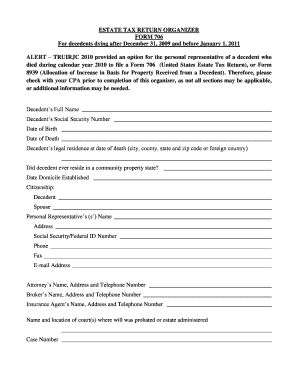

Estate Tax Return Organizer Form

What is the estate tax return organizer?

The estate tax return organizer is a crucial document used to gather and organize information required for filing an estate tax return. This form assists executors and administrators in compiling the necessary data about the deceased's assets, liabilities, and other pertinent details. It typically includes sections for personal information, asset descriptions, valuations, and deductions. By systematically organizing this information, the estate tax return organizer simplifies the preparation process and ensures compliance with federal and state tax regulations.

How to use the estate tax return organizer

Using the estate tax return organizer involves several steps to ensure that all relevant information is accurately captured. Begin by filling out the personal information section, which includes the decedent's name, date of birth, and date of death. Next, list all assets, including real estate, bank accounts, investments, and personal property. For each asset, provide a fair market value as of the date of death. Additionally, document any debts or liabilities owed by the estate. Once all sections are complete, review the information for accuracy before submitting it with the estate tax return.

Steps to complete the estate tax return organizer

Completing the estate tax return organizer requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including wills, bank statements, and property deeds.

- Fill out the personal information section, ensuring accuracy in names and dates.

- List all assets and provide their fair market values as of the date of death.

- Document any outstanding debts or liabilities associated with the estate.

- Review the completed organizer for any omissions or errors.

- Keep a copy for your records before submitting it with the estate tax return.

Legal use of the estate tax return organizer

The estate tax return organizer is legally recognized as a preparatory document that aids in the accurate filing of estate tax returns. It is essential to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or legal complications. The organizer itself does not need to be submitted to the IRS but serves as a comprehensive guide for preparing the official estate tax return form. Compliance with federal and state laws regarding estate taxes is crucial to avoid issues during the filing process.

Required documents

To effectively complete the estate tax return organizer, several documents are typically required. These may include:

- The decedent's will or trust documents.

- Death certificate.

- Financial statements for bank accounts and investment portfolios.

- Property deeds and titles.

- Records of any outstanding debts or liabilities.

Having these documents on hand will facilitate the accurate completion of the organizer and ensure that all necessary information is captured.

Filing deadlines / Important dates

Filing deadlines for estate tax returns can vary based on the date of death and state regulations. Generally, the IRS requires that estate tax returns be filed within nine months of the decedent's death. If additional time is needed, an extension may be requested, but it is crucial to adhere to the original deadline to avoid penalties. Additionally, some states may have their own filing deadlines, so it is essential to check local regulations to ensure compliance.

Examples of using the estate tax return organizer

The estate tax return organizer can be beneficial in various scenarios. For instance, an executor managing a large estate may use the organizer to compile detailed asset information, simplifying the process of filing the estate tax return. Similarly, individuals with modest estates can utilize the organizer to ensure they do not overlook any critical details that could affect tax liabilities. By providing a structured approach to gathering information, the organizer helps prevent errors and omissions, ultimately leading to a smoother filing experience.

Quick guide on how to complete estate tax return organizer

Complete Estate Tax Return Organizer effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Handle Estate Tax Return Organizer across any platform with airSlate SignNow's Android or iOS applications and simplify your document-based processes today.

How to modify and eSign Estate Tax Return Organizer with ease

- Locate Estate Tax Return Organizer and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive data using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Verify the details and click on the Done button to store your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes necessitating new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Edit and eSign Estate Tax Return Organizer and ensure outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the estate tax return organizer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an estate tax return organizer?

An estate tax return organizer is a comprehensive tool designed to help you gather and organize relevant financial information required for filing estate tax returns. This tool simplifies the process, ensuring that you have all necessary data at your fingertips, which can save you time and reduce errors during filing.

-

How does the estate tax return organizer benefit my estate planning?

By using an estate tax return organizer, you can streamline your estate planning process signNowly. It helps you accurately assess your estate's value and ensures that all required documents are prepared meticulously, making the process less daunting for you and your beneficiaries.

-

What features should I look for in an estate tax return organizer?

An effective estate tax return organizer should include customizable templates, integration with financial software, and eSignature capabilities for easy document execution. Look for features that enhance collaboration with your legal or tax professional, providing a seamless experience.

-

Is the estate tax return organizer easy to use for beginners?

Absolutely! The estate tax return organizer is designed with user-friendly interfaces that cater to users of all skill levels. With guided steps and clear instructions, even those unfamiliar with tax documents can navigate through the process confidently.

-

What are the pricing options for the estate tax return organizer?

Pricing for the estate tax return organizer varies based on the features and number of users. Many platforms, including airSlate SignNow, offer flexible pricing plans that are cost-effective, allowing you to choose a package that fits your budget and specific needs.

-

Can I integrate the estate tax return organizer with other financial tools?

Yes, most modern estate tax return organizers, including those from airSlate SignNow, offer seamless integrations with popular accounting and financial software. This capability allows you to synchronize data and streamline your workflow, enhancing efficiency in managing your estate documents.

-

How secure is my information when using an estate tax return organizer?

Security is a top priority when using an estate tax return organizer. Reputable platforms implement advanced encryption technology and comply with data protection regulations to ensure that your sensitive information remains safe and secure throughout the document management process.

Get more for Estate Tax Return Organizer

Find out other Estate Tax Return Organizer

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors