Tax File Declaration Form Printable

What is the Tax File Declaration Form Printable

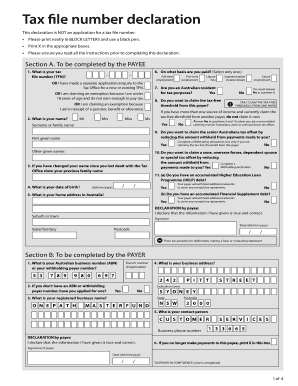

The tax file declaration form is a crucial document used by individuals and businesses to report their income and tax obligations to the Internal Revenue Service (IRS). This form serves as a formal declaration of a taxpayer's earnings, allowing the IRS to assess tax liabilities accurately. It is essential for ensuring compliance with federal tax laws and can affect various aspects of financial planning and obligations.

How to use the Tax File Declaration Form Printable

Using the tax file declaration form involves several steps. First, obtain the correct version of the form, which can be downloaded in PDF format. Next, fill out the form with accurate information regarding your income, deductions, and any credits you may be eligible for. Once completed, review the form for accuracy to avoid issues with the IRS. Finally, submit the form by the designated deadline, ensuring that you keep a copy for your records.

Steps to complete the Tax File Declaration Form Printable

Completing the tax file declaration form can be straightforward if you follow these steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Download and print the tax file declaration form from a reliable source.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, dividends, and other sources of income.

- Claim any deductions or credits you are eligible for to reduce your taxable income.

- Review the completed form for any errors before submission.

- Submit the form by mail or electronically, depending on your preference and the IRS guidelines.

Key elements of the Tax File Declaration Form Printable

The tax file declaration form includes several key elements that must be accurately completed to ensure compliance. These elements typically include:

- Personal Information: Name, address, and Social Security number.

- Income Details: Total income from various sources, including wages and investment income.

- Deductions: Any applicable deductions that can lower taxable income.

- Tax Credits: Information on any tax credits that can reduce tax liability.

- Signature: A declaration that the information provided is true and accurate, usually requiring a signature and date.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the tax file declaration form. These guidelines include instructions on how to report income, the types of deductions allowed, and the process for claiming credits. It is important to refer to the latest IRS publications to ensure compliance with current tax laws and regulations. Failure to adhere to these guidelines can result in penalties or delays in processing your tax return.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the tax file declaration form. Taxpayers can choose to file online using IRS-approved e-filing software, which often provides a streamlined process and faster refunds. Alternatively, the form can be mailed to the appropriate IRS address, ensuring it is postmarked by the filing deadline. In some cases, individuals may also submit their forms in person at designated IRS offices, though this option may vary by location.

Quick guide on how to complete tax file declaration form printable

Complete Tax File Declaration Form Printable effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documentation, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Handle Tax File Declaration Form Printable on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign Tax File Declaration Form Printable without hassle

- Find Tax File Declaration Form Printable and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal authority as a conventional ink signature.

- Verify all the details and then click on the Done button to secure your modifications.

- Choose your preferred method of submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign Tax File Declaration Form Printable and ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax file declaration form printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax declaration form, and why is it important?

A tax declaration form is a document that individuals and businesses use to report income, expenses, and taxes owed. This form is crucial for ensuring compliance with tax regulations and determining the amount of tax liability. Using airSlate SignNow, you can easily create, send, and eSign your tax declaration form quickly and securely.

-

How does airSlate SignNow help with managing tax declaration forms?

airSlate SignNow streamlines the process of creating and signing tax declaration forms by offering an intuitive interface and robust document management features. You can customize your forms, track their status, and get real-time notifications when they're signed. This makes managing your tax documents efficient and stress-free.

-

Is airSlate SignNow a cost-effective solution for creating tax declaration forms?

Yes, airSlate SignNow provides a cost-effective solution for all your document needs, including tax declaration forms. Plans are competitively priced to cater to businesses of all sizes, allowing you to save money while enjoying comprehensive eSigning and document management features.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your tax management process. Whether you use accounting software or customer relationship management tools, you can connect them with airSlate SignNow to streamline the workflow for your tax declaration forms.

-

What features does airSlate SignNow offer for tax declaration forms?

airSlate SignNow offers features tailored for tax declaration forms, including customizable templates, eSigning capabilities, and secure cloud storage. These tools ensure that you can generate accurate forms, facilitate signatures quickly, and store your documents safely, all from one platform.

-

How secure is the information shared via tax declaration forms on airSlate SignNow?

Security is a top priority at airSlate SignNow. We employ industry-standard encryption and comply with regulations to ensure that your tax declaration form and other sensitive information remain secure. You can confidently send and sign your documents, knowing that your data is well protected.

-

How can I optimize my workflow for tax declaration forms using airSlate SignNow?

You can optimize your workflow for tax declaration forms by using airSlate SignNow's automation features, such as workflows and reminders. Set up automated processes to notify team members when forms are due, and utilize templates to save time in form creation. This ensures that your tax management is efficient and systematic.

Get more for Tax File Declaration Form Printable

- Arkansas affidavit form

- Arkansas termination form

- Arkansas notice of breach of written lease for violating specific provisions of lease with right to cure for residential form

- Arkansas commercial rental lease application questionnaire form

- Arkansas order on petition for letters of administration form

- Arkansas waiver of notice of appointment of personal representative by heirs form

- Arkansas deed 481379064 form

- Arkansas arkansas forest products timber sale contract form

Find out other Tax File Declaration Form Printable

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document