F944 Form

What is the F944 Form

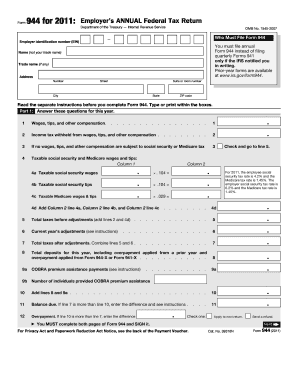

The F944 Form is a crucial document used in specific legal and financial contexts. It is primarily utilized to report certain financial information to the Internal Revenue Service (IRS). This form is essential for taxpayers who need to disclose income, deductions, or other relevant financial data. Understanding the purpose and requirements of the F944 Form can help ensure compliance with federal regulations.

How to use the F944 Form

Using the F944 Form involves several steps to ensure accurate completion. First, gather all necessary financial documents and information needed for the form. This may include income statements, deduction records, and any other relevant financial data. Next, carefully fill out each section of the form, ensuring that all entries are accurate and complete. After completing the form, review it for any errors or omissions before submission. Depending on the requirements, you may need to submit the form electronically or by mail.

Steps to complete the F944 Form

Completing the F944 Form requires attention to detail. Follow these steps for successful completion:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Provide detailed information about your income sources and any deductions you wish to claim.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the F944 Form

The F944 Form is legally binding when completed accurately and submitted according to IRS guidelines. It is essential to follow all legal requirements to ensure that the information provided is valid. Failure to comply with the regulations surrounding the use of this form may result in penalties or legal repercussions. Therefore, it is advisable to consult with a tax professional if you have questions about the legal implications of the F944 Form.

Key elements of the F944 Form

The F944 Form contains several key elements that must be completed for it to be valid. These include:

- Personal identification information, such as your name and Social Security number.

- Details of income sources, including wages, interest, and dividends.

- Information regarding deductions, such as mortgage interest, medical expenses, and charitable contributions.

- A signature and date to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the F944 Form are critical to avoid penalties. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most taxpayers. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to filing deadlines to ensure timely submission.

Quick guide on how to complete f944 form

Finalize F944 Form seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily access the required form and securely save it online. airSlate SignNow equips you with all the resources necessary to produce, modify, and eSign your documents promptly without delays. Handle F944 Form on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

How to adjust and eSign F944 Form effortlessly

- Locate F944 Form and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize critical sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Revise and eSign F944 Form to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f944 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the F944 Form and why is it important?

The F944 Form is a crucial document used for reporting financial data, particularly for businesses dealing with tax responsibilities. Understanding how to properly fill out the F944 Form can help your business ensure compliance with regulatory requirements and avoid potential penalties.

-

How can airSlate SignNow help me manage the F944 Form?

airSlate SignNow provides a user-friendly interface for filling out and signing the F944 Form electronically. With our platform, you can easily complete the form, request signatures, and store it securely, streamlining your workflow and saving time.

-

What are the pricing plans for using airSlate SignNow for the F944 Form?

airSlate SignNow offers various pricing plans tailored to meet different business needs. Our pricing is cost-effective, allowing you to easily manage documents like the F944 Form without breaking the bank, so you can focus on your core business activities.

-

Is it easy to integrate airSlate SignNow with other software for managing the F944 Form?

Yes, airSlate SignNow offers seamless integrations with popular software solutions, allowing you to streamline the process of managing the F944 Form. Whether you use CRM systems or document management tools, our integrations ensure a smooth workflow.

-

What features does airSlate SignNow offer for completing the F944 Form?

airSlate SignNow includes a range of features such as templates, custom branding, and real-time tracking for managing the F944 Form efficiently. These tools make it simple to customize your documents and manage the signing process effortlessly.

-

Can I access my F944 Form from mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is designed to be mobile-friendly, enabling you to access and complete the F944 Form from your smartphone or tablet. This flexibility allows you to manage your documents on-the-go, ensuring efficiency and convenience.

-

What benefits does airSlate SignNow provide for businesses using the F944 Form?

By using airSlate SignNow for the F944 Form, businesses can enhance their document management with reduced processing time, improved accuracy, and better compliance. Moreover, the electronic signing feature eliminates the need for physical paperwork, making the process eco-friendly.

Get more for F944 Form

- Bill of sale without warranty by corporate seller alabama form

- Chapter 13 plan alabama form

- Chapter 13 plan alabama 497295908 form

- Chapter 13 plan summary alabama form

- Chapter 13 plan alabama 497295910 form

- Reaffirmation agreement alabama form

- Verification creditors form

- Verification of creditors matrix alabama form

Find out other F944 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors