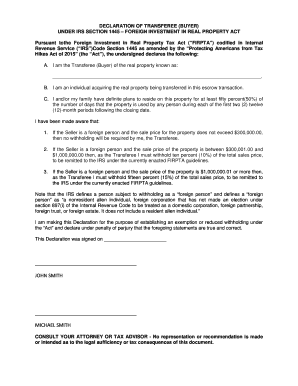

Irs Notice 1445 Form

What is the IRS Notice 1445?

The IRS Notice 1445 is a document issued by the Internal Revenue Service that provides important information regarding the Economic Impact Payments (EIP) provided to eligible individuals during specific periods, including 2021. This notice serves as a record of the payment amount received and is essential for taxpayers to reference when filing their tax returns. Understanding the details outlined in the notice is crucial for accurate tax reporting and compliance.

How to Use the IRS Notice 1445

To effectively use the IRS Notice 1445, taxpayers should keep it in a safe place along with their tax documents. The notice contains critical information such as the payment amount and the method of payment, which are necessary for completing tax returns. When preparing taxes, individuals should refer to this notice to ensure they report any Economic Impact Payments correctly, as this may affect their tax liability or refund.

Steps to Complete the IRS Notice 1445

Completing the IRS Notice 1445 involves several straightforward steps:

- Review the notice for accuracy, ensuring that the payment amount matches what was received.

- Keep the notice with your tax documents for reference when filing your tax return.

- If there are discrepancies, contact the IRS for clarification or correction.

Following these steps helps ensure that your tax filings are accurate and compliant with IRS regulations.

Legal Use of the IRS Notice 1445

The IRS Notice 1445 is legally recognized as a valid document that confirms the receipt of Economic Impact Payments. Taxpayers must use this notice to substantiate their claims on tax returns. Proper use of the notice ensures compliance with tax laws and regulations, helping to avoid potential penalties or issues with the IRS.

Key Elements of the IRS Notice 1445

Key elements of the IRS Notice 1445 include:

- Payment Amount: The total amount of the Economic Impact Payment received.

- Payment Date: The date when the payment was issued.

- Payment Method: Information on whether the payment was made via direct deposit or check.

- Tax Year: The tax year for which the payment applies, typically noted in the notice.

These elements are essential for accurate tax reporting and should be carefully reviewed by taxpayers.

Filing Deadlines / Important Dates

Filing deadlines related to the IRS Notice 1445 are crucial for taxpayers to observe. Generally, tax returns must be filed by April 15 of the following year, but specific deadlines may vary based on individual circumstances or extensions. It is important to stay informed about any changes to these dates, especially during tax season, to ensure timely compliance.

Quick guide on how to complete irs notice 1445

Complete Irs Notice 1445 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an optimal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents quickly without delays. Handle Irs Notice 1445 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to revise and eSign Irs Notice 1445 without effort

- Locate Irs Notice 1445 and click on Get Form to begin.

- Use the tools we provide to finalize your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or an invitation link, or download it to your computer.

Leave behind issues of lost or misfiled documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Irs Notice 1445 and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs notice 1445

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is notice 1445 IRS and why is it important for businesses?

Notice 1445 IRS is a notification sent by the IRS to inform taxpayers of their filing and tax responsibilities. Understanding this notice is crucial for businesses to ensure compliance and avoid penalties. By using airSlate SignNow, you can easily manage and eSign important documents related to your tax filings, streamlining your business operations.

-

How can airSlate SignNow help me with notice 1445 IRS?

airSlate SignNow offers an intuitive platform for sending and eSigning documents, making it easier to respond to notice 1445 IRS efficiently. With our features, you can digitally sign responses or related forms, ensuring that your submissions are timely and secure. This can signNowly reduce the stress associated with tax notifications.

-

What features does airSlate SignNow offer that are relevant to handling notice 1445 IRS?

AirSlate SignNow provides features such as document templates, electronic signatures, and secure storage. These tools enable you to quickly prepare and send necessary responses to notice 1445 IRS. Our platform's user-friendly interface also aids in tracking the status of your documents, ensuring you don't miss critical deadlines.

-

Is airSlate SignNow cost-effective for handling tax notices like notice 1445 IRS?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. The pricing structure is competitive, and its features help you save time and reduce costs when handling notices such as notice 1445 IRS. By streamlining document management, you can focus more on your business rather than paperwork.

-

Can I integrate airSlate SignNow with my existing software for tax management related to notice 1445 IRS?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax management software. This allows you to manage notice 1445 IRS and other documents directly from your preferred tools, enhancing your workflow and ensuring that all aspects of document handling are synchronized.

-

What are the benefits of using airSlate SignNow for notice 1445 IRS over traditional methods?

Using airSlate SignNow for notice 1445 IRS delivers numerous benefits compared to traditional methods, such as faster processing times, reduced paper use, and enhanced security. Digital signatures are legally binding, which simplifies compliance requirements. Additionally, you can access your documents from anywhere, making it easier to manage your tax responsibilities.

-

How secure is airSlate SignNow when dealing with sensitive documents like notice 1445 IRS?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and regulatory compliance measures to protect sensitive documents, including those related to notice 1445 IRS. You can trust that your information remains confidential and secure while utilizing our services.

Get more for Irs Notice 1445

- Software development agreement priori form

- Business law funeral service law ftc ampamp ethics flashcards form

- Form of subscription agreement used in the secgov

- Application for parts and service credit account utility trailer form

- Refusal of offer of employment form

- Affidavit of character accompanying application for license to do business in some manner form

- Affidavit of character reference in connection with gun or form

- Before me the undersigned authority on this day personally form

Find out other Irs Notice 1445

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure