Alabama Dissolution Package to Dissolve Limited Liability Company LLC Form

What is the Alabama Dissolution Package to Dissolve Limited Liability Company LLC

The Alabama Dissolution Package is a collection of forms and instructions required to officially dissolve a limited liability company (LLC) in the state of Alabama. This package typically includes the necessary documentation that outlines the intent to dissolve the LLC, ensuring compliance with state laws. The dissolution process is essential for formally closing a business and preventing any future liabilities or obligations associated with the LLC.

Steps to Complete the Alabama Dissolution Package to Dissolve Limited Liability Company LLC

Completing the Alabama Dissolution Package involves several key steps:

- Gather all necessary information about the LLC, including the name, registration number, and the reason for dissolution.

- Complete the Articles of Dissolution form, which is a critical document in the dissolution process.

- Ensure that all outstanding debts and obligations of the LLC are settled before submission.

- Obtain the necessary approvals from members or managers of the LLC, as required by the operating agreement.

- Submit the completed dissolution package to the Alabama Secretary of State, either online or by mail.

Legal Use of the Alabama Dissolution Package to Dissolve Limited Liability Company LLC

The legal use of the Alabama Dissolution Package is crucial for ensuring that the dissolution of the LLC is recognized by the state. Properly completing and submitting this package protects the members from future liabilities and confirms the termination of the LLC’s existence. It is important to adhere to all legal requirements outlined in the package to avoid complications or penalties.

Key Elements of the Alabama Dissolution Package to Dissolve Limited Liability Company LLC

The Alabama Dissolution Package typically includes several key elements:

- Articles of Dissolution form, which must be filled out accurately.

- Instructions for filing, including any applicable fees.

- Information regarding the settlement of debts and distribution of assets.

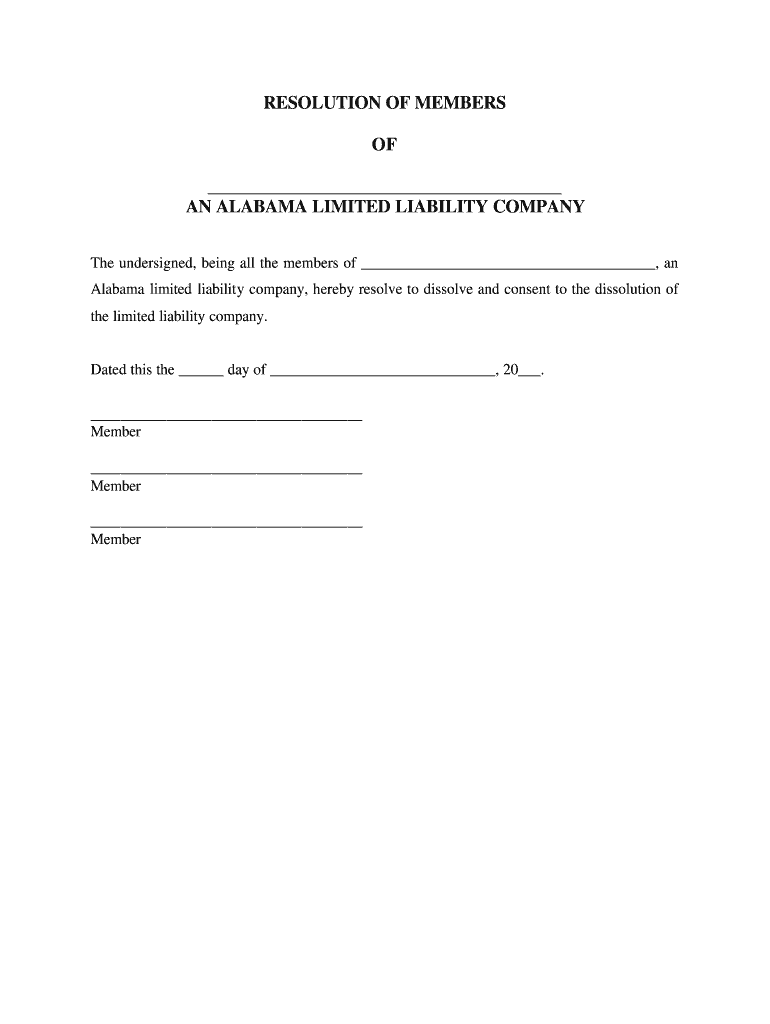

- Signature lines for members or managers to provide their consent.

Required Documents for the Alabama Dissolution Package to Dissolve Limited Liability Company LLC

To successfully dissolve an LLC in Alabama, the following documents are usually required:

- Completed Articles of Dissolution form.

- Any approvals or consents from LLC members, if applicable.

- Proof of debt settlement or a statement indicating that there are no outstanding debts.

- Payment of any required filing fees.

Filing Deadlines / Important Dates for the Alabama Dissolution Package to Dissolve Limited Liability Company LLC

It is important to be aware of any filing deadlines related to the dissolution of an LLC. Generally, the Articles of Dissolution should be filed as soon as the decision to dissolve has been made and all obligations are settled. Failure to file in a timely manner may result in continued liability for the LLC and its members.

Quick guide on how to complete alabama dissolution package to dissolve limited liability company llc

Effortlessly Prepare Alabama Dissolution Package To Dissolve Limited Liability Company LLC on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and without interruptions. Manage Alabama Dissolution Package To Dissolve Limited Liability Company LLC on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Modify and eSign Alabama Dissolution Package To Dissolve Limited Liability Company LLC with Ease

- Locate Alabama Dissolution Package To Dissolve Limited Liability Company LLC and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Alabama Dissolution Package To Dissolve Limited Liability Company LLC to ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

Up to how many members can a limited liability company (LLC) have in California?

There is no limit on the number of members that a limited liability company (LLC) may have as far as California law is concerned.However, the LLC’s Articles of Organization or Operating Agreement may, but is not required to, place a limit on the number of members the LLC may have.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How does a Limited Liability Company (LLC) protect the business owner(s) from personal liability when the LLCs have to sign a 'personal guarantee' from vendors that holds these owners personally liable?

Let’s see. You have a new company. The company has NO credit history. The company wants to purchase things from another business. That business wants to make sure that they get paid. Thus the personal guarantee. They are protecting themselves from your limited liability by having it expanded to you personally just to prevent what you are inferring.Now someone slips and falls in you place of business. They can get the business but not your personal assets.So the LLC still does limit liability - providing you have not “pierced the corporate veil” thru operating your llc in a non business like manner.

-

If a person wants to form a small business and their Certified Public accountant (CPA) advised them to form a Limited Liability Company (LLC), can they do this online? And would they need business liability insurance?

I think you should do what your CPA advises.In terms of HOW to form a LLC, you have options. Almost all states allow folks to form a LLC online either by using their web-based form or by downloading a PDF with instructions.There are many companies (including my own) that will form a LLC for you. So, you have two options: Do it yourself, or hire an Internet company to do it for you.There are pros and cons to each approach, and there are many variations of the companies that will do it for you.The advantage of doing it yourself is mostly the cost. You’re not paying anyone to do it for you.The negative, is that you will have to learn what to do and that can sometimes take a bit of work. Furthermore, the state (no matter where you file) won’t provide an Operating Agreement (which is critical for multi-member LLC’s) and they won’t help you with other aspects of forming a company. You tell them that Mickey Mouse is an owner, they will put Mickey Mouse down as an owner.Finally, there are some things that are just impossible doing it yourself (i.e. forming an Anonymous LLC), because by definition you need a third-party to be your organizer and registered agent.Conversely, hiring someone to form your LLC for you will provide some level of peace-of-mind and simplicity. They will provide some template documents, and they can provide additional services that may be important to your business (i.e. Registered Agent services).With that said, when you hire the “cheapest” company to help you, they are often not adding much value to the process, other than already knowing what to do. The absolute best company to hire would be your local business attorney or law firm, but they will also be the most expensive. The next best would be law firms who provide these services online (like my company, see Form a Limited Liability Company (LLC) | Law 4 Small Business, P.C. (L4SB)). After that will be your typical unlicensed legal provider, such as legalzoom and the others. Last on the list are individuals who are doing formations online, because they can make a quick buck.Factors that you should consider, when thinking about hiring a company to help you form a LLC are:Their online reputation, not the thousands of reviews listed on their website, but the actual google reviews.Do they provide attorney-client privilege and confidentiality?Can you actually speak to someone knowledgeable that will give you sound advice or has the ability to consult with your CPA?Can they help you with other aspects of their business?As it relates to business liability insurance, depending on the type of business you have, you may need to consider:General liability insuranceWorkers (or Workmans) CompensationKeyman / Key-life (if you have more than one owner, or the business needs money if you were to die or become incapacitated)Professional liability insurance (if you’re providing some sort of skilled service)Special insurance / riders, depending on what it is you doI strongly recommend you consult with at least TWO local business insurance agents (with good reputations) to see what they say.Good luck to you. Larry.

-

How do I form a LLC owned by a foreign limited company? Do I have to provide the foreign company documents when forming the LLC?

You form the LLC, and make the limited company a member of the LLC. The process for forming the LLC does not change regardless of whether its owners are foreign or domestic.No, you do not need to provide foreign company documents when forming the LLC. However, unless the person you will designate as the responsible person/organization of the LLC has a US Tax ID, you will need to apply for the Tax ID using the paper application (Form SS-4) rather than the online application. This adds a little complexity and a lot more time to the process.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

I am forming a Limited Liability Company. Do I need to file taxes separate for my company and how frequent should I file?

If you are the only owner of the LLC, the default tax classification as "sole proprietor," which means that the LLC itself is disregarded for tax purposes (i.e. it does not exist for tax purposes). In that case, you would include all of the company's business income and loss on your personal income tax return (Form 1040, filed annually), in a Schedule C attachment.If the LLC has more than one owner, the default tax classification is partnership, which means you would have to file a partnership tax return annually (Form 1065). The LLC would report any profit or loss to you via a Schedule K-1, and then you would include that income on your personal income tax return.

Create this form in 5 minutes!

How to create an eSignature for the alabama dissolution package to dissolve limited liability company llc

How to make an eSignature for your Alabama Dissolution Package To Dissolve Limited Liability Company Llc in the online mode

How to create an electronic signature for the Alabama Dissolution Package To Dissolve Limited Liability Company Llc in Google Chrome

How to make an eSignature for putting it on the Alabama Dissolution Package To Dissolve Limited Liability Company Llc in Gmail

How to make an electronic signature for the Alabama Dissolution Package To Dissolve Limited Liability Company Llc from your mobile device

How to generate an eSignature for the Alabama Dissolution Package To Dissolve Limited Liability Company Llc on iOS devices

How to create an electronic signature for the Alabama Dissolution Package To Dissolve Limited Liability Company Llc on Android OS

People also ask

-

What is the Alabama Dissolution Package To Dissolve Limited Liability Company LLC?

The Alabama Dissolution Package To Dissolve Limited Liability Company LLC is a comprehensive service designed to help business owners formally dissolve their LLC in Alabama. This package includes all necessary documentation and guidance to ensure compliance with state regulations, making the dissolution process smooth and efficient.

-

How much does the Alabama Dissolution Package To Dissolve Limited Liability Company LLC cost?

The pricing for the Alabama Dissolution Package To Dissolve Limited Liability Company LLC is competitively set to provide value while ensuring quality service. The exact cost may vary based on additional services you may choose, but we strive to keep our packages affordable and transparent.

-

What are the benefits of using the Alabama Dissolution Package To Dissolve Limited Liability Company LLC?

Using the Alabama Dissolution Package To Dissolve Limited Liability Company LLC simplifies the legal process of dissolution. It saves you time and reduces the risk of errors in documentation, ensuring that your LLC is dissolved properly and in accordance with Alabama law.

-

What documents are included in the Alabama Dissolution Package To Dissolve Limited Liability Company LLC?

The Alabama Dissolution Package To Dissolve Limited Liability Company LLC includes all essential documents such as the Articles of Dissolution and any required state forms. Additionally, you may receive guidance on how to handle outstanding liabilities and notify creditors, ensuring a thorough dissolution.

-

How long does the dissolution process take with the Alabama Dissolution Package To Dissolve Limited Liability Company LLC?

The timeline for dissolving your LLC can vary, but with the Alabama Dissolution Package To Dissolve Limited Liability Company LLC, you can expect a streamlined process. Typically, after submitting your documents, the state may take anywhere from a few days to a few weeks to process your application.

-

Can I use the Alabama Dissolution Package To Dissolve Limited Liability Company LLC for any type of LLC?

Yes, the Alabama Dissolution Package To Dissolve Limited Liability Company LLC is applicable to most types of LLCs operating in Alabama. Whether your LLC is single-member or multi-member, this package provides the necessary tools to ensure proper dissolution.

-

Is there customer support available for the Alabama Dissolution Package To Dissolve Limited Liability Company LLC?

Absolutely! With the Alabama Dissolution Package To Dissolve Limited Liability Company LLC, you can access dedicated customer support to assist you throughout the dissolution process. Our team is ready to answer any questions and provide guidance, ensuring you feel confident every step of the way.

Get more for Alabama Dissolution Package To Dissolve Limited Liability Company LLC

- Baby scrapbook templates download form

- 4h568 4 h entomology labels ksre bookstore kansas state pratt k state form

- Write the time below each clock form

- Screenplay submission release form

- Instructor recommendation form santa clara university scu

- Kirklees parking permit form

- Collection agreement template form

- Collective agreement template form

Find out other Alabama Dissolution Package To Dissolve Limited Liability Company LLC

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now