BUNKER HILL INSURANCE COMPANY Personal Umbrella Form

What is the Bunker Hill Insurance Company Personal Umbrella?

The Bunker Hill Insurance Company Personal Umbrella is a type of insurance policy designed to provide additional liability coverage beyond what is offered by standard home and auto insurance policies. This coverage acts as a safety net, protecting individuals from significant financial loss in the event of lawsuits or claims that exceed their primary insurance limits. It is particularly beneficial for those with substantial assets or income, as it helps safeguard against potential legal claims resulting from accidents, injuries, or property damage.

How to Obtain the Bunker Hill Insurance Company Personal Umbrella

To obtain a Personal Umbrella policy from Bunker Hill Insurance Company, individuals typically need to follow a straightforward process. First, assess your current insurance needs and determine the amount of additional coverage required. Next, contact Bunker Hill Insurance Company or an authorized agent to discuss your options. They will guide you through the application process, which may involve providing details about your existing insurance policies and personal assets. Once your application is submitted, the company will review it and provide a quote based on your specific circumstances.

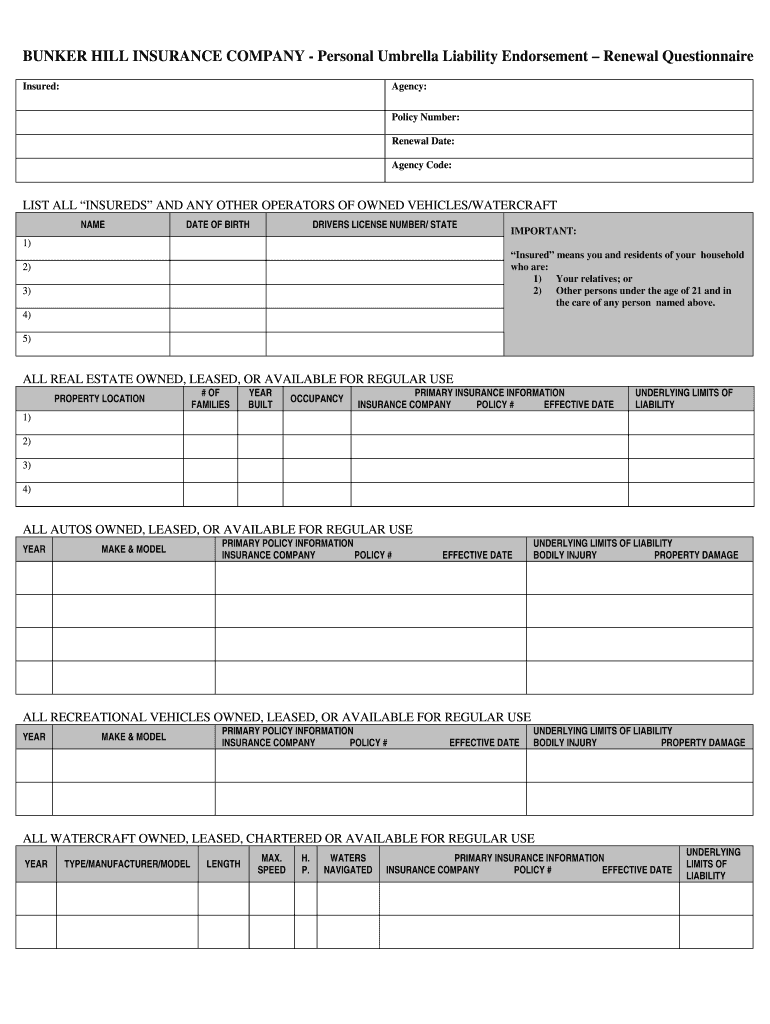

Steps to Complete the Bunker Hill Insurance Company Personal Umbrella

Completing the Bunker Hill Insurance Company Personal Umbrella form involves several key steps. Start by gathering all necessary information, including your current insurance policy details and personal asset information. Fill out the application form accurately, ensuring that all required fields are completed. Review your information for accuracy before submission. Once submitted, keep a copy of the completed form for your records. If required, follow up with your insurance agent to finalize the policy and address any questions or concerns.

Legal Use of the Bunker Hill Insurance Company Personal Umbrella

The legal use of the Bunker Hill Insurance Company Personal Umbrella policy hinges on compliance with state regulations and the terms outlined in the policy itself. It is essential to understand that this type of insurance provides coverage for claims that may arise from various incidents, such as personal injury or property damage. To ensure legal protection, policyholders must maintain their underlying home and auto insurance policies, as the umbrella policy typically requires these as a prerequisite for coverage.

Key Elements of the Bunker Hill Insurance Company Personal Umbrella

Several key elements define the Bunker Hill Insurance Company Personal Umbrella policy. These include the coverage limits, which specify the maximum amount the policy will pay for claims, and the types of incidents covered, such as bodily injury, property damage, and certain legal fees. Additionally, the policy may include exclusions that outline specific situations not covered under the umbrella. Understanding these elements is crucial for policyholders to ensure adequate protection and to make informed decisions regarding their insurance needs.

Examples of Using the Bunker Hill Insurance Company Personal Umbrella

Examples of situations where a Bunker Hill Insurance Company Personal Umbrella policy may be beneficial include severe car accidents resulting in significant medical expenses, or incidents where someone is injured on your property and files a lawsuit. In these cases, if the costs exceed the limits of your primary insurance policies, the umbrella policy would cover the additional expenses, helping to protect your financial assets and providing peace of mind in the face of unexpected events.

Quick guide on how to complete bunker hill insurance company personal umbrella

Complete BUNKER HILL INSURANCE COMPANY Personal Umbrella effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly and efficiently. Manage BUNKER HILL INSURANCE COMPANY Personal Umbrella from any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign BUNKER HILL INSURANCE COMPANY Personal Umbrella with ease

- Find BUNKER HILL INSURANCE COMPANY Personal Umbrella and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign BUNKER HILL INSURANCE COMPANY Personal Umbrella and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bunker hill insurance company personal umbrella

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Bunker Hill Insurance and how does it work?

Bunker Hill Insurance provides a range of insurance options designed to meet diverse needs. It offers coverage for personal and commercial purposes, focusing on ease of access and affordability. With Bunker Hill Insurance, customers can conveniently manage their policies online, ensuring they are well-protected.

-

What types of insurance does Bunker Hill Insurance offer?

Bunker Hill Insurance offers various types of coverage, including auto, home, and business insurance. Each policy is tailored to provide unique benefits and features that cater to specific customer requirements. This comprehensive approach helps individuals and businesses find the right protection for their assets.

-

How can I get a quote for Bunker Hill Insurance?

To get a quote for Bunker Hill Insurance, visit their official website and use their online quote tool. By filling out a simple form with your details, you can receive an estimate based on your specific needs. Comparing quotes helps ensure you find the most suitable coverage at a competitive price.

-

Is Bunker Hill Insurance cost-effective for small businesses?

Yes, Bunker Hill Insurance offers cost-effective solutions specifically designed for small businesses. Their affordable pricing models ensure that even startups can access essential coverage without breaking the bank. With a focus on value, Bunker Hill Insurance helps protect businesses from potential risks.

-

What are the key benefits of using Bunker Hill Insurance?

Bunker Hill Insurance provides numerous benefits, including comprehensive coverage, competitive pricing, and exceptional customer support. Their user-friendly online platform makes managing policies straightforward and efficient. Additionally, Bunker Hill Insurance is committed to offering peace of mind through reliable protection.

-

Can I manage my Bunker Hill Insurance policy online?

Absolutely! Bunker Hill Insurance allows customers to manage their policies online through a secure portal. This includes options to view policy details, make payments, and file claims easily. The online management system enhances customer convenience and ensures 24/7 access to important information.

-

Does Bunker Hill Insurance integrate with any other platforms?

Yes, Bunker Hill Insurance may integrate with various third-party applications to streamline user experience. This includes tools for billing and claim management that help customers simplify their insurance processes. Check with customer support for more details on available integrations.

Get more for BUNKER HILL INSURANCE COMPANY Personal Umbrella

- Temporary lease agreement to prospective buyer of residence prior to closing illinois form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497306164 form

- Letter from landlord to tenant returning security deposit less deductions illinois form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return illinois form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return illinois form

- Letter from tenant to landlord containing request for permission to sublease illinois form

- Il landlord tenant form

- Illinois sublease form

Find out other BUNKER HILL INSURANCE COMPANY Personal Umbrella

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile