Nys Sales Tax Form St 101

What is the NYS Sales Tax Form ST-101?

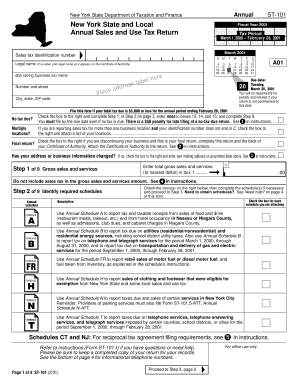

The NYS Sales Tax Form ST-101 is a crucial document used by businesses in New York State to report and remit sales tax. This form is specifically designed for vendors who are required to collect sales tax on taxable sales. It provides a comprehensive overview of the sales made during a specified period and the corresponding tax collected. Understanding this form is essential for compliance with state tax regulations.

How to Use the NYS Sales Tax Form ST-101

Using the NYS Sales Tax Form ST-101 involves several steps that ensure accurate reporting of sales tax. First, gather all relevant sales data for the reporting period. This includes total sales, exempt sales, and any sales tax collected. Next, accurately fill out the form, ensuring that all figures are correct. After completing the form, it must be submitted to the New York State Department of Taxation and Finance along with any sales tax owed.

Steps to Complete the NYS Sales Tax Form ST-101

Completing the NYS Sales Tax Form ST-101 requires attention to detail. Follow these steps:

- Begin by entering your business information, including name, address, and sales tax identification number.

- Report total sales for the period in the designated section, distinguishing between taxable and exempt sales.

- Calculate the total sales tax collected and enter this amount on the form.

- If applicable, include any adjustments for previous periods.

- Review the completed form for accuracy before submission.

Legal Use of the NYS Sales Tax Form ST-101

The NYS Sales Tax Form ST-101 is legally binding when completed and submitted according to New York State tax laws. It serves as an official record of sales tax obligations and compliance. Failing to accurately report sales tax can lead to penalties and interest charges. Therefore, it is important to understand the legal implications of this form and ensure that it is filled out correctly.

Filing Deadlines / Important Dates

Timely filing of the NYS Sales Tax Form ST-101 is essential to avoid penalties. The filing deadlines typically align with the sales tax reporting periods, which can be monthly, quarterly, or annually, depending on the volume of sales. Businesses should be aware of these deadlines and mark them on their calendars to ensure compliance.

Form Submission Methods

The NYS Sales Tax Form ST-101 can be submitted through various methods. Businesses have the option to file online through the New York State Department of Taxation and Finance website, which is often the fastest and most efficient method. Alternatively, the form can be mailed to the appropriate address or submitted in person at designated tax offices. Each method has its own processing times and requirements.

Quick guide on how to complete nys sales tax form st 101

Complete Nys Sales Tax Form St 101 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Nys Sales Tax Form St 101 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-focused operation today.

The easiest way to modify and eSign Nys Sales Tax Form St 101 seamlessly

- Locate Nys Sales Tax Form St 101 and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and hit the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or an invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Nys Sales Tax Form St 101 to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys sales tax form st 101

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 101 printable form and how is it used?

The st 101 printable form is a vital document used for sales tax exemption in various states. It allows eligible purchasers to claim exempt status for eligible goods or services. By filling out this form accurately, businesses can help streamline their tax processes and ensure compliance.

-

How can I obtain the st 101 printable form through airSlate SignNow?

You can easily access the st 101 printable form through airSlate SignNow's user-friendly platform. Simply create an account, navigate to the forms section, and search for the st 101 printable form. Once located, you can complete and eSign the document seamlessly.

-

Is there a cost associated with using the st 101 printable form on airSlate SignNow?

Using airSlate SignNow involves a subscription model; however, the st 101 printable form can be accessed without additional charges. Pricing plans offer a range of features suitable for businesses of all sizes, making it a cost-effective solution for document management.

-

Can I integrate the st 101 printable form with other software?

Yes, airSlate SignNow allows seamless integration of the st 101 printable form with other applications, enhancing your workflow. By connecting with popular tools like CRM systems and cloud storage, businesses can improve their document handling and storage processes.

-

What are the benefits of using the st 101 printable form electronically?

Using the st 101 printable form electronically via airSlate SignNow offers numerous benefits, including increased efficiency and reduced paperwork. Electronic forms help minimize errors and allow for tracking of completed documents, ensuring that all steps are properly followed.

-

Can the st 101 printable form be eSigned securely?

Absolutely! airSlate SignNow provides a secure platform for eSigning documents, including the st 101 printable form. With advanced encryption and compliance with industry standards, your information remains protected throughout the signing process.

-

What types of businesses benefit the most from the st 101 printable form?

The st 101 printable form is especially beneficial for wholesalers, retailers, and any business involved in sales of taxable goods or services. By using this form, businesses can ensure they are not overpaying on sales tax, improving their bottom line.

Get more for Nys Sales Tax Form St 101

- Sample request letter template for admission in schoolcollegesample request letter template for admission in form

- Pdf dear valued patient thank you for choosing manatee physician form

- New mexico registration certificate form

- Wwwtemplaterollercomtemplate2049547form ea fssa ampquotapplication for south dakota medicaidchip

- Trillium consent for release of member informationmanuals forms and resources trilliumprovider documents ampamp formstrillium

- Filliodeclaration and certification of financesfill declaration and certification of finances tulane form

- Dom information act report

- Median sale price reaches 500000 for single family homes form

Find out other Nys Sales Tax Form St 101

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online