Business Privilege Tax Form Allentownpa

What is the Business Privilege Tax Form Allentownpa

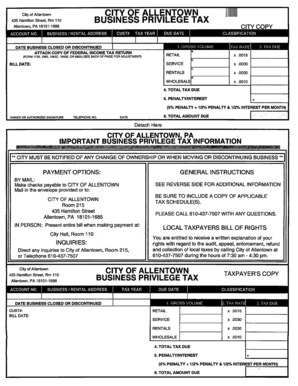

The city of Allentown's business privilege tax (BPT) is a tax imposed on businesses operating within the city limits. This tax is based on the gross receipts of the business and is designed to generate revenue for local government services. The Allentown business privilege tax form is essential for businesses to report their earnings and calculate the tax owed. Completing this form accurately ensures compliance with local tax regulations and helps maintain good standing with the city.

Steps to complete the Business Privilege Tax Form Allentownpa

Filling out the Allentown business privilege tax form involves several key steps:

- Gather necessary information: Collect all relevant financial data, including gross receipts and any deductions applicable to your business.

- Obtain the form: Access the Allentown business privilege tax form from the city’s official website or local tax office.

- Fill out the form: Input your business information, including name, address, and tax identification number, along with financial details.

- Review for accuracy: Double-check all entries to ensure correctness and completeness before submission.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent before the deadline.

How to obtain the Business Privilege Tax Form Allentownpa

The Allentown business privilege tax form can be obtained through various channels. Businesses can download the form from the official Allentown city website, where it is typically available in PDF format for easy printing. Alternatively, businesses may visit the local tax office in person to request a physical copy of the form. It is advisable to check for the most current version of the form to ensure compliance with any recent changes in tax regulations.

Legal use of the Business Privilege Tax Form Allentownpa

The Allentown business privilege tax form must be utilized in accordance with local tax laws. This means that businesses are required to file the form annually, reporting their gross receipts accurately. Failure to use the form as intended can lead to penalties, including fines or additional taxes owed. It is important for businesses to understand the legal implications of their submissions and to keep records of their filings for future reference.

Filing Deadlines / Important Dates

Businesses must adhere to specific deadlines for filing the Allentown business privilege tax form. The typical deadline for submission is often set for the end of the first quarter, but it is crucial to verify the exact date each year, as it may vary. Late submissions can result in penalties, so businesses should mark their calendars and prepare their filings in advance to avoid any issues.

Penalties for Non-Compliance

Non-compliance with the Allentown business privilege tax regulations can lead to significant penalties. Businesses that fail to file the tax form on time may incur late fees, which can accumulate over time. Additionally, failure to pay the tax owed can result in further fines and interest charges. It is essential for businesses to stay informed about their tax obligations to avoid these financial repercussions.

Quick guide on how to complete business privilege tax form allentownpa

Prepare Business Privilege Tax Form Allentownpa seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Business Privilege Tax Form Allentownpa on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to change and electronically sign Business Privilege Tax Form Allentownpa without hassle

- Locate Business Privilege Tax Form Allentownpa and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Business Privilege Tax Form Allentownpa and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business privilege tax form allentownpa

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Allentown business privilege tax?

The Allentown business privilege tax is a local tax imposed on businesses operating within the city. This tax is calculated based on the gross receipts generated by the business. Understanding this tax is crucial for compliance and ensuring that your business meets local regulations.

-

How can airSlate SignNow help with the Allentown business privilege tax?

airSlate SignNow provides a seamless way for businesses to eSign and manage documents related to the Allentown business privilege tax. By using our platform, you can easily prepare, sign, and store tax-related documents securely. This helps ensure that your business remains compliant while saving you valuable time.

-

What features does airSlate SignNow offer for businesses dealing with taxes?

With airSlate SignNow, businesses benefit from features such as template creation, reusable workflows, and automated reminders. These features streamline document management, making it easier to handle paperwork related to the Allentown business privilege tax. Efficient document handling ultimately leads to more effective tax compliance.

-

Is airSlate SignNow cost-effective for small businesses managing the Allentown business privilege tax?

Yes, airSlate SignNow offers a cost-effective solution tailored for small businesses managing the Allentown business privilege tax. Our pricing plans are designed to accommodate various business sizes while providing essential features without breaking the bank. Investing in SignNow can lead to signNow savings in time and resources.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow integrates with various software applications to enhance your overall tax management process. This means you can easily connect your existing accounting systems with our eSigning platform to ensure smooth handling of documents related to the Allentown business privilege tax.

-

What are the benefits of using airSlate SignNow for business tax filings?

Using airSlate SignNow for business tax filings brings several benefits, such as increased efficiency and reduced paperwork. Our platform ensures that all documents related to the Allentown business privilege tax are signed and stored securely, allowing for quick retrieval when needed. This ultimately helps businesses focus on their core operations.

-

How secure is airSlate SignNow for sensitive tax documentation?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technologies to protect sensitive documents, including those related to the Allentown business privilege tax. Our compliance with industry standards ensures that your information is safe, allowing you to eSign with peace of mind.

Get more for Business Privilege Tax Form Allentownpa

- Certificate of resignation of registered agent form

- Certificate of revocation of appointment of registered form

- Churches definedinternal revenue service form

- Acknowledgment by form

- Pastor elder governance model bylaws open bible churches form

- Church religious organization or faith based group form

- When in the course of human events it becomes necessary for one people to dissolve the form

- N a m e o f c o m p a n y inc 490231203 form

Find out other Business Privilege Tax Form Allentownpa

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template