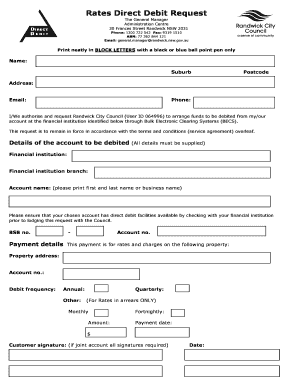

Randwick City Council Rates Form

What is the Randwick City Council Rates

The Randwick City Council Rates refer to the property taxes levied by the Randwick City Council in New South Wales, Australia. These rates are essential for funding local services and infrastructure, including waste management, parks, and community facilities. The rates are calculated based on the assessed value of the property, which is determined by the local council. Understanding these rates is crucial for property owners, as they contribute significantly to the overall cost of property ownership.

How to use the Randwick City Council Rates

Using the Randwick City Council Rates involves understanding how they are assessed and billed. Property owners receive a rates notice, typically annually, detailing the amount owed. This document includes information about the property’s valuation and the applicable rate in the dollar. To manage payments effectively, property owners should keep track of due dates and any potential discounts for early payments. Additionally, understanding the breakdown of services funded by these rates can help residents appreciate their contributions to the community.

Steps to complete the Randwick City Council Rates

Completing the Randwick City Council Rates payment process involves several straightforward steps:

- Review your rates notice for accuracy, including property details and amount due.

- Determine your payment method, which may include online payment, mail, or in-person options.

- If paying online, visit the Randwick City Council website and navigate to the rates payment section.

- Enter the required information, including your property details and payment amount.

- Submit your payment and retain any confirmation received for your records.

Legal use of the Randwick City Council Rates

The legal use of the Randwick City Council Rates is governed by local legislation, which outlines the council's authority to levy rates on properties within its jurisdiction. Property owners are legally obligated to pay these rates, and failure to do so can result in penalties, including interest charges or legal action. It is important for property owners to stay informed about their rights and responsibilities regarding council rates, ensuring compliance with all applicable laws.

Form Submission Methods for Randwick Rates Payment

Submitting payments for the Randwick City Council Rates can be done through various methods to accommodate different preferences:

- Online: Payments can be made through the Randwick City Council website, offering a convenient and immediate option.

- Mail: Property owners can send their payment via check or money order to the council's designated address.

- In-Person: Payments can also be made at the council offices during business hours, allowing for direct interaction with council staff.

Key elements of the Randwick City Council Rates

Understanding the key elements of the Randwick City Council Rates is essential for property owners. These include:

- Valuation: The assessed value of the property, determined by the council.

- Rate in the dollar: The amount charged per dollar of property value.

- Rate notice: An official document sent to property owners detailing the amount due and payment instructions.

- Payment deadlines: Specific dates by which payments must be made to avoid penalties.

Quick guide on how to complete randwick city council rates

Complete Randwick City Council Rates easily on any device

Managing documents online has become widely accepted by both businesses and individuals. It presents an excellent environmentally friendly substitute for traditional printed and signed paperwork, as you can locate the right form and securely save it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents rapidly without any hold-ups. Handle Randwick City Council Rates on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Randwick City Council Rates effortlessly

- Locate Randwick City Council Rates and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Randwick City Council Rates and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the randwick city council rates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Randwick council rates, and how are they calculated?

Randwick council rates are local taxes imposed on properties within the Randwick area to fund community services and infrastructure. These rates are calculated based on the value of the property, determined through regular assessments, and are typically announced annually by the council.

-

How can I pay my Randwick council rates?

You can pay your Randwick council rates online via the Randwick City Council website, by phone, or through mail. Additionally, payments can often be made in person at the council offices. Setting up direct debit is also a convenient option to ensure your payments are made automatically.

-

What happens if I miss a Randwick council rates payment?

If you miss a Randwick council rates payment, the council may apply interest charges and additional fees. It's crucial to contact the council as soon as possible to avoid further penalties and discuss potential payment arrangements.

-

How does airSlate SignNow help with managing documents related to Randwick council rates?

airSlate SignNow provides a secure platform to electronically sign and manage documents related to Randwick council rates. This can include payment confirmations or correspondence with the council, streamlining the process and ensuring all necessary documentation is easily accessible.

-

What features does airSlate SignNow offer that can help with council rates documentation?

airSlate SignNow offers features such as customizable templates, cloud storage, and real-time collaboration, making it easy to create and manage documents related to Randwick council rates. These features enhance efficiency, ensuring that your documentation process is quick and hassle-free.

-

Are there any discounts available for Randwick council rates?

Randwick City Council may offer discounts and rebates for eligible property owners, including pensioners and those facing financial hardship. It's advisable to check with the council directly or visit their website for specific details on available discounts related to Randwick council rates.

-

Can I dispute my Randwick council rates assessment?

Yes, if you believe your Randwick council rates assessment is incorrect, you can submit a request for review or dispute the valuation with the council. Ensure to provide any necessary documentation to support your claim, and follow the council's outlined procedures for disputes.

Get more for Randwick City Council Rates

- Ar satisfaction mortgage form

- Partial release of property from mortgage for corporation arkansas form

- Partial release of property from mortgage by individual holder arkansas form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy arkansas form

- Warranty deed for parents to child with reservation of life estate arkansas form

- Warranty deed for separate or joint property to joint tenancy arkansas form

- Warranty deed to separate property of one spouse to both as joint tenants or as community property with right of survivorship 497296774 form

- Ar deed fiduciary form

Find out other Randwick City Council Rates

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF