Georgia Gid 253 Rs Form

What is the Georgia Gid 253 Rs

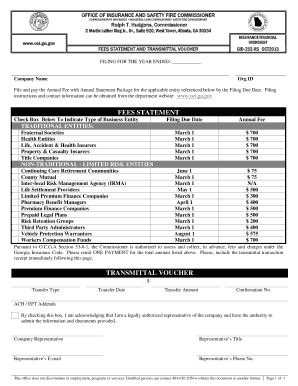

The Georgia Gid 253 Rs form is a specific document used in the state of Georgia for various regulatory purposes. It is essential for individuals and businesses to understand this form's function and requirements. This form typically pertains to reporting and compliance obligations, ensuring that parties involved adhere to state regulations. The Gid 253 Rs is often utilized in contexts where formal documentation is necessary for legal or administrative processes.

How to use the Georgia Gid 253 Rs

Using the Georgia Gid 253 Rs involves several steps to ensure accurate completion and submission. First, gather all necessary information that the form requires. This may include personal identification details, business information, and any relevant documentation that supports your submission. Once you have all required data, fill out the form carefully, ensuring that all fields are completed accurately. After completing the form, review it for any errors before submitting it to the appropriate authority, either online or by mail.

Steps to complete the Georgia Gid 253 Rs

Completing the Georgia Gid 253 Rs requires a systematic approach. Follow these steps for effective completion:

- Read the instructions thoroughly to understand the requirements.

- Gather all necessary documents and information, such as identification and supporting materials.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form to the designated authority.

Legal use of the Georgia Gid 253 Rs

The legal use of the Georgia Gid 253 Rs is crucial for compliance with state regulations. This form serves as an official record and may be required for various legal processes. It is important to ensure that the form is filled out correctly and submitted within the specified timelines to avoid any legal repercussions. Understanding the legal implications of this form can help individuals and businesses navigate their obligations effectively.

Key elements of the Georgia Gid 253 Rs

Key elements of the Georgia Gid 253 Rs include specific information that must be provided for the form to be valid. These elements typically encompass:

- Personal or business identification details.

- Description of the purpose for which the form is being submitted.

- Signature of the individual or authorized representative.

- Date of submission.

Who Issues the Form

The Georgia Gid 253 Rs form is issued by the relevant state authority responsible for overseeing compliance and regulatory matters in Georgia. This may include state departments or agencies that manage specific sectors or industries. It is important to ensure that the form is obtained from the official source to guarantee its validity and compliance with state requirements.

Quick guide on how to complete georgia gid 253 rs

Prepare Georgia Gid 253 Rs effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to acquire the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to generate, alter, and electronically sign your documents quickly without any hold-ups. Manage Georgia Gid 253 Rs on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest method to alter and electronically sign Georgia Gid 253 Rs without hassle

- Find Georgia Gid 253 Rs and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to store your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign Georgia Gid 253 Rs and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the georgia gid 253 rs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are gid 253 rs instructions in airSlate SignNow?

The gid 253 rs instructions provide detailed guidance on how to utilize airSlate SignNow's features effectively. These instructions help users navigate the platform to create, send, and eSign documents with ease, ensuring that you can fully utilize the software's capabilities.

-

How much does airSlate SignNow cost?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes. By following the gid 253 rs instructions, users can easily compare plans, allowing them to choose the most cost-effective solution that meets their document signing needs.

-

What features are included with airSlate SignNow?

airSlate SignNow comes with a range of features including document templates, customizable workflows, and secure electronic signatures. By adhering to the gid 253 rs instructions, users can access advanced features that streamline the signing process and enhance productivity.

-

How can I integrate airSlate SignNow with other tools?

Integrating airSlate SignNow with other software is straightforward. The gid 253 rs instructions provide step-by-step processes for connecting with various platforms like Google Drive and Salesforce, which enhances workflow efficiency through seamless data transfer.

-

What are the benefits of using airSlate SignNow?

Using airSlate SignNow offers numerous benefits, including increased efficiency, improved document security, and enhanced collaboration. The gid 253 rs instructions guide users on maximizing these benefits, helping you streamline operations and reduce paper waste.

-

Is airSlate SignNow suitable for small businesses?

Yes, airSlate SignNow is an excellent solution for small businesses. The gid 253 rs instructions highlight how this cost-effective tool allows small teams to manage document signing processes without overwhelming expenses or complicated setups.

-

How do I get started with airSlate SignNow?

Getting started with airSlate SignNow is simple and user-friendly. By following the gid 253 rs instructions, users can set up their accounts quickly, allowing them to send and eSign documents in no time.

Get more for Georgia Gid 253 Rs

- Civil formssouthern district of iowaunited states district

- Reduce class 6 undesignated felony to a form

- Appendix t3 form

- Private process server arizona judicial branch form

- The superior court of arizona clerk of the superior court form

- Vehicle ampamp equipment purchase agreement free download form

- Agreementforsaleof automobile form

- 411021 iowa department of transportation power of attorney form

Find out other Georgia Gid 253 Rs

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure