Irs Form 8857 Instructions

What is the IRS Form 8857 Instructions

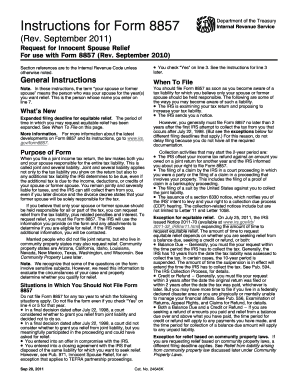

The IRS Form 8857 instructions provide essential guidance for individuals seeking to request innocent spouse relief. This form is crucial for taxpayers who believe they should not be held liable for tax deficiencies due to their spouse's actions. The instructions detail the eligibility criteria, necessary documentation, and the process for submitting the form to the IRS. Understanding these instructions is vital for ensuring that the request is properly filed and considered by the IRS.

Steps to Complete the IRS Form 8857 Instructions

Completing the IRS Form 8857 requires several key steps to ensure accuracy and compliance. First, gather all relevant financial documents, including tax returns and any notices from the IRS. Next, carefully read through the instructions to understand the specific information required. Fill out the form, providing detailed explanations of your situation and why you believe you qualify for relief. After completing the form, review it thoroughly for any errors or omissions before submission. Finally, decide on the submission method, whether online, by mail, or in person.

Legal Use of the IRS Form 8857 Instructions

The legal use of the IRS Form 8857 instructions is grounded in tax law, which allows for innocent spouse relief under certain conditions. This form protects taxpayers from being held liable for tax debts incurred by a spouse without their knowledge or consent. To ensure legal validity, it is important to follow the instructions accurately and provide all required documentation. Compliance with IRS guidelines is essential to avoid delays or rejections of the request.

Required Documents for IRS Form 8857 Instructions

When submitting the IRS Form 8857, specific documents are required to support your claim for innocent spouse relief. These documents typically include copies of joint tax returns, any IRS correspondence related to the tax liability, and financial records that demonstrate your current financial situation. Additionally, any evidence that supports your claim, such as proof of your spouse's income or expenses, should also be included. Having all necessary documents ready will facilitate a smoother review process by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8857 are crucial for taxpayers seeking relief. Generally, the form must be submitted within two years of the IRS's first collection activity related to the tax liability. It is important to stay informed about specific deadlines that may apply to your situation, as late submissions can result in the denial of your request for relief. Keeping track of these dates ensures that you remain compliant with IRS regulations and increases the likelihood of a favorable outcome.

Form Submission Methods

The IRS Form 8857 can be submitted through various methods, providing flexibility for taxpayers. The form can be filed online using the IRS e-file system, which is the quickest method for submission. Alternatively, taxpayers may choose to mail the completed form to the appropriate IRS address, ensuring it is sent via a traceable method for confirmation. In-person submissions may also be possible at certain IRS offices, though this option may require an appointment. Understanding these submission methods helps ensure timely processing of your request.

Quick guide on how to complete irs form 8857 instructions

Accomplish Irs Form 8857 Instructions effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Handle Irs Form 8857 Instructions on any device using the airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign Irs Form 8857 Instructions seamlessly

- Find Irs Form 8857 Instructions and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Irs Form 8857 Instructions and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8857 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 8857 instructions for using airSlate SignNow?

The 8857 instructions for airSlate SignNow provide a step-by-step guide on how to effectively utilize the platform for signing and sending documents. By following these instructions, users can easily navigate the application and take full advantage of its features, ensuring a seamless experience.

-

How does airSlate SignNow simplify the 8857 instructions process?

airSlate SignNow simplifies the 8857 instructions process by offering an intuitive interface and user-friendly tools. This means that even those unfamiliar with digital signing can follow along without technical difficulties, enhancing overall productivity.

-

Are there any costs associated with accessing the 8857 instructions?

Accessing the 8857 instructions within airSlate SignNow is free for all users of the platform. Signing up for a plan will give you not only access to these instructions but also to a variety of features that enhance document workflow.

-

What features are highlighted in the 8857 instructions?

The 8857 instructions highlight a range of features such as document templates, customizable workflows, and real-time tracking of document statuses. These features are designed to streamline the signing process and improve user efficiency.

-

Can I integrate other tools with airSlate SignNow using 8857 instructions?

Yes, the 8857 instructions indicate that airSlate SignNow supports integrations with various applications like Google Drive, Salesforce, and Dropbox. This makes it easy to enhance your document management processes further.

-

What are the benefits of following the 8857 instructions?

Following the 8857 instructions ensures that you leverage airSlate SignNow to its fullest potential, maximizing your efficiency and document management capabilities. Users will experience a simplified signing process, enabling faster contract fulfillment.

-

How often are the 8857 instructions updated?

The 8857 instructions are regularly updated to reflect any changes in the airSlate SignNow platform or enhancements in features. Staying current with these instructions ensures that you are always using the best practices for document signing.

Get more for Irs Form 8857 Instructions

- What is a landlords duty to deliver possession form

- 1 ground lease template for real property form

- Windstream holdings inc edgar online form

- Is the condemnation clause in your lease going faegre form

- Landlord and tenant rights and responsibilities in the case of form

- Example 2 clause dealing with fire damage form

- Damage and destruction provisions of a commercial lease form

- Leasedamages destruction and business interruption form

Find out other Irs Form 8857 Instructions

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe