Acuerdo Voluntario Internal Revenue Service Irs Form

What is the Acuerdo Voluntario Internal Revenue Service IRS

The Acuerdo Voluntario Internal Revenue Service IRS is a formal agreement between a taxpayer and the IRS. This agreement typically addresses tax liabilities, allowing taxpayers to resolve outstanding issues with the IRS while ensuring compliance with tax laws. The Acuerdo Voluntario serves as a mechanism for taxpayers to negotiate terms that may include payment plans or reduced penalties, depending on individual circumstances.

How to use the Acuerdo Voluntario Internal Revenue Service IRS

Utilizing the Acuerdo Voluntario involves understanding your tax situation and communicating effectively with the IRS. Taxpayers should first gather all relevant financial documents, including tax returns and any notices received from the IRS. Once you have this information, you can initiate a discussion with the IRS, either by calling or writing to them, to propose an agreement tailored to your financial capabilities.

Steps to complete the Acuerdo Voluntario Internal Revenue Service IRS

Completing the Acuerdo Voluntario requires several important steps:

- Gather necessary documentation, including tax returns and IRS correspondence.

- Assess your financial situation to determine what terms you can propose.

- Contact the IRS to discuss your situation and express your intent to enter into an agreement.

- Negotiate terms that are mutually acceptable, focusing on payment plans or penalties.

- Document the agreement in writing, ensuring both parties understand the terms.

Legal use of the Acuerdo Voluntario Internal Revenue Service IRS

The legal use of the Acuerdo Voluntario is grounded in tax law, which allows taxpayers to negotiate terms with the IRS. This agreement must comply with federal regulations and is legally binding once both parties have signed. It is crucial for taxpayers to ensure that the terms of the agreement are clear and that they adhere to the agreed-upon conditions to avoid further legal complications.

Key elements of the Acuerdo Voluntario Internal Revenue Service IRS

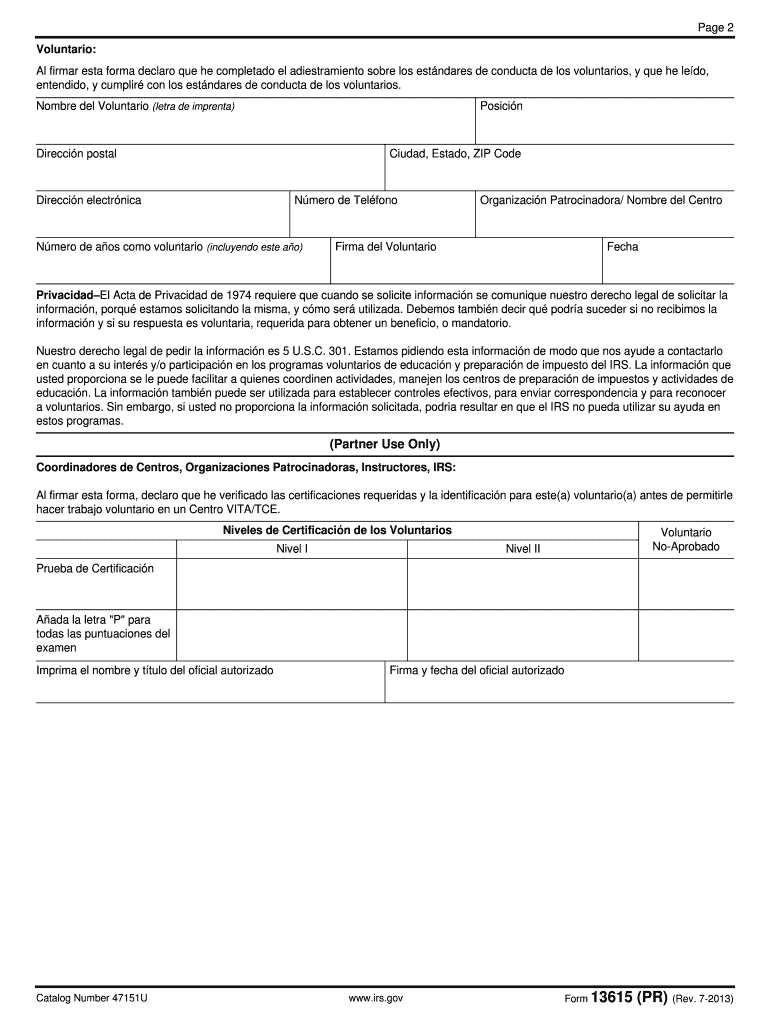

Key elements of the Acuerdo Voluntario include:

- The taxpayer's identification and tax information.

- Details of the tax liability being addressed.

- Proposed terms, including payment amounts and schedules.

- Signatures from both the taxpayer and an authorized IRS representative.

- Any specific conditions or stipulations related to the agreement.

Filing Deadlines / Important Dates

When dealing with the Acuerdo Voluntario, it is essential to be aware of filing deadlines and important dates. Taxpayers should note the deadlines for submitting requests for agreements, as well as any payment due dates outlined in the agreement. Missing these deadlines can result in penalties or the nullification of the agreement.

Quick guide on how to complete acuerdo voluntario internal revenue service irs

Effortlessly Prepare Acuerdo Voluntario Internal Revenue Service Irs on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle Acuerdo Voluntario Internal Revenue Service Irs on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The Easiest Way to Modify and Electronically Sign Acuerdo Voluntario Internal Revenue Service Irs

- Locate Acuerdo Voluntario Internal Revenue Service Irs and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that reason.

- Create your signature using the Sign tool, which requires just seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to secure your updates.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Acuerdo Voluntario Internal Revenue Service Irs to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Internal Revenue Service (IRS): How do you attach a W2 form to your tax return?

A number of answers — including one from a supposed IRS employee — say not to physically attach them, but just to include the W-2 in the envelope.In fact, the 1040 instructions say to “attach” the W-2 to the front of the return, and the Form 1040 itself —around midway down the left-hand side — says to “attach” Form W-2 here; throwing it in the envelope is not “attaching.” Anything but a staple risks having the forms become separated, just like connecting the multiple pages of the return, scheduled, etc.

-

Which Internal Revenue Service forms do I need to fill (salaried employee) for tax filing when my visa status changed from F1 OPT to H1B during 2015?

You can use the IRS page for residency test: Substantial Presence TestIf you live in a state that does not have income tax, you can use IRS tool: Free File: Do Your Federal Taxes for Free or any other free online software. TaxAct is one such.If not and if you are filing for the first time, it might be worth spending few dollars on a tax consultant. You can claim the fee in your return.

-

Internal Revenue Service (IRS): How many W-2s were issued in 2012? How many Forms 1099-MISC?

I don't have an answer as I was also unable to find this statistic anywhere. I can tell you that the Social Security Administration actually processes W2's and forwards the information to the IRS. 1099's however are processed by the IRS directly.The closest statistic I can find is that in 2010 there were 117,820,074 tax returns processed that showed salaries and wages (W2 income) on them. That does not allow for returns where the taxpayers have multiple W2's nor does it allow for people who received a W2 and did not file a tax return, so all I can say is the number of W2's is something larger than 117M.

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

Internal Revenue Service (IRS): Why do so many companies wait until the last second to give employees their W2 forms?

WWEELLL consider that most small businesses do not prepare their own W-2s. Being a CPA and today is 1/18/17 I still have about 10 or so businesses that I’ve W-2s to prepare for them.Now as to the second part of the question you are aware that the IRS does not even accept a return for electronic filing until 1/23/17?Why such a hurry? Additionally, with the new security procedures in place you are probably looking at 4 -6 weeks to get your refund (even filing electronically) - AANNDD truthfully no one really knows because this is the first year for these new security measures.

-

Internal Revenue Service (IRS): How to expensify a payment for a foreign contractor?

Absolutely. That's the way we used to do it back in the old days before computers :)Seriously, the IRS does not require any specific method of record keeping; all that you are required to do in the event of an audit is to produce documentation that substantiates the deductions that you claim. A paper invoice with a signed paper receipt attached certainly meets the requirements. Refer to IRS Publication 583, http://www.irs.gov/publications/... for more information.

-

There is curfew in my area and Internet service is blocked, how can I fill my exam form as today is the last day to fill it out?

Spend less time using your blocked Internet to ask questions on Quora, andTravel back in time to when there was no curfew and you were playing Super Mario Kart, and instead, fill out your exam form.

-

How much money does the US Internal Revenue Service (IRS) fail to collect in a typical fiscal year?

