return Fillable Form

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now