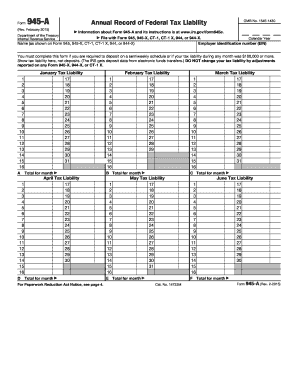

You Must Complete This Form If You Are Required to Deposit on a Semiweekly Schedule or If Your Tax Irs

Understanding the Semiweekly Deposit Schedule

The semiweekly deposit schedule is crucial for employers who are required to deposit federal payroll taxes. This schedule applies to businesses that have accumulated a certain amount of payroll tax liability in the previous year. Specifically, if your business owed more than $50,000 in payroll taxes during the lookback period, you must adhere to this schedule. The semiweekly deposit schedule divides the tax deposit obligations into two distinct deposit days each week, allowing for a structured approach to tax payments.

Steps to Complete the Semiweekly Deposit Requirements

To fulfill the semiweekly deposit requirements, follow these steps:

- Determine your deposit schedule based on your payroll tax liability from the previous year.

- Calculate the total payroll taxes owed for each pay period.

- Make the deposit electronically using the Electronic Federal Tax Payment System (EFTPS) or another approved method.

- Ensure that the deposit is made by the designated deadlines to avoid penalties.

Completing these steps accurately will help maintain compliance with IRS regulations and avoid potential fines.

Legal Validity of the Semiweekly Deposit Schedule

The semiweekly deposit schedule is legally valid as long as it complies with IRS regulations. Electronic payments made through authorized channels, such as EFTPS, are recognized as legitimate. It is essential to keep records of all transactions, including confirmation numbers and payment dates, to ensure that you have proof of compliance in case of an audit.

Filing Deadlines for Semiweekly Deposits

Filing deadlines for semiweekly deposits are critical to avoid penalties. Deposits are due on specific days of the week, depending on when the payroll is processed. For example, if payroll is paid on a Friday, the deposit must be made by the following Wednesday. Understanding these deadlines is vital for maintaining compliance and ensuring timely payments.

IRS Guidelines for Semiweekly Deposits

The IRS provides detailed guidelines regarding the semiweekly deposit schedule. These guidelines outline the criteria for determining eligibility, the calculation of payroll tax liabilities, and the methods for making deposits. Familiarizing yourself with these guidelines will help ensure that your business remains compliant with federal tax laws.

Penalties for Non-Compliance

Failure to comply with the semiweekly deposit schedule can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. It is essential to adhere to the deposit schedule to avoid these financial repercussions and maintain a good standing with tax authorities.

Quick guide on how to complete you must complete this form if you are required to deposit on a semiweekly schedule or if your tax irs

Effortlessly Prepare You Must Complete This Form If You Are Required To Deposit On A Semiweekly Schedule Or If Your Tax Irs on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a great environmentally friendly substitute for traditional printed and signed documents, allowing users to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to generate, modify, and electronically sign your documents promptly without hindrances. Manage You Must Complete This Form If You Are Required To Deposit On A Semiweekly Schedule Or If Your Tax Irs on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and Electronically Sign You Must Complete This Form If You Are Required To Deposit On A Semiweekly Schedule Or If Your Tax Irs with Ease

- Obtain You Must Complete This Form If You Are Required To Deposit On A Semiweekly Schedule Or If Your Tax Irs and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional pen-and-ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form, either by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your preference. Edit and electronically sign You Must Complete This Form If You Are Required To Deposit On A Semiweekly Schedule Or If Your Tax Irs and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the you must complete this form if you are required to deposit on a semiweekly schedule or if your tax irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it support semiweekly document management?

airSlate SignNow is a user-friendly eSignature solution that allows businesses to efficiently send and eSign documents. With features designed for organizations requiring semiweekly processing, it streamlines workflows, enabling teams to complete necessary paperwork twice a week without hassle.

-

How can airSlate SignNow help me manage semiweekly tasks more effectively?

By implementing airSlate SignNow, you can automate your semiweekly tasks, reducing the time spent on document handling. Its signature workflows and reminder features ensure that your documents are signed and processed on schedule, helping you stay organized and efficient.

-

What are the pricing plans for airSlate SignNow when dealing with semiweekly needs?

airSlate SignNow offers flexible pricing plans suitable for businesses with semiweekly document handling requirements. Whether you're a small startup or a large enterprise, you can choose a plan that meets your frequency of use without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for semiweekly operations?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and more, enhancing your semiweekly operations. These integrations allow you to pull documents from your existing systems, making it easy to manage your eSigning process.

-

What are the key features of airSlate SignNow for semiweekly use?

Key features of airSlate SignNow for semiweekly use include customizable templates, automated reminders, and team collaboration options. These features help simplify the signing process and ensure that your team stays on track with important documents that need attention regularly.

-

How secure is airSlate SignNow for semiweekly document signing?

Security is a priority for airSlate SignNow, which employs industry-standard encryption and compliance measures. This ensures that your semiweekly document signing occurs in a secure environment, protecting sensitive information from unauthorized access.

-

What benefits does airSlate SignNow provide for small businesses with semiweekly needs?

For small businesses managing semiweekly tasks, airSlate SignNow offers a cost-effective solution that enhances efficiency. It reduces paperwork, accelerates the signing process, and allows team members to focus on core tasks rather than getting bogged down in administrative duties.

Get more for You Must Complete This Form If You Are Required To Deposit On A Semiweekly Schedule Or If Your Tax Irs

- Affidavit of mailing delaware 497302414 form

- Final order for appointment of co guardians of the person and property delaware form

- Final order for appointment of guardians of the person delaware form

- Notice guardian form

- Notice of petition for appointment of guardians of the person delaware form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497302419 form

- Delaware annual statement 497302420 form

- Notices resolutions simple stock ledger and certificate delaware form

Find out other You Must Complete This Form If You Are Required To Deposit On A Semiweekly Schedule Or If Your Tax Irs

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT