Ptax 343 Form

What is the Ptax 343 Form

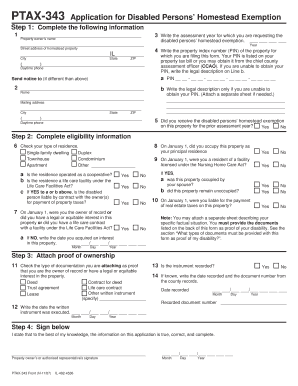

The Ptax 343 Form is a property tax exemption application used in the United States, specifically designed for individuals seeking to claim a property tax exemption on their residential property. This form is essential for homeowners who qualify for certain exemptions, allowing them to reduce their property tax burden. The form typically requires detailed information about the property, the owner, and the specific exemption being claimed.

How to use the Ptax 343 Form

Using the Ptax 343 Form involves several key steps. First, ensure you meet the eligibility criteria for the exemption you intend to claim. Next, download the form from the appropriate state or local government website. Carefully fill out the form, providing accurate information regarding your property and personal details. After completing the form, submit it according to the instructions provided, whether online, by mail, or in person, depending on your local regulations.

Steps to complete the Ptax 343 Form

Completing the Ptax 343 Form requires attention to detail. Follow these steps:

- Gather necessary documents, including proof of ownership and any required identification.

- Download the Ptax 343 Form from the official source.

- Fill out the form, ensuring all fields are accurately completed.

- Review the form for any errors or omissions.

- Submit the form via the designated method, ensuring it is sent before any applicable deadlines.

Legal use of the Ptax 343 Form

The Ptax 343 Form is legally binding when completed and submitted in accordance with state laws. It is crucial to provide truthful and accurate information, as any discrepancies may lead to penalties or denial of the exemption. Understanding the legal implications of the form helps ensure compliance with local property tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Ptax 343 Form can vary by state and local jurisdiction. Typically, homeowners must submit the form by a specific date to qualify for the tax exemption for the upcoming tax year. It is essential to check with local tax authorities to confirm the exact deadlines and avoid missing the opportunity to claim the exemption.

Who Issues the Form

The Ptax 343 Form is issued by local or state tax authorities, depending on the jurisdiction. Homeowners can obtain the form from their local assessor’s office or the official state tax website. Understanding where to access the form ensures that individuals are using the correct and most current version required for their application.

Quick guide on how to complete ptax 343 form

Effortlessly prepare Ptax 343 Form on any device

Digital document management has gained traction among enterprises and individuals alike. It serves as a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Ptax 343 Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The most efficient way to alter and electronically sign Ptax 343 Form with ease

- Locate Ptax 343 Form and click Get Form to commence.

- Utilize the tools available to finalize your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Ptax 343 Form and ensure excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 343 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ptax 343 Form?

The Ptax 343 Form is a tax document used in certain jurisdictions for property tax assessments. It enables property owners to provide necessary information to local tax authorities, ensuring accurate valuation and assessment of their properties.

-

How can airSlate SignNow help with the Ptax 343 Form?

airSlate SignNow simplifies the process of completing and signing the Ptax 343 Form. With our platform, users can easily fill out this document electronically and securely eSign it, making submissions more efficient and reducing the risk of errors.

-

Is there a cost to using airSlate SignNow for the Ptax 343 Form?

airSlate SignNow offers various pricing plans tailored to different needs, including options for businesses handling multiple Ptax 343 Forms. Our cost-effective solution ensures that you can effectively manage your tax documents without breaking the bank.

-

What features does airSlate SignNow provide for the Ptax 343 Form?

Our platform includes features such as easy document editing, electronic signatures, and templates specifically for the Ptax 343 Form. This streamlines the process, allowing users to complete and send their forms quickly and securely.

-

Can I integrate airSlate SignNow with other tools for the Ptax 343 Form?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage the Ptax 343 Form within your existing workflow. Whether you use CRMs, project management tools, or cloud storage solutions, our platform enhances your productivity.

-

What are the benefits of using airSlate SignNow for the Ptax 343 Form?

Using airSlate SignNow for the Ptax 343 Form offers convenience, speed, and security. The platform ensures that your documents are handled efficiently, reducing processing times and ensuring compliance with local regulations.

-

Is airSlate SignNow secure for submitting the Ptax 343 Form?

Absolutely! airSlate SignNow prioritizes security, providing advanced encryption and secure storage for all documents, including the Ptax 343 Form. This ensures that your sensitive tax information remains confidential and protected.

Get more for Ptax 343 Form

- Revocation of postnuptial property agreement connecticut connecticut form

- Ct agreement 497300964 form

- Connecticut postnuptial form

- Quitclaim deed from husband and wife to an individual connecticut form

- Warranty deed from husband and wife to an individual connecticut form

- Quitclaim deed two individuals to one individual connecticut form

- Connecticut special warranty deed form

- Ct certificate incorporation form

Find out other Ptax 343 Form

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document