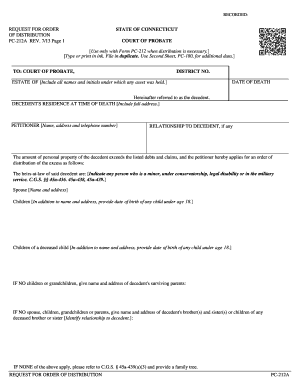

Form PC 212A Connecticut Probate Courts

What is the Form PC 212A Connecticut Probate Courts

The Form PC 212A is a legal document used within the Connecticut probate court system. It serves as a petition for the appointment of a conservator for an individual who is unable to manage their own affairs due to various reasons, such as mental incapacity or physical disability. This form is crucial in initiating the legal process to protect the interests of those who may not be able to advocate for themselves.

How to use the Form PC 212A Connecticut Probate Courts

Using the Form PC 212A involves several steps to ensure that the petition is properly filled out and submitted. First, gather all necessary information about the individual for whom the conservatorship is being requested. This includes personal details, medical information, and any relevant financial data. Next, complete the form accurately, ensuring that all sections are filled out as required. Once completed, the form must be filed with the appropriate probate court, along with any required supporting documents.

Steps to complete the Form PC 212A Connecticut Probate Courts

Completing the Form PC 212A requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the Connecticut probate court website or office.

- Fill in the personal information of the individual needing a conservator, including their name, address, and date of birth.

- Provide details regarding the proposed conservator, including their relationship to the individual and their qualifications.

- Include any medical or psychological evaluations that support the need for a conservatorship.

- Sign and date the form, ensuring all required signatures are present.

Legal use of the Form PC 212A Connecticut Probate Courts

The legal use of the Form PC 212A is governed by Connecticut state law, which outlines the requirements for establishing a conservatorship. The form must be completed accurately and submitted to the probate court to initiate legal proceedings. It is essential that the form is used in compliance with all relevant laws and regulations to ensure that the rights of the individual are protected throughout the process.

Key elements of the Form PC 212A Connecticut Probate Courts

Key elements of the Form PC 212A include:

- Identification of the individual needing a conservator.

- Details about the proposed conservator, including their qualifications.

- Medical documentation supporting the need for conservatorship.

- Signatures from all parties involved, including the proposed conservator and witnesses.

Form Submission Methods for PC 212A Connecticut Probate Courts

The Form PC 212A can be submitted to the probate court through various methods. Individuals may choose to file the form in person at the local probate court office. Alternatively, some courts may allow for electronic submission through their online portals. It is also possible to mail the completed form to the appropriate court. Each submission method may have specific requirements, so it is important to verify the preferred method with the local court.

Quick guide on how to complete form pc 212a connecticut probate courts

Effortlessly prepare Form PC 212A Connecticut Probate Courts on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form PC 212A Connecticut Probate Courts on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to modify and electronically sign Form PC 212A Connecticut Probate Courts with ease

- Find Form PC 212A Connecticut Probate Courts and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, invite link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Form PC 212A Connecticut Probate Courts and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form pc 212a connecticut probate courts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pc 212a and how does it help businesses?

The pc 212a is an advanced eSigning solution offered by airSlate SignNow that allows businesses to efficiently send, sign, and manage documents electronically. It streamlines the signing process, reducing turnaround times and enhancing productivity across teams.

-

How much does the pc 212a cost?

The pricing for the pc 212a varies depending on your business needs and the number of users. airSlate SignNow offers flexible pricing plans that ensure you receive a cost-effective solution tailored to your budget.

-

What features are included in the pc 212a?

The pc 212a includes features like customizable templates, user authentication, and real-time tracking of document status. These functionalities make it easy for businesses to manage and sign documents securely and efficiently.

-

Can I integrate the pc 212a with other tools?

Yes, the pc 212a provides seamless integration capabilities with various business applications, including CRM systems and cloud storage services. This ensures that your document workflows remain efficient and interconnected across platforms.

-

What are the key benefits of using the pc 212a?

The pc 212a offers several key benefits, including time savings, reduced paperwork, and enhanced security for your documents. Additionally, it helps improve collaboration and ensures compliance with legal standards, making it an ideal choice for modern businesses.

-

Is the pc 212a suitable for small businesses?

Absolutely! The pc 212a is designed to accommodate businesses of all sizes. Its user-friendly interface and cost-effective pricing make it an excellent option for small businesses looking to enhance their document management processes.

-

How does the pc 212a ensure the security of my documents?

The pc 212a utilizes advanced encryption and authentication measures to ensure the security of your documents during transmission and storage. This commitment to security helps protect sensitive information and maintain the integrity of your business communications.

Get more for Form PC 212A Connecticut Probate Courts

- Shop fitness programs nutritional products beachbody form

- Irs form 8508 fill online printable fillable blank

- Oklahoma statutes dshs form

- Demand for list of laborers and material suppliers form

- Payee affidavit for non monetary receipt lancaster county form

- Control number ok 07 78 form

- Waiver of lien corporation 490206820 form

- Being first sworn under oath states that heshe signed the above form

Find out other Form PC 212A Connecticut Probate Courts

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer