Schmates Home Rentals 2015-2026

What is the Schmates Home Rentals

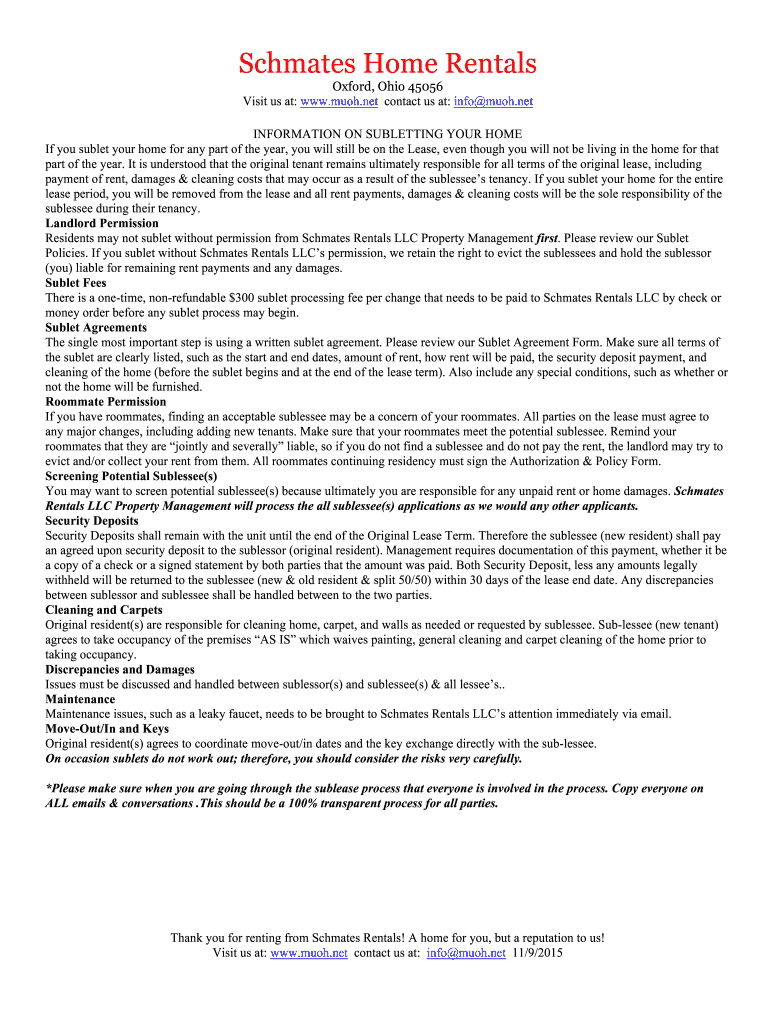

The Schmates Home Rentals form serves as a crucial document for individuals and businesses involved in renting properties. This form outlines the terms and conditions of rental agreements, ensuring that both landlords and tenants understand their rights and responsibilities. It typically includes details such as property descriptions, rental amounts, lease duration, and any specific rules that apply to the rental. Understanding this form is essential for anyone looking to navigate the rental market effectively.

How to use the Schmates Home Rentals

Using the Schmates Home Rentals form involves several key steps. First, gather all necessary information about the property and the parties involved. This includes the names of the landlord and tenant, property address, rental price, and duration of the lease. Next, fill out the form accurately, ensuring all details are clear and precise. Once completed, both parties should review the document to confirm agreement on all terms. Finally, the form must be signed by both parties to make it legally binding.

Key elements of the Schmates Home Rentals

Several key elements are essential to the Schmates Home Rentals form. These include:

- Property Information: A detailed description of the rental property, including its address and any unique features.

- Rental Terms: The agreed-upon rental price, payment schedule, and lease duration.

- Responsibilities: Clear delineation of responsibilities for both the landlord and tenant regarding maintenance and repairs.

- Signatures: Signatures from both parties are required to validate the agreement.

Legal use of the Schmates Home Rentals

The legal use of the Schmates Home Rentals form is governed by state and federal laws. It is essential that the form complies with local regulations to ensure its validity. This includes adhering to laws regarding lease agreements, tenant rights, and eviction processes. Additionally, both parties should retain copies of the signed form for their records, as this can be crucial in case of disputes.

Steps to complete the Schmates Home Rentals

Completing the Schmates Home Rentals form involves a systematic approach:

- Collect all necessary information about the rental property and parties involved.

- Fill out the form with accurate details, ensuring clarity.

- Review the completed form with all parties to confirm agreement.

- Sign the form to make it legally binding.

- Distribute copies to all parties for their records.

Examples of using the Schmates Home Rentals

Examples of using the Schmates Home Rentals form can vary widely. For instance, a landlord may use it to rent out a single-family home, specifying the rental terms and conditions. Alternatively, a property management company might utilize the form for multiple rental units, tailoring the details for each specific property. These examples illustrate the versatility of the form in different rental scenarios.

Quick guide on how to complete downlaod the sublease policy here schmates home rentals llc

Cross your t's and dot your i's on Schmates Home Rentals

Negotiating contracts, overseeing listings, organizing calls, and viewings—realtors and real estate professionals juggle a multitude of responsibilities each day. Many of these responsibilities entail a signNow amount of paperwork, such as Schmates Home Rentals, that must be completed according to established deadlines and with utmost precision.

airSlate SignNow is a comprehensive solution designed to assist real estate professionals in alleviating the burden of paperwork, allowing them to focus more on their clients’ goals throughout the negotiation process and securing the most favorable terms for the agreement.

How to accomplish Schmates Home Rentals with airSlate SignNow:

- Navigate to the Schmates Home Rentals page or utilize our library’s search options to locate the form you require.

- Click Get form—you will be promptly directed to the editor.

- Begin completing the document by selecting fillable fields and inputting your information into them.

- Add additional text and modify its settings if necessary.

- Select the Sign option in the upper toolbar to create your electronic signature.

- Explore other features that can enhance and annotate your form, such as drawing, highlighting, inserting shapes, and more.

- Choose the comment section and provide feedback about your form.

- Conclude the process by downloading, sharing, or sending your form to your specified users or organizations.

Eliminate paper entirely and simplify the homebuying process with our user-friendly and robust solution. Experience improved convenience when completing Schmates Home Rentals and other real estate documents online. Give our tool a try!

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How likely are you to win a car from filling out a form at a mall? Who drives the new car home? What are your chances to win another car again?

I am going to get pretty literal here. Please forgive meHow likely are you to win a car from filling out a form at a mall? In the US, at least, this is usually spelled out somewhere on the form or on a website listed on the form. If it is not, you could ask (and may or may not get a truthful answer). If none of this works, you could probably be able to guess using a few factors: * How many people take the time to stop and enter (what percentage of passers-by, multiplied by amount of typical or expected foot-traffic)?* Are multiple entries allowed? * How long will entries be accepted before the drawing? As a rule of thumb, if the odds aren’t stated (and usually, even if they are) the odds are probably staggering. If you multiply the amount of time it takes to fill out the form by the amount of forms you would have to fill-out before you had an even 1% chance of winning the car, you would likely do better using that time to get a second job. Oh, and lastly, realize that the reason they are enticing you with the chance to win a car is that they are collecting your personal information on the form. It usually is quite a cheap way to generate a LOT of personal data, add you to mailing/dialing lists, etc. They folks running the drawing often gather another great bit of psychology about you: person who fills out form likes to enter “something for nothing” type contests (the drawing itself). This can be valuable to advertisers.Who drives the new car home? By definition of “home” the owner (presumably the winner) would drive the car “home”. If the car is driven to your house by an employee of the company running the lottery, they would just be driving the car to the winners residence…not their “home”.Frankly, I am not sure of what is meant by this question. I would assume that any winner of the drawing would either pick up the vehicle and drive it themselves away from the drawing or other site where the prize was moved to, possibly prepped for delivery tot he winner, or someone would deliver it to the winner’s home by driving it or trucking it there.What are your chances to win another car again? Your chances of winning the next drawing you entered would be EXACTLY the same as they would be had you lost the previous one, as specified in item number one. The odds of winning/losing do not change based on previous outcome. Think about it this way: If I just flipped a coin and it landed on “heads” 50 times in a row, what are the chances that it will be “heads” on the 51st attempt? EXACTLY (assuming there is nothing about the coin or flip that favors one side over the other) 1 in 2 or 50%, just as it was the first flip, just as it will be on the 51st millionth.Now the probability of winning 2 drawings, each with 1 million entries is staggeringly small. But they are two separate events, each governed independently by their own set of probabilities. Landing on heads 51 times in a row or winning 2 cars in consecutive drawings would be matters of remarkable coincidence: respectively 50 1 in 2 or 2 one in a million events happening to share the same outcome.Good luck

-

How did you go to start your journey to the United States? What forms did you fill out? How long did it take? My best friend wants to come here and I will help him until he gets his green card.

I worked hard at school to get good grades, went to university, studied hard, graduated, got a series of better and better jobs, and finally transferred across as an international manager under an L1-A visa (executive management).After a year my lawyer submitted my green card paperwork, and a few months later I was approved.Your friends experience may differ - there are MANY ways of ending up with a green card - hard work, education, and business success is one of the easiest, but not the only way.You can be lucky (diversity lottery), rich (investment), talented (internationally recognised artists, athletes and scientists), or have family in the USA.ALL these options require you to either pay a lawyer, or actually learn the process yourself.Your friend should start by obtaining a visa which allows them to legally reside and work in the USA - that’s the first step in the process.Simply “wanting to come to the USA” isn’t enough - it’s a start. Now your friend needs to learn the process and apply themselves.U.S. Visas

Create this form in 5 minutes!

How to create an eSignature for the downlaod the sublease policy here schmates home rentals llc

How to generate an electronic signature for your Downlaod The Sublease Policy Here Schmates Home Rentals Llc in the online mode

How to generate an eSignature for your Downlaod The Sublease Policy Here Schmates Home Rentals Llc in Chrome

How to generate an electronic signature for signing the Downlaod The Sublease Policy Here Schmates Home Rentals Llc in Gmail

How to make an eSignature for the Downlaod The Sublease Policy Here Schmates Home Rentals Llc right from your mobile device

How to generate an electronic signature for the Downlaod The Sublease Policy Here Schmates Home Rentals Llc on iOS devices

How to generate an eSignature for the Downlaod The Sublease Policy Here Schmates Home Rentals Llc on Android devices

People also ask

-

What is the 2015 schmates search feature in airSlate SignNow?

The 2015 schmates search feature in airSlate SignNow allows users to find specific documents and contracts quickly. This functionality boosts efficiency by enabling easy access to essential files in just a few clicks, simplifying the document management process.

-

How does airSlate SignNow ensure document security during a 2015 schmates search?

During a 2015 schmates search, airSlate SignNow employs advanced encryption protocols to protect your documents. This means your sensitive information remains secure, ensuring peace of mind while utilizing the platform.

-

What are the pricing options for airSlate SignNow regarding the 2015 schmates search functionality?

AirSlate SignNow offers competitive pricing options that include the full suite of features, including the 2015 schmates search. Plans vary based on user needs and organizational size, ensuring that businesses of all sizes can access this valuable tool.

-

Can I integrate airSlate SignNow with other applications while using the 2015 schmates search?

Yes, airSlate SignNow supports integration with various applications. When using the 2015 schmates search, you can easily connect to platforms like Google Drive and Dropbox, enhancing your document workflow and accessibility.

-

What benefits does the 2015 schmates search provide for businesses?

The 2015 schmates search feature enhances productivity by minimizing the time spent scouring for documents. Businesses can leverage this efficiency to process transactions faster, improve client communication, and streamline their workflow.

-

Is the 2015 schmates search functionality user-friendly for new users?

Absolutely! AirSlate SignNow is designed with user-friendliness in mind. The 2015 schmates search feature includes intuitive navigation, making it easy for new users to find their documents without extensive training.

-

How does the 2015 schmates search contribute to document collaboration?

The 2015 schmates search allows multiple users to locate and access documents easily, facilitating better collaboration. Teams can work together on contracts and agreements in real-time, ensuring everyone stays on the same page.

Get more for Schmates Home Rentals

Find out other Schmates Home Rentals

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form