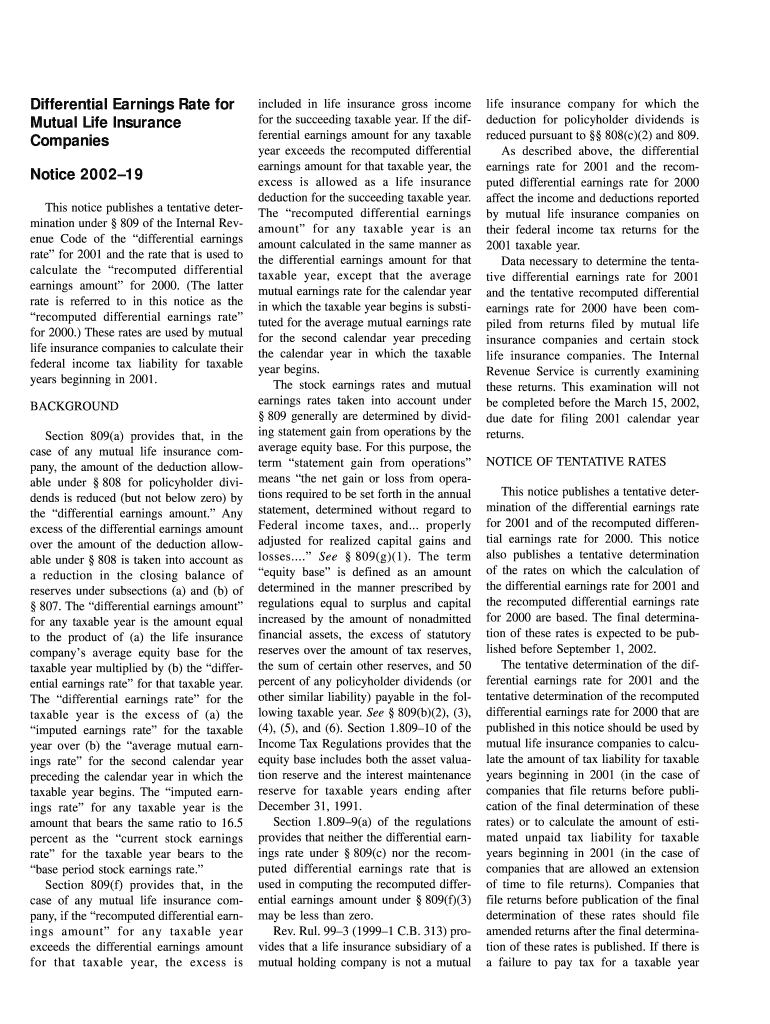

Notice 19 Differential Earnings Rate for Mutual Life Insurance Companies Differential Earnings Rate for Mutual Life Insu Form

What makes the notice 2002 19 differential earnings rate for mutual life insurance companies differential earnings rate for mutual life form legally binding?

As the world ditches office work, the execution of paperwork more and more happens online. The notice 2002 19 differential earnings rate for mutual life insurance companies differential earnings rate for mutual life form isn’t an any different. Dealing with it utilizing electronic means is different from doing so in the physical world.

An eDocument can be regarded as legally binding given that certain requirements are fulfilled. They are especially crucial when it comes to signatures and stipulations related to them. Typing in your initials or full name alone will not ensure that the institution requesting the form or a court would consider it accomplished. You need a reliable solution, like airSlate SignNow that provides a signer with a electronic certificate. In addition to that, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your notice 2002 19 differential earnings rate for mutual life insurance companies differential earnings rate for mutual life form when filling out it online?

Compliance with eSignature regulations is only a fraction of what airSlate SignNow can offer to make form execution legitimate and secure. It also provides a lot of possibilities for smooth completion security wise. Let's rapidly run through them so that you can be assured that your notice 2002 19 differential earnings rate for mutual life insurance companies differential earnings rate for mutual life form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy regulations in the USA and Europe.

- Two-factor authentication: provides an extra layer of protection and validates other parties identities through additional means, such as a Text message or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the information securely to the servers.

Submitting the notice 2002 19 differential earnings rate for mutual life insurance companies differential earnings rate for mutual life form with airSlate SignNow will give greater confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete notice 2002 19 differential earnings rate for mutual life insurance companies differential earnings rate for mutual life

airSlate SignNow's web-based service is specifically designed to simplify the organization of workflow and enhance the whole process of competent document management. Use this step-by-step instruction to fill out the Get And Sign Notice 2002-19 — Differential Earnings Rate For Mutual Life Insurance Companies. Differential Earnings Rate For Mutual Life Insurance Companies Form quickly and with excellent accuracy.

How you can fill out the Get And Sign Notice 2002-19 — Differential Earnings Rate For Mutual Life Insurance Companies. Differential Earnings Rate For Mutual Life Insurance Companies Form on the web:

- To start the blank, utilize the Fill camp; Sign Online button or tick the preview image of the form.

- The advanced tools of the editor will lead you through the editable PDF template.

- Enter your official identification and contact details.

- Utilize a check mark to indicate the choice where required.

- Double check all the fillable fields to ensure full accuracy.

- Utilize the Sign Tool to create and add your electronic signature to airSlate SignNow the Get And Sign Notice 2002-19 — Differential Earnings Rate For Mutual Life Insurance Companies. Differential Earnings Rate For Mutual Life Insurance Companies Form.

- Press Done after you complete the form.

- Now it is possible to print, download, or share the form.

- Follow the Support section or get in touch with our Support group in case you've got any questions.

By making use of airSlate SignNow's complete solution, you're able to perform any needed edits to Get And Sign Notice 2002-19 — Differential Earnings Rate For Mutual Life Insurance Companies. Differential Earnings Rate For Mutual Life Insurance Companies Form, create your customized digital signature in a couple quick steps, and streamline your workflow without leaving your browser.

Create this form in 5 minutes or less

Video instructions and help with filling out and completing Notice 19 Differential Earnings Rate For Mutual Life Insurance Companies Differential Earnings Rate For Mutual Life INSU Form

Instructions and help about Notice 19 Differential Earnings Rate For Mutual Life Insurance Companies Differential Earnings Rate For Mutual Life INSU

Related searches to Notice 19 Differential Earnings Rate For Mutual Life Insurance Companies Differential Earnings Rate For Mutual Life Insu

Create this form in 5 minutes!

How to create an eSignature for the notice 2002 19 differential earnings rate for mutual life insurance companies differential earnings rate for mutual life

How to generate an signature for your Notice 2002 19 Differential Earnings Rate For Mutual Life Insurance Companies Differential Earnings Rate For Mutual Life online

How to make an electronic signature for the Notice 2002 19 Differential Earnings Rate For Mutual Life Insurance Companies Differential Earnings Rate For Mutual Life in Google Chrome

How to make an signature for signing the Notice 2002 19 Differential Earnings Rate For Mutual Life Insurance Companies Differential Earnings Rate For Mutual Life in Gmail

How to create an electronic signature for the Notice 2002 19 Differential Earnings Rate For Mutual Life Insurance Companies Differential Earnings Rate For Mutual Life right from your smartphone

How to create an electronic signature for the Notice 2002 19 Differential Earnings Rate For Mutual Life Insurance Companies Differential Earnings Rate For Mutual Life on iOS devices

How to make an signature for the Notice 2002 19 Differential Earnings Rate For Mutual Life Insurance Companies Differential Earnings Rate For Mutual Life on Android

Get more for Notice 19 Differential Earnings Rate For Mutual Life Insurance Companies Differential Earnings Rate For Mutual Life Insu

- Course 3 chapter 1 real numbers form

- Nas prescription form

- Missouri gun bill of sale form

- New family registration online form

- Self employed worksheet fannie mae form

- Kansas city mo rabies vaccination and license certificate petdata form

- Eviction notice template zimbabwe form

- The pyramid beauty school form

Find out other Notice 19 Differential Earnings Rate For Mutual Life Insurance Companies Differential Earnings Rate For Mutual Life Insu

- Sign South Carolina Police Lease Agreement Template Easy

- Sign South Carolina Police Lease Termination Letter Easy

- Sign South Carolina Police Lease Termination Letter Safe

- Sign Pennsylvania Police Quitclaim Deed Easy

- Sign South Carolina Police Lease Agreement Template Safe

- Sign Pennsylvania Police Quitclaim Deed Safe

- How To Sign South Carolina Police Lease Termination Letter

- How Do I Sign South Carolina Police Lease Termination Letter

- Help Me With Sign South Carolina Police Lease Termination Letter

- How Can I Sign South Carolina Police Lease Termination Letter

- Can I Sign South Carolina Police Lease Termination Letter

- Sign South Dakota Police Rental Lease Agreement Online

- How To Sign Pennsylvania Police Quitclaim Deed

- Sign South Dakota Police Rental Lease Agreement Computer

- Sign South Dakota Police Rental Lease Agreement Mobile

- Sign South Carolina Police Medical History Online

- How Do I Sign Pennsylvania Police Quitclaim Deed

- Sign South Dakota Police Rental Lease Agreement Now

- Sign South Dakota Police Rental Lease Agreement Later

- Help Me With Sign Pennsylvania Police Quitclaim Deed