A LOT. We negotiate on our clients behalf to help them recoop some of it. Keystone National Tax

-

Internal Revenue Service (IRS): How are deductions to taxable income applied between ordinary income and capital gains?

There are a lot of possible answers depending on specific situations, but in general deductions apply to ordinary income first. Look at the Schedule D Tax Worksheet on the last page of the Instructions for Schedule D (http://www.irs.gov/pub/irs-pdf/i...). This is the worksheet used to calculate your tax when you have a mix of ordinary income and taxable gains.It starts by taking the number from Form 1040 Line 43, which is your taxable income after adjustments, exemptions, and deductions. It then basically computes the tax separately on the ordinary income and capital gains/qualifying dividends portions of your income, finally summing those categories to find your total tax.Suppose, therefore, that you have $125,000 in total income, of which $25,000 is qualified investment income. If you have $40,000 in deductions, adjustments, and exemptions, leaving $85,000 in taxable income, then the worksheet will calculate tax on your $25,000 of qualified investment income at the preferred rates, and tax on the other $60,000 using the regular tax tables or formulas. So, if you suddenly discovered another deduction, the tax on your qualified investment income would stay the same, while the tax calculated using the regular rates would decrease.

Create this form in 5 minutes!

How to create an eSignature for the acuerdo voluntario internal revenue service irs

How to make an electronic signature for your Acuerdo Voluntario Internal Revenue Service Irs online

How to make an electronic signature for the Acuerdo Voluntario Internal Revenue Service Irs in Google Chrome

How to create an eSignature for putting it on the Acuerdo Voluntario Internal Revenue Service Irs in Gmail

How to create an electronic signature for the Acuerdo Voluntario Internal Revenue Service Irs from your smart phone

How to make an eSignature for the Acuerdo Voluntario Internal Revenue Service Irs on iOS

How to create an electronic signature for the Acuerdo Voluntario Internal Revenue Service Irs on Android

People also ask

-

What is the Acuerdo Voluntario Internal Revenue Service Irs?

The Acuerdo Voluntario Internal Revenue Service Irs is a voluntary agreement that allows taxpayers to address tax obligations and streamline their compliance with the IRS. Understanding this process is crucial for businesses looking to simplify their tax handling through effective e-signatures and document management.

-

How can airSlate SignNow assist with the Acuerdo Voluntario Internal Revenue Service Irs?

airSlate SignNow provides businesses with the tools to eSign documents related to the Acuerdo Voluntario Internal Revenue Service Irs efficiently. Our easy-to-use platform ensures that you can swiftly send and sign necessary documents, making tax compliance processes more manageable.

-

Is there a cost associated with using airSlate SignNow for the Acuerdo Voluntario Internal Revenue Service Irs?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs when handling the Acuerdo Voluntario Internal Revenue Service Irs. Each plan provides cost-effective solutions, ensuring that you can manage your tax documentation without breaking the bank.

-

What features does airSlate SignNow offer for managing the Acuerdo Voluntario Internal Revenue Service Irs?

Our platform includes features such as document templates, customizable workflows, and advanced e-signature options, all designed to facilitate the Acuerdo Voluntario Internal Revenue Service Irs process. These tools enhance efficiency and help ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for the Acuerdo Voluntario Internal Revenue Service Irs?

Absolutely! airSlate SignNow easily integrates with various applications to streamline your workflow related to the Acuerdo Voluntario Internal Revenue Service Irs. Integration with popular accounting software can create a seamless process for managing documents and signatures.

-

What are the benefits of using airSlate SignNow for the Acuerdo Voluntario Internal Revenue Service Irs?

Using airSlate SignNow for the Acuerdo Voluntario Internal Revenue Service Irs enhances your efficiency and accuracy in managing tax documents. The platform allows for faster turnaround times, reduces paperwork, and minimizes the risk of errors during the e-signing process.

-

Is airSlate SignNow secure for handling the Acuerdo Voluntario Internal Revenue Service Irs?

Yes, airSlate SignNow employs encryption and advanced security measures to protect your documents related to the Acuerdo Voluntario Internal Revenue Service Irs. We prioritize your data security, ensuring that sensitive tax information remains confidential during and after the signing process.

Get more for Acuerdo Voluntario Internal Revenue Service Irs

Find out other Acuerdo Voluntario Internal Revenue Service Irs

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT