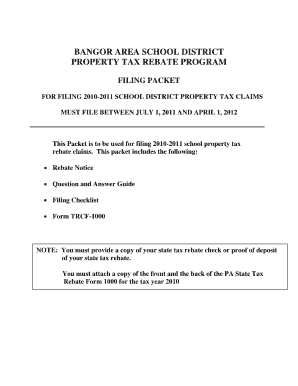

Bangor Area School District Tax Rebate Form

What is the Bangor Area School District Tax Rebate

The Bangor Area School District Tax Rebate is a financial program designed to provide eligible residents with a rebate on their property taxes. This initiative aims to alleviate the financial burden on homeowners within the district, particularly those who may be facing economic hardships. The rebate is typically calculated based on the amount of property tax paid and is available to qualifying individuals, including seniors and low-income families.

Eligibility Criteria

To qualify for the Bangor Area School District Tax Rebate, applicants must meet specific criteria. Generally, eligibility includes:

- Residency within the Bangor Area School District.

- Meeting income limits set by the district.

- Being the owner of the property for which the rebate is being claimed.

- Filing the appropriate tax forms within the designated timeframe.

Steps to Complete the Bangor Area School District Tax Rebate

Completing the Bangor Area School District Tax Rebate form involves several key steps:

- Gather necessary documentation, including proof of income and property tax payments.

- Obtain the rebate application form from the school district's website or local office.

- Fill out the form accurately, ensuring all required information is provided.

- Submit the completed form along with any supporting documents by the specified deadline.

Required Documents

Applicants must provide specific documents to support their rebate application. These typically include:

- Proof of property ownership, such as a deed or tax bill.

- Income verification documents, like W-2 forms or tax returns.

- Any additional forms required by the Bangor Area School District.

Form Submission Methods

Once the application is completed, there are several methods for submitting the Bangor Area School District Tax Rebate form:

- Online submission through the school district's designated portal.

- Mailing the completed form to the school district's office.

- In-person submission at the local school district office.

Legal Use of the Bangor Area School District Tax Rebate

The Bangor Area School District Tax Rebate is governed by specific legal frameworks that ensure its proper use. It is essential for applicants to understand these regulations to ensure compliance and avoid any potential issues. The rebate is legally binding once the application is submitted and approved, provided that all eligibility requirements are met.

Quick guide on how to complete bangor area school district tax rebate

Effortlessly Prepare Bangor Area School District Tax Rebate on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal sustainable substitute for conventional printed and signed documents, allowing you to find the necessary template and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Bangor Area School District Tax Rebate on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Bangor Area School District Tax Rebate with ease

- Find Bangor Area School District Tax Rebate and click Get Form to start.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for this task.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to deliver your form via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized files, monotonous form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Bangor Area School District Tax Rebate and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bangor area school district tax rebate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Bangor area school district tax rebate?

The Bangor area school district tax rebate is a financial incentive aimed at providing eligible residents with a reduction in their school district property taxes. This rebate is designed to alleviate some of the financial burdens for families living in the Bangor area. Ensuring you understand the guidelines for eligibility can help you maximize your potential savings from this tax rebate.

-

Who is eligible for the Bangor area school district tax rebate?

Eligibility for the Bangor area school district tax rebate typically includes homeowners within the district who meet specific income requirements. Senior citizens and low-income families often receive priority in the rebate application process. Always check the official guidelines to ensure you meet the necessary criteria for claiming this beneficial tax rebate.

-

How do I apply for the Bangor area school district tax rebate?

To apply for the Bangor area school district tax rebate, you need to complete and submit the official application form to your local tax office. Make sure to have your financial documentation handy to support your application. The process is straightforward, and timely submission can help you receive your tax rebate sooner.

-

What documents are required for the application of the Bangor area school district tax rebate?

When applying for the Bangor area school district tax rebate, you will generally need to provide proof of residency, income documentation, and any relevant financial information. It is crucial to check with your local tax office for a comprehensive list of required documents to ensure a smooth application process. This preparation can greatly enhance your chances of securing the rebate.

-

Is there a deadline for applying for the Bangor area school district tax rebate?

Yes, there is typically a deadline for applying for the Bangor area school district tax rebate, which is usually set in accordance with local tax regulations. Staying informed about these deadlines is critical to ensure you do not miss the opportunity to receive a tax reduction. Plan ahead to avoid any last-minute rush and ensure all your documentation is ready.

-

How does the Bangor area school district tax rebate impact my overall taxes?

The Bangor area school district tax rebate can signNowly reduce the total amount of property taxes you owe, providing much-needed financial relief for homeowners. This rebate acts as a direct reduction in your tax bill, which can have a positive impact on your monthly budget and expenses. Understanding how this rebate applies to your overall tax situation can help you take advantage of the benefits it offers.

-

Can I receive assistance with the Bangor area school district tax rebate application process?

Yes, there are various resources available to assist you with the Bangor area school district tax rebate application process. Local community organizations, tax professionals, and the district tax office can provide guidance and answer any questions you may have. Utilizing these resources can make the application process smoother and ensure you have all the necessary information.

Get more for Bangor Area School District Tax Rebate

Find out other Bangor Area School District Tax Rebate

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later