Tennessee Department of Revenue Form Fae 170

What is the Tennessee Department of Revenue Form FAE 170

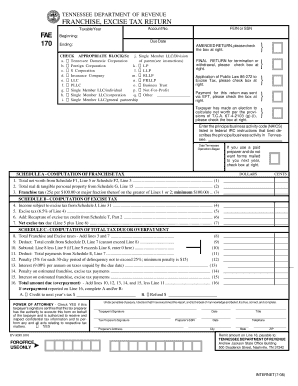

The Tennessee Department of Revenue Form FAE 170 is a tax form primarily used by businesses to report franchise and excise taxes. This form is essential for corporations and limited liability companies (LLCs) operating within Tennessee. It helps the state assess the tax liability of these entities based on their net earnings and gross receipts. Understanding this form is crucial for compliance with state tax regulations.

Steps to complete the Tennessee Department of Revenue Form FAE 170

Completing the FAE 170 involves several clear steps:

- Gather financial records: Collect all necessary financial documents, including income statements and balance sheets.

- Determine your tax liability: Calculate your franchise and excise taxes based on the instructions provided with the form.

- Fill out the form: Accurately enter your business information, including your federal employer identification number (EIN), and complete all required sections.

- Review your entries: Double-check all figures and information for accuracy to avoid delays or penalties.

- Submit the form: Choose your preferred submission method—online, by mail, or in person—and ensure it is sent by the deadline.

How to obtain the Tennessee Department of Revenue Form FAE 170

The FAE 170 form can be easily obtained through the Tennessee Department of Revenue's official website. It is available for download in PDF format, allowing you to print and fill it out manually. Additionally, businesses can access the form through various tax preparation software that supports Tennessee tax filings.

Legal use of the Tennessee Department of Revenue Form FAE 170

For the FAE 170 to be considered legally valid, it must be completed accurately and submitted on time. The form must comply with the Tennessee tax laws, and any electronic submissions should adhere to eSignature regulations. Utilizing a reliable eSignature platform can enhance the legal standing of your electronically submitted documents.

Key elements of the Tennessee Department of Revenue Form FAE 170

Key elements of the FAE 170 include:

- Business Information: This section requires the name, address, and EIN of the business.

- Tax Calculation: Businesses must provide detailed calculations of their franchise and excise taxes.

- Signature: A designated representative must sign the form, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the FAE 170. Typically, the form is due on the fifteenth day of the fourth month following the end of the business's fiscal year. For businesses operating on a calendar year, this means the form is due by April 15. Late submissions may incur penalties, so timely filing is essential.

Quick guide on how to complete tennessee department of revenue form fae 170

Prepare Tennessee Department Of Revenue Form Fae 170 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a sustainable alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Tennessee Department Of Revenue Form Fae 170 on any device with airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Tennessee Department Of Revenue Form Fae 170 without hassle

- Obtain Tennessee Department Of Revenue Form Fae 170 and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight key sections of the documents or black out sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Modify and eSign Tennessee Department Of Revenue Form Fae 170 and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tennessee department of revenue form fae 170

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form fae 170 instructions for eSigning documents with airSlate SignNow?

The form fae 170 instructions guide users on how to electronically sign documents using airSlate SignNow. This includes step-by-step directions on uploading your document, adding signatures, and sending it for eSignature. By following these instructions, you can streamline your document management process.

-

How much does the airSlate SignNow service cost?

Pricing for airSlate SignNow varies based on the plan you choose. Each plan provides different features, including access to form fae 170 instructions and integrations with other services. Visit our pricing page to find a plan that suits your business needs.

-

What features does airSlate SignNow offer regarding form fae 170 instructions?

airSlate SignNow offers a variety of features to enhance the eSigning process, including customizable templates and automatic reminders. The platform also includes resources for users to access form fae 170 instructions, ensuring you can complete your agreements efficiently.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with numerous applications such as CRM systems and cloud storage services. This allows users to access form fae 170 instructions directly in their workflows, increasing efficiency and productivity.

-

What are the benefits of using airSlate SignNow for form fae 170 instructions?

Using airSlate SignNow for form fae 170 instructions can signNowly reduce the time spent on document signing processes. The platform is designed for ease of use and offers secure, legally-binding eSignatures, streamlining your operations and ensuring compliance.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore the platform's features, including how to use form fae 170 instructions effectively. This trial helps you determine if our solution meets your business's needs before committing to a plan.

-

How secure is the eSigning process with airSlate SignNow?

AirSlate SignNow employs advanced security measures to ensure that all eSigning transactions, including those following form fae 170 instructions, are secure. Our platform is compliant with industry standards, giving you peace of mind that your documents are protected.

Get more for Tennessee Department Of Revenue Form Fae 170

Find out other Tennessee Department Of Revenue Form Fae 170

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed