Form 8847 Fill in Version Credit for Contributions to Selected Community Development Corporations

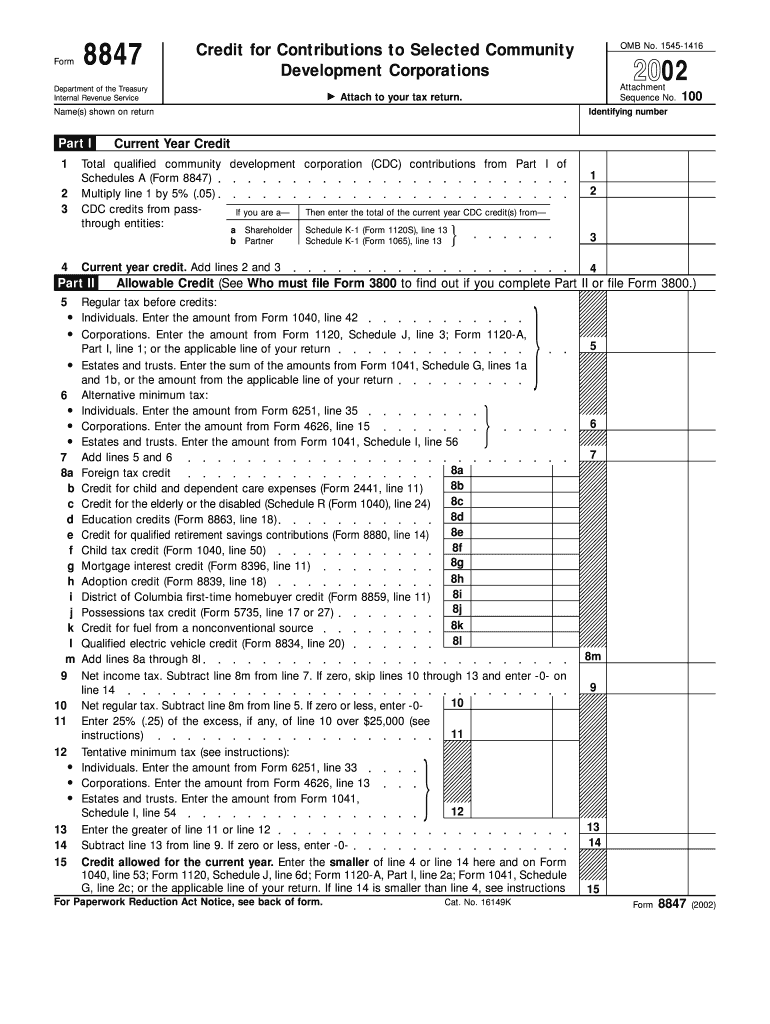

What is the Form 8847 Credit for Contributions to Selected Community Development Corporations?

The Form 8847 is a tax form used to claim a credit for contributions made to selected community development corporations. This credit is designed to encourage charitable contributions that support community development initiatives. By filling out this form, taxpayers can potentially reduce their tax liability while supporting local organizations that contribute to the economic growth and revitalization of communities.

How to Use the Form 8847 Credit for Contributions to Selected Community Development Corporations

Using the Form 8847 involves several steps to ensure that your contributions are properly documented and that you receive the appropriate tax credit. First, gather all relevant information about your contributions, including the amount donated and the recipient organization. Next, complete the form by entering your personal information, the details of your contributions, and any required supporting documentation. After filling out the form, it must be submitted along with your tax return to the IRS.

Steps to Complete the Form 8847 Credit for Contributions to Selected Community Development Corporations

Completing the Form 8847 requires careful attention to detail. Follow these steps:

- Gather documentation: Collect receipts and records of your contributions to selected community development corporations.

- Fill in personal details: Provide your name, address, and taxpayer identification number on the form.

- Detail contributions: Clearly list each contribution, including the date, amount, and the name of the organization.

- Review for accuracy: Double-check all entries to ensure they are correct and complete.

- Submit with your tax return: Include the completed Form 8847 when you file your federal tax return.

Legal Use of the Form 8847 Credit for Contributions to Selected Community Development Corporations

The legal use of Form 8847 is governed by IRS regulations. To qualify for the credit, contributions must be made to organizations that meet specific criteria set by the IRS. It is essential to ensure that the organization is recognized as a qualified community development corporation to avoid issues with compliance. The form must be accurately completed and submitted according to IRS guidelines to be considered valid.

Eligibility Criteria for the Form 8847 Credit for Contributions to Selected Community Development Corporations

To be eligible for the credit claimed on Form 8847, taxpayers must meet certain criteria. Contributions must be made to selected community development corporations that are recognized by the IRS. Additionally, the contributions must not exceed the limits set forth by tax regulations. Taxpayers should also be aware of any state-specific rules that may apply to the credit, as these can vary significantly.

IRS Guidelines for the Form 8847 Credit for Contributions to Selected Community Development Corporations

The IRS provides specific guidelines for completing and submitting Form 8847. These guidelines include instructions on what constitutes a qualifying contribution, the necessary documentation required, and the deadlines for submission. It is crucial for taxpayers to familiarize themselves with these guidelines to ensure compliance and maximize the benefits of the tax credit.

Quick guide on how to complete form 8847

Create form 8847 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow provides all the resources you need to design, modify, and electronically sign your documents promptly without delays. Handle form 8847 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to modify and electronically sign irs letter 288c with ease

- Obtain form 8847 and then select Get Form to initiate the process.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method of sending your form, whether by email, SMS, an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your selected device. Modify and electronically sign irs letter 288c to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs irs letter 288c

-

I want to create a web app that enables users to sign up/in, fill out a form, and then fax it to a fax machine. How to difficult is this to develop?

Are you sending yourself the fax or are they able to send the fax anywhere? The latter has already been done numerous times. There are email to fax and fax to email applications that have been available for decades. I'm pretty certain that converting email to fax into app or form submission to fax is pretty trivial. They convert faxes to PDF's in many of these apps IIRC so anywhere you could view a PDF you could get a fax.

-

How do I fill out the form for admission to a BA (Honours) in English at Allahabad University?

English is an arts subject,Shruty.As you're applying for Bachelor of Arts programme, it will definitely come under arts. In a central university, every subject is having a separate department and that doesn't mean it will change the subject's credibility.

-

What is wrong with the hiring process and how could it be fixed? Endless forms have to be filled out, nothing is unified, and GitHub, StackOverflow (for developers) or Dribbble (for designers) are not taken into consideration.

Finding the right job candidates is one of the biggest recruiting challenges. Recruiters and other HR professionals that don’t use best recruiting strategies are often unable to find high-quality job applicants. With all the changes and advances in HR technologies, new recruiting and hiring solutions have emerged. Many recruiters are now implementing these new solutions to become more effective and productive in their jobs.According to Recruitment strategies report 2017 done by GetApp, the biggest recruiting challenge in 2017 was the shortage of skilled candidates.The process of finding job candidates has changed signNowly since few years ago. Back then, it was enough to post a job on job boards and wait for candidates to apply. Also called “post and pray” strategy.Today, it is more about building a strong Employer Branding strategy that attracts high quality applicants for hard-to-fill roles.Steps for finding the right job candidates1. Define your ideal candidate a.k.a candidate personaNot knowing who your ideal candidate is, will make finding one impossible. To be able to attract and hire them, you need to know their characteristics, motivations, skills and preferences.Defining a candidate persona requires planning and evaluation. The best way is to start from your current talent star employees. Learn more about their personalities, preferences, motivations and characteristics. Use these findings to find similar people for your current and future job openings.2. Engage your current employeesYou probably already know that your current employees are your best brand ambassadors. Same as current product users are best ambassadors for product brands. Their word of mouth means more than anyone else’s.Encourage their engagement and let them communicate their positive experiences to the outside. Remember, your employees are your best ambassadors, and people trust people more than brands, CEOs and other C-level executives.Involving your current employees can not only help you build a strong Employer Branding strategy, but it can also help your employees feel more engaged and satisfied with their jobs.3. Write a clear job descriptionsEven though many recruiters underestimate this step, it is extremely important to do it right! Writing a clear and detailed job description plays a huge role in finding and attracting candidates with a good fit. Don’t only list duties, responsibilities and requirements, but talk about your company’s culture and Employee Value Proposition.To save time, here are our free job description templates.4. Streamline your efforts with a Recruitment Marketing toolIf you have right tools, finding the right job candidates is much easier and faster than without them. Solutions offered by recruitment marketing software are various, and with them you can build innovative recruiting strategies such as Inbound Recruiting and Candidate Relationship Management to improve Candidate Experience and encourage Candidate Engagement.Sending useful, timely and relevant information to the candidates from your talent pool is a great way for strengthening your Employer Brand and communicating your Employee Value Proposition.5. Optimize your career site to invite visitors to applyWhen candidates want to learn about you, they go to your career site. Don-t loose this opportunity to impress them. Create content and look that reflects your company’s culture, mission and vision. Tell visitors about other employees success and career stories.You can start by adding employee testimonials, fun videos, introduce your team, and write about cool project that your company is working on.Don’t let visitors leave before hitting “Apply Now” button.6. Use a recruiting software with a powerful sourcing toolToday, there are powerful sourcing tools that find and extract candidates profiles. They also add them directly to your talent pool. Manual search takes a lot of time and effort, and is often very inefficient. With a powerful sourcing tool, you can make this process much faster, easier and more productive. These tools help you find candidates that match both the position and company culture.7. Use an Applicant Tracking SystemSolutions offered by applicant tracking systems are various, but their main purpose is to fasten and streamline the selections and hiring processes. By fastening the hiring and selection process, you can signNowly improve Candidate Experience. With this, you can increase your application and hire rate for hard-to-fill roles. Did you know that top talent stays available on the market for only 10 days?8. Implement and use employee referral programsReferrals are proven to be best employees! Referrals can improve your time, cost and quality of hire, and make your hiring strategy much more productive. Yet, many companies still don’t have developed strategies for employee referrals.This is another great way to use your current employee to help you find the best people. To start, use these referral email templates for recruiters, and start engaging your employees today!GetApp‘s survey has proven that employee referrals take shortest to hire, and bring the highest quality job applicants.If you don’t have ideas about how to reward good referrals, here’s our favorite list of ideas for employee referral rewards.

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

-

How do I take admission in a B.Tech without taking the JEE Mains?

Admissions into B.Tech courses offered by engineering colleges in India is based on JEE Mains score and 12th percentile. Different private and government universities have already started B Tech admission 2019 procedure. However many reputed Private Colleges in India and colleges not affiliated with the Government colleges conduct state/region wise exams for admission or have their eligibility criterion set for admission.1. State Sponsored Colleges: These colleges have their state entrance exams for entry in such colleges. These colleges follow a particular eligibility criterion2. Private Colleges: These colleges either take admission on the basis of 10+2 score of the candidate or their respective entrance exam score. These colleges generally require students with Physics and Mathematics as compulsory subjects with minimum score requirement in each subject, as prescribed by them.3. Direct Admission: This lateral entry is introduced for students who want direct admission in 2nd year of their Bachelor’s course. However, there is an eligibility criterion for the same.Students should give as many entrance exams, to widen their possibility. College preference should always be based on certain factors like placement, faculty etc.

Create this form in 5 minutes!

How to create an eSignature for the irs letter 288c

How to create an electronic signature for your 2002 Form 8847 Fill In Version Credit For Contributions To Selected Community Development Corporations online

How to generate an eSignature for the 2002 Form 8847 Fill In Version Credit For Contributions To Selected Community Development Corporations in Google Chrome

How to create an eSignature for signing the 2002 Form 8847 Fill In Version Credit For Contributions To Selected Community Development Corporations in Gmail

How to create an eSignature for the 2002 Form 8847 Fill In Version Credit For Contributions To Selected Community Development Corporations from your smartphone

How to generate an eSignature for the 2002 Form 8847 Fill In Version Credit For Contributions To Selected Community Development Corporations on iOS

How to create an eSignature for the 2002 Form 8847 Fill In Version Credit For Contributions To Selected Community Development Corporations on Android OS

People also ask irs letter 288c

-

What is Form 8847 and who needs it?

Form 8847 is a tax form used by employers to claim the Work Opportunity Tax Credit (WOTC). Businesses that hire individuals from certain target groups, such as veterans or long-term unemployed individuals, should consider using Form 8847 to benefit from tax credits.

-

How can airSlate SignNow help with completing Form 8847?

airSlate SignNow provides an easy-to-use platform for electronically signing and managing Form 8847. With our service, you can streamline the process of filling out and submitting Form 8847, ensuring compliance and reducing paperwork hassle.

-

Is there a cost associated with using airSlate SignNow for Form 8847?

airSlate SignNow offers various pricing plans designed to meet different needs and budgets. You can start with a free trial to explore our features for handling Form 8847 before choosing a plan that fits your business requirements.

-

What features does airSlate SignNow offer for secure document signing?

airSlate SignNow includes features such as secure encryption, user authentication, and an audit trail to ensure safe handling of documents like Form 8847. These features not only protect your information but also provide peace of mind during the signing process.

-

Can I integrate airSlate SignNow with other applications for Form 8847 processing?

Yes, airSlate SignNow offers integrations with various business applications to enhance the efficiency of processing Form 8847. This means you can seamlessly connect with CRM systems, storage solutions, and more to manage your documents.

-

How does airSlate SignNow help in tracking the status of Form 8847 submissions?

airSlate SignNow allows users to track the status of their Form 8847 submissions in real-time. Notifications and reminders keep you updated on where your document is in the signing process, ensuring that you never miss a critical deadline.

-

What are the benefits of using airSlate SignNow for business tax forms like Form 8847?

Using airSlate SignNow for Form 8847 and other business tax forms enhances efficiency by reducing paper consumption and processing time. Our platform simplifies collaboration and ensures that all stakeholders can review and sign documents securely, ultimately saving your business time and money.

Get more for form 8847

Find out other irs letter 288c

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile