City of Toledo Ez Individual Resident Tax Return Form

What is the City of Toledo EZ Individual Resident Tax Return

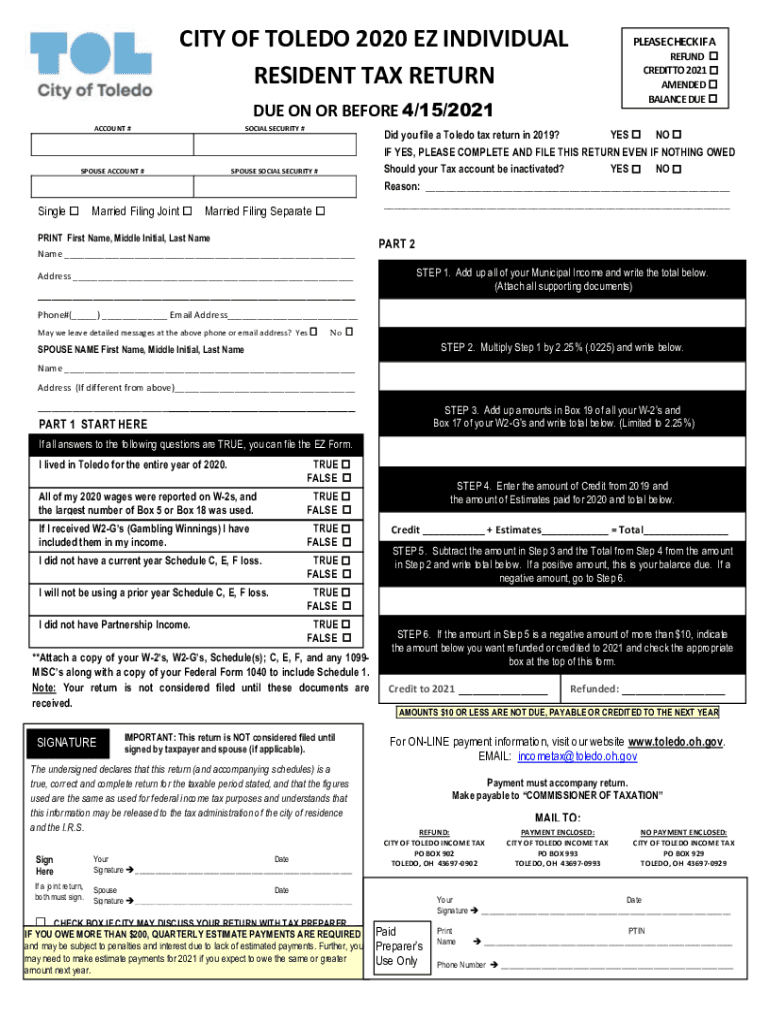

The City of Toledo EZ Individual Resident Tax Return is a simplified tax form designed for residents of Toledo who meet specific eligibility criteria. This form allows eligible individuals to report their income and calculate their tax liabilities in a straightforward manner. It is particularly beneficial for those with uncomplicated tax situations, such as single filers or those without significant deductions. By using this form, residents can efficiently fulfill their tax obligations while minimizing the complexity often associated with tax filing.

Steps to Complete the City of Toledo EZ Individual Resident Tax Return

Completing the City of Toledo EZ Individual Resident Tax Return involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, proof of residency, and any other relevant income statements. Next, carefully fill out the form, ensuring that all information is accurate and complete. Pay special attention to sections that require personal identification and income details. After completing the form, review it thoroughly for any errors before submitting it to the appropriate city department. Lastly, retain a copy of the filed return for your records.

Legal Use of the City of Toledo EZ Individual Resident Tax Return

The City of Toledo EZ Individual Resident Tax Return is legally binding when completed and submitted according to the city’s regulations. To ensure its legal standing, the form must be signed and dated appropriately. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. It is crucial for residents to understand that submitting this form signifies an affirmation of the information provided, making it essential to report accurate and truthful data to avoid potential legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the City of Toledo EZ Individual Resident Tax Return typically align with federal tax deadlines. Residents should be aware that the deadline for submitting the form is usually April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to keep track of any announcements from the city regarding changes to deadlines or extensions, especially during unusual circumstances such as public emergencies.

Required Documents

To successfully complete the City of Toledo EZ Individual Resident Tax Return, residents must gather several essential documents. These typically include:

- W-2 forms from employers

- Proof of residency in Toledo

- Any additional income statements, such as 1099 forms

- Documentation for any applicable deductions or credits

Having these documents ready will streamline the process and ensure that all necessary information is accurately reported on the tax return.

Form Submission Methods (Online / Mail / In-Person)

The City of Toledo EZ Individual Resident Tax Return can be submitted through various methods to accommodate residents' preferences. Individuals may choose to file online through the city’s official tax portal, which provides a convenient and efficient way to submit forms electronically. Alternatively, residents can mail their completed forms to the designated city tax office or deliver them in person during business hours. Each submission method has its advantages, and residents should select the one that best suits their needs.

Quick guide on how to complete city of toledo ez individual resident tax return

Manage City Of Toledo Ez Individual Resident Tax Return effortlessly on any device

Digital document organization has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle City Of Toledo Ez Individual Resident Tax Return on any device using airSlate SignNow applications for Android or iOS and streamline any document-related tasks today.

How to modify and eSign City Of Toledo Ez Individual Resident Tax Return with ease

- Locate City Of Toledo Ez Individual Resident Tax Return and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant portions of the documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign City Of Toledo Ez Individual Resident Tax Return and ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of toledo ez individual resident tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for filing a city of Toledo 2020 individual tax return using airSlate SignNow?

Filing a city of Toledo 2020 individual tax return with airSlate SignNow is simple and efficient. You can upload your tax documents, use our eSigning feature to sign forms digitally, and ensure that your return is submitted timely. Our platform streamlines the entire process, making it easy for you to manage all your tax paperwork in one place.

-

How much does it cost to use airSlate SignNow for the city of Toledo 2020 individual tax return?

airSlate SignNow offers competitive pricing plans tailored to your needs, making it an affordable choice for managing your city of Toledo 2020 individual tax return. We provide different tiers based on features and usage requirements, ensuring you only pay for what you need. You can check our pricing page for more details on the current plans available.

-

What features does airSlate SignNow provide for handling a city of Toledo 2020 individual tax return?

airSlate SignNow offers several features designed to assist with your city of Toledo 2020 individual tax return, including document templates, eSigning, automated workflows, and secure document storage. These tools help you organize and manage your tax filings efficiently while reducing errors. Plus, our user-friendly interface makes navigation easy for all users.

-

Is airSlate SignNow secure for filing a city of Toledo 2020 individual tax return?

Yes, airSlate SignNow is highly secure and compliant with industry-standard security protocols for personal and financial information. We utilize encryption and secure storage solutions to ensure that your city of Toledo 2020 individual tax return data is protected. You can file your taxes with peace of mind knowing your information is safe.

-

Can I integrate airSlate SignNow with other tools for my city of Toledo 2020 individual tax return?

Absolutely! airSlate SignNow integrates seamlessly with various applications and software tools, enhancing your ability to manage your city of Toledo 2020 individual tax return. Whether you’re using accounting software or document management systems, our integration capabilities facilitate a more streamlined workflow. Check our integrations page for the list of compatible applications.

-

How can airSlate SignNow benefit me for my city of Toledo 2020 individual tax return filings?

AirSlate SignNow provides numerous benefits for filing your city of Toledo 2020 individual tax return, such as time savings, increased accuracy, and enhanced convenience. Our eSigning feature reduces the need for printing and scanning, while automated reminders help keep you on track. Overall, using airSlate SignNow simplifies the tax filing process signNowly.

-

What support is available for users filing a city of Toledo 2020 individual tax return with airSlate SignNow?

We provide comprehensive support for users of airSlate SignNow, including tutorials, FAQs, and customer service assistance. If you have questions specifically about filing your city of Toledo 2020 individual tax return or using our features, our support team is ready to help you. You can easily signNow out via chat, email, or our help center.

Get more for City Of Toledo Ez Individual Resident Tax Return

- Rookie rugby registration form buffalo pal

- Great lakes delegation of parental power for athletic club form

- Erin tennis club waiver of liability and release form

- Waiver and release by parent of minor child from liability for tennis form

- Waiver and release from liability for lacrosse form

- Participation agreement roberts wesleyan college form

- Waiver and release from liability for owner of bed and breakfast form

- Or in any way related to childs participation in any of the events or activities conducted by on the form

Find out other City Of Toledo Ez Individual Resident Tax Return

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document