FIN 429 This Verification Form May Be Completed by a Motor Vehicle Vendor to Substantiate Non Collection of Social Service Tax O

Understanding the fin429 Form

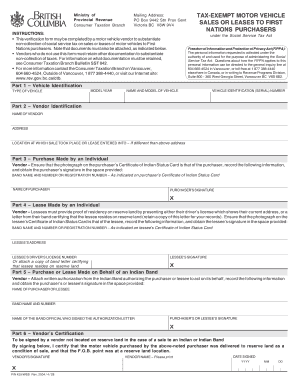

The fin429 form is a verification document that may be completed by a motor vehicle vendor to substantiate the non-collection of social service tax on sales or leases of motor vehicles to First Nations purchasers. This form is crucial for ensuring compliance with tax regulations while facilitating transactions involving motor vehicles. It serves as a formal declaration that the sale or lease qualifies for tax exemption under specific conditions, particularly for eligible purchasers.

How to Complete the fin429 Form

To effectively complete the fin429 form, follow these steps:

- Gather necessary information, including the purchaser's details and vehicle information.

- Clearly indicate the reason for the tax exemption on the form.

- Ensure all signatures are present, as missing signatures can lead to delays or rejections.

- Review the completed form for accuracy before submission.

Key Elements of the fin429 Form

The fin429 form includes several key elements that are essential for its validity:

- Purchaser Information: Name, address, and identification details of the First Nations purchaser.

- Vendor Information: Name and contact details of the motor vehicle vendor.

- Vehicle Details: Make, model, year, and identification number of the vehicle involved in the transaction.

- Exemption Reason: A clear statement justifying the exemption from social service tax.

Legal Use of the fin429 Form

The fin429 form is legally recognized when it meets the requirements set forth by relevant tax authorities. It must be filled out completely and accurately to ensure that it serves its intended purpose. Compliance with local and federal regulations is essential, as any discrepancies may lead to penalties or the denial of tax exemption claims.

Obtaining the fin429 Form

The fin429 form can typically be obtained through state tax authority websites or directly from motor vehicle vendors who are familiar with the process. It is advisable to ensure that you are using the most current version of the form to avoid any compliance issues.

Examples of Using the fin429 Form

Common scenarios for using the fin429 form include:

- A motor vehicle vendor selling a vehicle to a First Nations purchaser who qualifies for tax exemption.

- Leasing a vehicle to a First Nations entity that is exempt from social service tax.

- Documenting the sale of vehicles at events or auctions specifically targeting First Nations buyers.

Quick guide on how to complete fin 429 this verification form may be completed by a motor vehicle vendor to substantiate non collection of social service tax

Complete FIN 429 This Verification Form May Be Completed By A Motor Vehicle Vendor To Substantiate Non collection Of Social Service Tax O effortlessly on any device

Online document organization has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to find the right template and securely store it online. airSlate SignNow provides all the necessary tools to quickly create, modify, and eSign your documents without delays. Manage FIN 429 This Verification Form May Be Completed By A Motor Vehicle Vendor To Substantiate Non collection Of Social Service Tax O on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign FIN 429 This Verification Form May Be Completed By A Motor Vehicle Vendor To Substantiate Non collection Of Social Service Tax O effortlessly

- Locate FIN 429 This Verification Form May Be Completed By A Motor Vehicle Vendor To Substantiate Non collection Of Social Service Tax O and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid files, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign FIN 429 This Verification Form May Be Completed By A Motor Vehicle Vendor To Substantiate Non collection Of Social Service Tax O to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fin 429 this verification form may be completed by a motor vehicle vendor to substantiate non collection of social service tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fin 429 form and its purpose?

The fin 429 form is a necessary document used for reporting specific financial transactions within businesses. This form ensures compliance with regulatory standards and helps organizations maintain accurate records for auditing and taxation purposes. By using the fin 429 form, businesses can streamline their financial management processes.

-

How can airSlate SignNow help with the fin 429 form?

airSlate SignNow simplifies the process of managing the fin 429 form by allowing users to easily create, send, and eSign documents securely. With our platform, you can fill in the required fields and electronically sign the fin 429 form, reducing time and effort in document handling. This efficiency ultimately supports compliance and accuracy in your financial reporting.

-

Is there a cost associated with using airSlate SignNow for the fin 429 form?

Yes, there is a cost associated with using airSlate SignNow, which varies based on the subscription plan you choose. Our pricing is designed to be cost-effective for businesses of all sizes, providing access to essential eSignature features for managing documents like the fin 429 form. Explore our pricing plans to find the right fit for your needs.

-

What features does airSlate SignNow offer for managing the fin 429 form?

airSlate SignNow offers a variety of features for managing the fin 429 form, including customizable templates, electronic signatures, and automated workflows. These tools are designed to enhance efficiency and accuracy while handling financial documentation. Additionally, you can track document status, ensuring all parties are informed throughout the signing process.

-

Are there integrations available with airSlate SignNow for the fin 429 form?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms that support the fin 429 form. These integrations allow for streamlined workflows and easy access to information across your favorite tools. By utilizing our integrations, you can enhance your business processes and ensure that your financial documents are managed effectively.

-

What are the benefits of using airSlate SignNow for the fin 429 form?

Using airSlate SignNow for the fin 429 form offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security in document handling. The platform also allows for real-time collaboration, making it easier for multiple stakeholders to contribute to the form. Embracing airSlate SignNow can lead to better compliance and faster processing of important financial documents.

-

Can I track who has signed the fin 429 form using airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive tracking for the fin 429 form, allowing you to see who has signed and when. This feature enhances transparency and accountability in the document signing process, giving you peace of mind that your financial forms are managed properly. You can easily access audit trails from your dashboard as well.

Get more for FIN 429 This Verification Form May Be Completed By A Motor Vehicle Vendor To Substantiate Non collection Of Social Service Tax O

- Promotional letter corporate security form

- Enclosed herewith please find a copy of the judgment for support and other relief under form

- Papering the deal graves dougherty hearon form

- Apology and tender of compensation form

- Sample letter of delivery schedule hautnah nettetal form

- Terms of agreement for sale and transfer of a work of art form

- Proposal to buy into business form

- Enclosed herewith please find a revised asset purchase agreement regarding form

Find out other FIN 429 This Verification Form May Be Completed By A Motor Vehicle Vendor To Substantiate Non collection Of Social Service Tax O

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word