FATCA CRS Self Declaration Form Catholic Syrian Bank Csb Co

What is the FATCA CRS Self Declaration Form Catholic Syrian Bank CSB Co

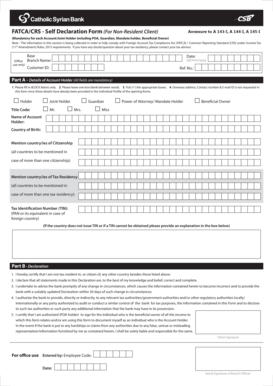

The FATCA CRS Self Declaration Form for Catholic Syrian Bank (CSB Co) is a document required for compliance with the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS). This form is essential for individuals and entities to declare their tax residency status and provide necessary information to ensure compliance with international tax regulations. It helps the bank identify clients who are subject to U.S. tax laws and reporting requirements.

How to use the FATCA CRS Self Declaration Form Catholic Syrian Bank CSB Co

Using the FATCA CRS Self Declaration Form involves several straightforward steps. First, download the form from the official Catholic Syrian Bank website or request a physical copy at a branch. Next, fill in your personal details, including your name, address, and tax identification number. It is crucial to accurately declare your tax residency status. Once completed, submit the form to the bank either in person or via their designated online submission method, ensuring you retain a copy for your records.

Steps to complete the FATCA CRS Self Declaration Form Catholic Syrian Bank CSB Co

Completing the FATCA CRS Self Declaration Form requires careful attention to detail. Follow these steps:

- Download or obtain the form from Catholic Syrian Bank.

- Provide your personal information, including name, address, and date of birth.

- Indicate your tax residency status, ensuring it aligns with your financial activities.

- Sign and date the form to certify the information is accurate.

- Submit the completed form to the bank either in person or through their online platform.

Legal use of the FATCA CRS Self Declaration Form Catholic Syrian Bank CSB Co

The FATCA CRS Self Declaration Form is legally binding and must be filled out truthfully. Providing false information can lead to penalties, including fines or legal action. The form serves as a declaration of your tax status and is used by the bank to comply with international tax reporting obligations. It is essential to understand that this form is not just a routine document; it plays a critical role in ensuring compliance with U.S. tax laws and international agreements.

Key elements of the FATCA CRS Self Declaration Form Catholic Syrian Bank CSB Co

Key elements of the FATCA CRS Self Declaration Form include:

- Personal Information: Full name, address, and date of birth.

- Tax Identification Number: Required for accurate identification.

- Tax Residency Status: Declaration of your residency for tax purposes.

- Signature: Certifying the accuracy of the information provided.

Penalties for Non-Compliance

Failing to submit the FATCA CRS Self Declaration Form or providing inaccurate information can result in significant penalties. These may include fines imposed by tax authorities, potential legal repercussions, and restrictions on banking services. It is crucial to comply with the requirements to avoid these consequences and ensure that your financial dealings remain uninterrupted.

Quick guide on how to complete fatca crs self declaration form catholic syrian bank csb co

Effortlessly Prepare FATCA CRS Self Declaration Form Catholic Syrian Bank Csb Co on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can access the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage FATCA CRS Self Declaration Form Catholic Syrian Bank Csb Co on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Edit and eSign FATCA CRS Self Declaration Form Catholic Syrian Bank Csb Co with Ease

- Obtain FATCA CRS Self Declaration Form Catholic Syrian Bank Csb Co and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that task.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign FATCA CRS Self Declaration Form Catholic Syrian Bank Csb Co to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fatca crs self declaration form catholic syrian bank csb co

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FATCA full form and why is it important for businesses?

The FATCA full form is the Foreign Account Tax Compliance Act. It is essential for businesses as it requires financial institutions to report on foreign assets held by U.S. taxpayers, helping to combat tax evasion and ensuring compliance with tax laws.

-

How can airSlate SignNow assist in managing FATCA compliance?

airSlate SignNow simplifies the document signing process, enabling businesses to create and manage compliance documents related to the FATCA full form. This ensures that all necessary agreements and disclosures are executed efficiently, helping organizations maintain compliance.

-

Is there a specific feature in airSlate SignNow that supports FATCA documentation?

Yes, airSlate SignNow offers customizable templates that can be tailored to FATCA documentation requirements. This feature allows users to quickly create and distribute necessary forms ensuring that all FATCA-related documents are consistently managed.

-

What pricing plans does airSlate SignNow offer for businesses focused on FATCA compliance?

airSlate SignNow offers several pricing plans suitable for various business sizes, allowing organizations to choose an option that fits their needs while ensuring compliance with FATCA regulations. Each plan includes features that streamline document management and signature collection.

-

Can airSlate SignNow integrate with other tools for FATCA reporting?

Yes, airSlate SignNow seamlessly integrates with popular accounting and financial software, enhancing your ability to manage FATCA compliance. These integrations help to centralize data and automate reporting requirements connected to the FATCA full form.

-

What benefits does airSlate SignNow provide in relation to FATCA compliance?

The key benefits of using airSlate SignNow for FATCA compliance include increased efficiency, secure document handling, and reduced errors in form submissions. By streamlining the e-signature process, businesses can ensure timely compliance with FATCA requirements.

-

How does airSlate SignNow ensure the security of FATCA documents?

airSlate SignNow employs advanced security measures to protect all documents, including those related to the FATCA full form. Features such as encryption, secure storage, and access controls ensure that sensitive information remains confidential and compliant with regulations.

Get more for FATCA CRS Self Declaration Form Catholic Syrian Bank Csb Co

Find out other FATCA CRS Self Declaration Form Catholic Syrian Bank Csb Co

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement