Nebraska Department of Revenue Type of Organization Check Only One Estate or Trust Taxable Year of Organization Beginning Nebras Form

What is the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning Nebraska Nonresident Income Tax Agreement Revenue Ne

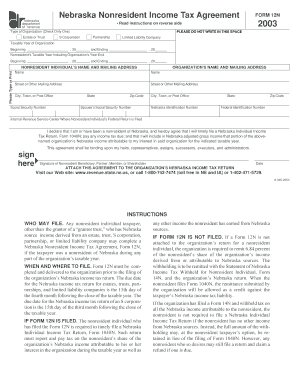

The Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning form is a crucial document for individuals or entities filing taxes in Nebraska. This form serves to classify the type of organization, whether it is an estate or trust, and specifies the taxable year of the organization. Understanding this form is essential for compliance with Nebraska tax laws, particularly for nonresidents earning income in the state. It helps determine the tax obligations and ensures that the correct information is submitted to the state revenue department.

Steps to complete the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning Nebraska Nonresident Income Tax Agreement Revenue Ne

Completing the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning form involves several key steps. First, gather all necessary information about the organization, including its legal name, address, and the type of entity. Next, accurately check the appropriate box to indicate whether the organization is an estate or trust. Then, provide the taxable year information, ensuring it aligns with the organization's fiscal year. Finally, review the form for accuracy before submission to avoid any potential delays or issues with the Nebraska Department of Revenue.

Key elements of the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning Nebraska Nonresident Income Tax Agreement Revenue Ne

Key elements of the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning form include the identification of the organization type, the taxable year, and the signature of the authorized representative. Each section must be filled out completely and accurately. The form also requires the organization’s identification number, which is critical for the Nebraska Department of Revenue to process the submission correctly. Ensuring all key elements are addressed is vital for compliance and to prevent any legal complications.

Legal use of the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning Nebraska Nonresident Income Tax Agreement Revenue Ne

The legal use of the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning form is paramount for both compliance and tax reporting. This form is recognized under Nebraska tax law and must be filed correctly to avoid penalties. It serves as a formal declaration of the organization’s tax status and is essential for nonresidents to report income earned in Nebraska. Proper completion and submission of this form ensure that the organization adheres to state regulations and maintains good standing with the tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning form are critical for compliance. Generally, the form must be submitted by the tax filing deadline, which aligns with the organization’s taxable year. It is important to stay informed about specific dates, as late submissions may incur penalties or interest charges. Keeping a calendar of important tax dates can help ensure timely filing and compliance with Nebraska tax laws.

Form Submission Methods (Online / Mail / In-Person)

The Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning form can be submitted through various methods. Organizations may choose to file online through the Nebraska Department of Revenue's website, which offers a streamlined process. Alternatively, the form can be mailed directly to the appropriate department or submitted in person at designated tax offices. Each submission method has its own requirements and processing times, so it is advisable to select the method that best suits the organization’s needs.

Quick guide on how to complete nebraska department of revenue type of organization check only one estate or trust taxable year of organization beginning

Effortlessly Prepare Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning Nebras on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed paperwork, enabling you to obtain the right document and securely store it online. airSlate SignNow equips you with all necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning Nebras on any device with the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

Effortlessly Modify and eSign Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning Nebras

- Find Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning Nebras and click on Get Form to begin.

- Use the tools provided to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, cumbersome form navigation, or mistakes that require printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning Nebras and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska department of revenue type of organization check only one estate or trust taxable year of organization beginning

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust?

The Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust is a classification used to determine the tax obligations of estates or trusts in Nebraska. This classification affects how income generated by the entity is reported and taxed, emphasizing the significance of understanding your organization type.

-

How does airSlate SignNow simplify the Nebraska Department Of Revenue Type Of Organization process?

airSlate SignNow streamlines the process of sending and eSigning necessary documents, including those relevant for the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust. By providing templates and quick access to forms, users can efficiently manage their tax documentation and ensure compliance.

-

What features does airSlate SignNow offer for managing estate or trust documents?

airSlate SignNow offers a variety of features for managing estate or trust documents, including easy document sharing, customizable templates, and secure eSignature capabilities. This makes it ideal for those dealing with the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization.

-

Is there a free trial available for airSlate SignNow users?

Yes, airSlate SignNow offers a free trial that allows users to experience the full capabilities of the platform, including features related to the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust. This helps potential customers assess how well the solution meets their needs.

-

How can airSlate SignNow improve compliance with Nebraska tax regulations?

By using airSlate SignNow, businesses can enhance compliance with Nebraska tax regulations through streamlined workflows and audit trails. This ensures that all documentation related to the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust is handled precisely, reducing the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to various business needs, catering to users dealing with the Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust. Businesses can select from monthly or annual billing options to find the best fit for their organization.

-

Can airSlate SignNow integrate with other software for enhanced functionality?

Yes, airSlate SignNow seamlessly integrates with various popular software solutions, enhancing functionality for users tracking their Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust documentation. This integration allows for a more efficient workflow when managing related tasks.

Get more for Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning Nebras

- 1800704 wisconsin legislature form

- A131 the form in which documents must be submitted 06072015

- 012 action by written consent of board of directors upon incorporation form

- Was called and held at location on the date day of month year at time form

- View html sec filingdar bioscience form

- We the undersigned being all of the members of the board of directors of form

- Sec info sub surface waste management of delaware inc form

- Island connections 694 by island connections media group issuu form

Find out other Nebraska Department Of Revenue Type Of Organization Check Only One Estate Or Trust Taxable Year Of Organization Beginning Nebras

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation