Claim Form Gl5 S

What is the Claim Form GL5 S

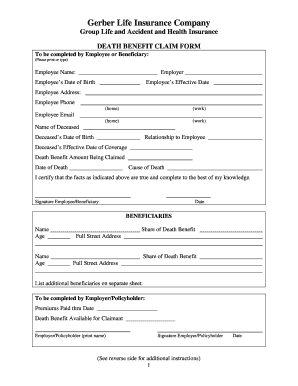

The Claim Form GL5 S is a specific document used to initiate a life insurance death benefit claim. This form is essential for beneficiaries seeking to collect the death benefit from a life insurance policy after the policyholder has passed away. It typically requires detailed information about the deceased, the policy, and the claimant. Understanding the purpose and structure of this form is crucial for ensuring a smooth claims process.

Steps to Complete the Claim Form GL5 S

Completing the Claim Form GL5 S involves several important steps to ensure accuracy and compliance. Here’s a breakdown of the process:

- Gather necessary information about the deceased, including full name, date of birth, and policy number.

- Provide personal details of the claimant, including name, address, and relationship to the deceased.

- Fill out the sections regarding the cause of death and any relevant medical information.

- Sign and date the form to certify that all information provided is accurate and complete.

Double-check all entries before submission to avoid delays in processing your claim.

Required Documents

When submitting the Claim Form GL5 S, several supporting documents are typically required to validate the claim. These may include:

- A certified copy of the death certificate.

- Proof of identity for the claimant, such as a driver's license or passport.

- Any additional documentation requested by the insurance company, such as medical records or policy statements.

Having these documents ready can expedite the claims process and reduce the likelihood of complications.

Form Submission Methods

The Claim Form GL5 S can be submitted through various methods, depending on the preferences of the insurance company. Common submission options include:

- Online submission via the insurance company's website or a secure portal.

- Mailing the completed form and supporting documents to the designated claims address.

- In-person delivery at a local office, if available.

Check with the specific life insurance company for their preferred submission method to ensure proper handling of your claim.

Legal Use of the Claim Form GL5 S

The Claim Form GL5 S must be completed and submitted in accordance with applicable laws and regulations governing life insurance claims. The form serves as a legal document that initiates the claims process and establishes the claimant's right to the death benefit. Ensuring compliance with state-specific laws and insurance regulations is essential for a valid claim.

How to Obtain the Claim Form GL5 S

The Claim Form GL5 S can typically be obtained through the following channels:

- Directly from the life insurance company’s website, where it may be available for download.

- By contacting the insurance company’s customer service for assistance.

- Visiting a local office of the insurance provider, if applicable.

It is important to ensure that you are using the most current version of the form to avoid any issues during the claims process.

Quick guide on how to complete claim form gl5 s

Complete Claim Form Gl5 S seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and effectively. Manage Claim Form Gl5 S on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and electronically sign Claim Form Gl5 S without hassle

- Obtain Claim Form Gl5 S and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Claim Form Gl5 S and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the claim form gl5 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a life insurance death benefit claim?

A life insurance death benefit claim is a request made by the beneficiaries of a policyholder who has passed away, seeking the financial benefit specified in the life insurance policy. It is essential to provide the necessary documentation, including a death certificate, to process the claim efficiently. Understanding how to file a life insurance death benefit claim can help beneficiaries receive funds in a timely manner.

-

How do I file a life insurance death benefit claim?

To file a life insurance death benefit claim, start by contacting the insurance company directly and requesting a claim form. Fill out the form with accurate information and submit it along with the required documents, such as the death certificate and policy number. Many companies offer online options, making it easier to submit your life insurance death benefit claim.

-

What documents are needed for a life insurance death benefit claim?

When filing a life insurance death benefit claim, you typically need the deceased's insurance policy number, a certified copy of the death certificate, and identification of the claimant. Additional documents may include medical records or proof of relationship to the deceased. Ensure you gather all necessary documents to expedite the life insurance death benefit claim process.

-

How long does it take to process a life insurance death benefit claim?

The processing time for a life insurance death benefit claim can vary signNowly, often taking anywhere from a few days to several weeks. Factors such as the complexity of the case, the documentation submitted, and the insurance company's policies can all influence the timeline. It's recommended to follow up with the insurer to check the status of your life insurance death benefit claim.

-

Are there any fees associated with filing a life insurance death benefit claim?

Generally, there are no direct fees to file a life insurance death benefit claim, as insurers handle this process as part of their service. However, you may incur costs when obtaining required documents, such as certified copies of the death certificate. Review your policy details and consult with your insurance agent to clarify any concerns about costs related to your life insurance death benefit claim.

-

Can I expedite my life insurance death benefit claim?

Yes, you can expedite your life insurance death benefit claim by ensuring that all relevant documentation is complete and submitted promptly. Some insurance companies may offer expedited processing for urgent situations, so it’s essential to communicate your needs clearly when filing your claim. signNow out to your insurer for guidance on how to speed up your life insurance death benefit claim.

-

What if my life insurance death benefit claim is denied?

If your life insurance death benefit claim is denied, you should receive a written explanation from the insurer detailing the reasons for the denial. Common causes include discrepancies in the information provided or policy exclusions. If you believe the denial was unjustified, you can appeal the decision by providing additional evidence or contact your state insurance department for assistance with your life insurance death benefit claim.

Get more for Claim Form Gl5 S

- Iowa notice cure form

- Notice of breach of written lease for violating specific provisions of lease with no right to cure for nonresidential property 497305015 form

- Business credit application iowa form

- Individual credit application iowa form

- Interrogatories to plaintiff for motor vehicle occurrence iowa form

- Interrogatories to defendant for motor vehicle accident iowa form

- Llc notices resolutions and other operations forms package iowa

- Notice of dishonored check civil keywords bad check bounced check iowa form

Find out other Claim Form Gl5 S

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast