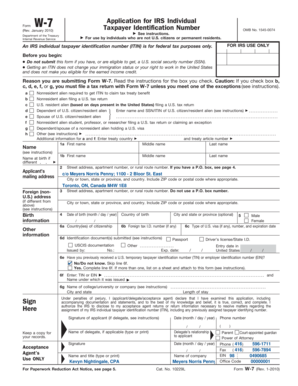

Taxpayer Identification Number Form

What makes the taxpayer identification number 14733152 form legally binding?

Because the society takes a step away from office working conditions, the execution of paperwork increasingly takes place online. The taxpayer identification number 14733152 form isn’t an exception. Working with it utilizing digital tools differs from doing this in the physical world.

An eDocument can be regarded as legally binding provided that specific needs are satisfied. They are especially critical when it comes to signatures and stipulations related to them. Typing in your initials or full name alone will not guarantee that the institution requesting the sample or a court would consider it executed. You need a reliable tool, like airSlate SignNow that provides a signer with a digital certificate. In addition to that, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - key legal frameworks for eSignatures.

How to protect your taxpayer identification number 14733152 form when completing it online?

Compliance with eSignature laws is only a fraction of what airSlate SignNow can offer to make document execution legitimate and safe. In addition, it offers a lot of opportunities for smooth completion security smart. Let's quickly go through them so that you can be certain that your taxpayer identification number 14733152 form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy standards in the USA and Europe.

- Two-factor authentication: adds an extra layer of security and validates other parties identities via additional means, like an SMS or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the data safely to the servers.

Submitting the taxpayer identification number 14733152 form with airSlate SignNow will give greater confidence that the output form will be legally binding and safeguarded.

Quick guide on how to complete taxpayer identification number 14733152

Complete Taxpayer Identification Number effortlessly on any device

Online document management has become widely embraced by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Manage Taxpayer Identification Number on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Taxpayer Identification Number without hassle

- Locate Taxpayer Identification Number and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or disorganized files, tedious form searches, and errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Taxpayer Identification Number and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the taxpayer identification number 14733152

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a taxpayer identification number (TIN) and why is it important?

A taxpayer identification number (TIN) is a unique identifier assigned to individuals and businesses for tax purposes. It is essential for accurately reporting income to the IRS and ensuring compliance with tax regulations. Using airSlate SignNow can streamline the process of collecting and verifying TINs in your documents.

-

How can airSlate SignNow help me manage taxpayer identification numbers?

airSlate SignNow provides tools that allow you to securely collect and manage taxpayer identification numbers (TINs) in your electronic documents. With features like customizable templates and easy electronic signatures, you can ensure that TINs are captured accurately and efficiently. This reduces errors and improves your documentation workflow.

-

Does airSlate SignNow have features for verifying taxpayer identification numbers?

While airSlate SignNow focuses on eSigning and document management, it allows you to include verification steps within your workflows. You can create forms that prompt users to input their taxpayer identification numbers (TINs) and add additional instructions for verification if needed. This helps maintain accuracy in your documentation processes.

-

What pricing options does airSlate SignNow offer for businesses needing TIN management?

airSlate SignNow offers various pricing plans tailored to different business needs, ensuring that you can find a solution that fits your budget. The plans include features that enable efficient management of taxpayer identification numbers (TINs), along with other document-related functionalities. You can explore the pricing page for more details on each plan.

-

Can I integrate airSlate SignNow with other tools to manage taxpayer identification numbers?

Yes, airSlate SignNow integrates with various third-party applications, enhancing its functionality for managing taxpayer identification numbers (TINs). You can connect with CRM systems, accounting software, and more, allowing you to streamline your document workflows and ensure that TINs are captured where needed seamlessly.

-

What are the benefits of using airSlate SignNow for taxpayer identification number documentation?

Using airSlate SignNow for managing taxpayer identification numbers (TINs) offers multiple benefits, including increased efficiency, enhanced document security, and improved compliance with tax regulations. The platform simplifies the eSigning process, ensuring that TIN-related documents are completed quickly and accurately. This can signNowly reduce the administrative burden on your team.

-

Is airSlate SignNow compliant with tax regulations regarding taxpayer identification numbers?

Yes, airSlate SignNow prioritizes compliance and security, ensuring that your management of taxpayer identification numbers (TINs) adheres to relevant tax regulations. The platform complies with data protection laws, allowing you to collect and store sensitive information securely. This ensures that your business minimizes risk when handling TIN-related documents.

Get more for Taxpayer Identification Number

- Electron configuration worksheet high school pdf form

- Liquor liability for special events questionnaire nsq0006b0610doc form

- Schedule of real estate owned form

- For lab use only analytical request form

- Total nasal symptom score please answer all questions to form

- California certification trust form

- Employment application tvobgyncom form

- Fl 320 s declaracin de respuesta a la solicitud de orden judicial council forms

Find out other Taxpayer Identification Number

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed