Nrcc Lti 03 E Form

What is the Nrcc Lti 03 E

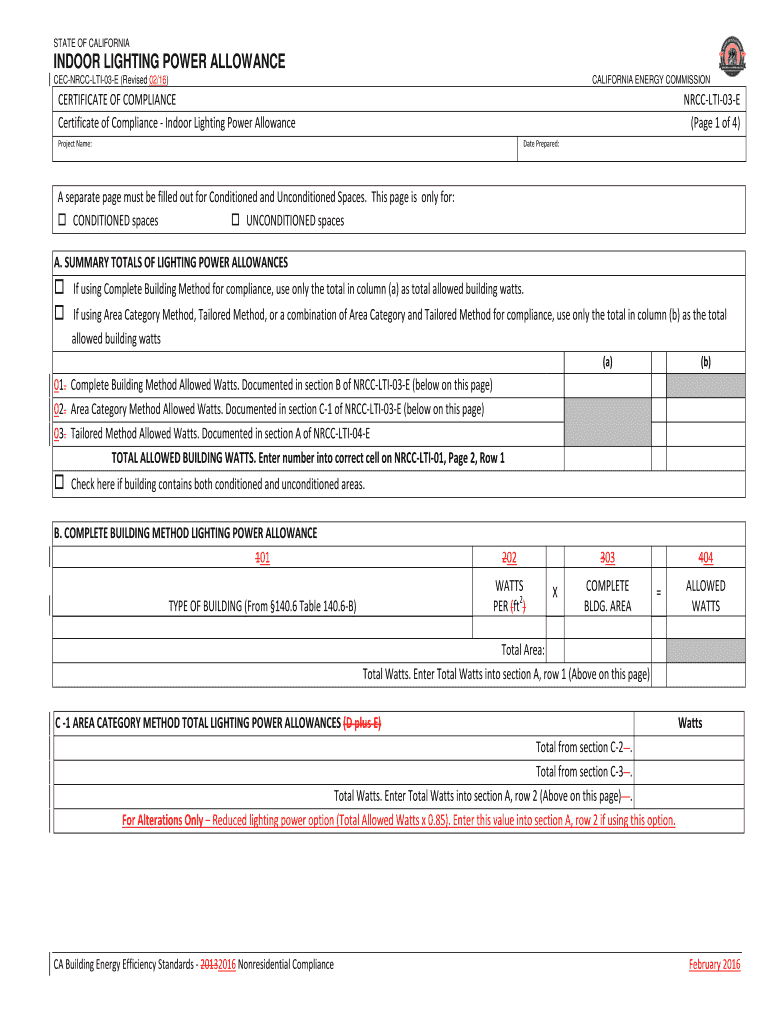

The Nrcc Lti 03 E is a specific form used for reporting certain tax-related information to the IRS. This form is essential for individuals and businesses who need to disclose specific financial details as part of their tax obligations. Understanding the purpose of the Nrcc Lti 03 E is crucial for compliance with federal tax regulations.

How to use the Nrcc Lti 03 E

Using the Nrcc Lti 03 E involves accurately filling out the required fields with relevant information. This form typically requires details such as income, deductions, and other pertinent financial data. It is important to follow the instructions closely to ensure that all information is reported correctly, as inaccuracies can lead to delays or penalties.

Steps to complete the Nrcc Lti 03 E

Completing the Nrcc Lti 03 E involves several key steps:

- Gather all necessary financial documents, including income statements and deduction records.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the completed form for any errors or omissions before submission.

- Submit the form according to the guidelines, either electronically or by mail.

Legal use of the Nrcc Lti 03 E

The legal use of the Nrcc Lti 03 E is governed by IRS regulations, which stipulate that the information reported must be truthful and complete. Failure to comply with these regulations can result in legal penalties. It is essential to ensure that the form is used solely for its intended purpose and that all information provided adheres to federal guidelines.

Filing Deadlines / Important Dates

Filing deadlines for the Nrcc Lti 03 E are crucial to ensure compliance with tax regulations. Typically, the form must be submitted by the annual tax filing deadline, which is usually April 15 for most individuals. However, specific deadlines may vary based on individual circumstances, such as extensions or specific tax situations.

Form Submission Methods (Online / Mail / In-Person)

The Nrcc Lti 03 E can be submitted using various methods, depending on the preferences of the filer:

- Online Submission: Many individuals choose to file electronically using tax software or through the IRS e-file system.

- Mail Submission: The form can also be printed and mailed to the appropriate IRS address.

- In-Person Submission: In certain cases, individuals may opt to submit the form in person at designated IRS offices.

Quick guide on how to complete cec nrcc lti 03 e revised 0216 energy ca

Effortlessly Prepare Nrcc Lti 03 E on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Nrcc Lti 03 E on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Nrcc Lti 03 E with Ease

- Find Nrcc Lti 03 E and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes requiring new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Nrcc Lti 03 E and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cec nrcc lti 03 e revised 0216 energy ca

How to create an electronic signature for your Cec Nrcc Lti 03 E Revised 0216 Energy Ca in the online mode

How to create an electronic signature for the Cec Nrcc Lti 03 E Revised 0216 Energy Ca in Chrome

How to create an electronic signature for signing the Cec Nrcc Lti 03 E Revised 0216 Energy Ca in Gmail

How to make an eSignature for the Cec Nrcc Lti 03 E Revised 0216 Energy Ca right from your smartphone

How to make an electronic signature for the Cec Nrcc Lti 03 E Revised 0216 Energy Ca on iOS

How to create an eSignature for the Cec Nrcc Lti 03 E Revised 0216 Energy Ca on Android devices

People also ask

-

What is the e lti 03 and how does it work?

The e lti 03 is a part of the airSlate SignNow platform designed to enhance document signing and management. It simplifies the process by allowing users to send, sign, and store documents securely in one place, making it ideal for businesses looking to streamline their operations.

-

What are the key features of airSlate SignNow's e lti 03?

The e lti 03 offers various features such as customizable templates, team collaboration tools, and real-time tracking of document status. It also includes powerful integrations with other applications, improving workflow efficiency for users.

-

Is the e lti 03 cost-effective compared to other eSignature solutions?

Absolutely! The e lti 03 provides a budget-friendly solution for businesses of all sizes. With its flexible pricing plans and robust capabilities, companies can save signNowly while enhancing their document management processes.

-

How can the e lti 03 benefit my business?

By utilizing the e lti 03, your business can increase efficiency in document handling and improve compliance with a secure eSignature solution. It enhances customer experience by facilitating faster transaction processes, ultimately driving better customer satisfaction.

-

What integrations are available for the e lti 03?

The e lti 03 integrates seamlessly with numerous popular business applications such as Salesforce, Google Workspace, and Dropbox. These integrations enable users to streamline their workflows and maintain a unified ecosystem for document management.

-

Is the e lti 03 secure for sensitive documents?

Yes, security is a top priority for the e lti 03. It employs advanced encryption and complies with industry regulations to ensure that your sensitive documents are protected from unauthorized access.

-

Can I customize the e lti 03 templates for my business?

Definitely! The e lti 03 allows you to create and customize templates that align with your brand and needs. This feature helps in maintaining consistency in your documents while saving time during the signing process.

Get more for Nrcc Lti 03 E

- Fsco form

- Temtrol ahu manual form

- Form ucc1ad

- Joint agreement to affirm independent relationship for certain building and construction workers form

- Affidavit annual financial report form

- Levitin family endowed scholarship norfolk state university nsu form

- Consultant agreement template form

- Consultancy service agreement template form

Find out other Nrcc Lti 03 E

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy