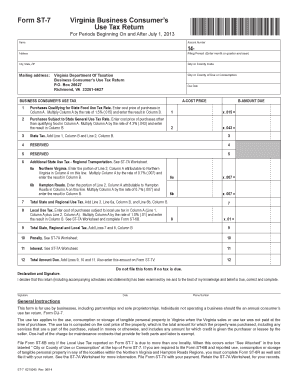

Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia

What is the Form ST-7 Virginia Business Consumer's Use Tax Return?

The Form ST-7 is a tax document used in Virginia for reporting and paying the consumer's use tax. This tax applies to purchases made by businesses that do not pay sales tax at the time of purchase. The form is essential for businesses that acquire tangible personal property or taxable services for use in Virginia, ensuring compliance with state tax regulations.

Steps to Complete the Form ST-7 Virginia Business Consumer's Use Tax Return

Completing the Form ST-7 involves several key steps to ensure accurate reporting:

- Gather Necessary Information: Collect details about your business, including your name, address, and Virginia tax identification number.

- List Purchases: Document all purchases subject to use tax, including dates, descriptions, and amounts.

- Calculate Tax Due: Determine the total use tax owed by applying the appropriate tax rate to the purchase amounts.

- Complete the Form: Fill out the form with the gathered information, ensuring accuracy in all entries.

- Review and Sign: Double-check all information for errors before signing the form to validate it.

How to Obtain the Form ST-7 Virginia Business Consumer's Use Tax Return

The Form ST-7 can be obtained through various methods to accommodate business needs. It is available for download directly from the Virginia Department of Taxation's website. Additionally, businesses may request a physical copy by contacting the department or visiting their local tax office. Ensuring you have the correct and most current version of the form is crucial for compliance.

Legal Use of the Form ST-7 Virginia Business Consumer's Use Tax Return

The Form ST-7 is legally binding when completed and submitted according to Virginia tax laws. It serves as a formal declaration of the use tax owed by the business. To ensure its legal standing, the form must be signed and dated by an authorized representative of the business. Compliance with all state regulations regarding use tax is essential to avoid penalties.

Filing Deadlines / Important Dates

Businesses must adhere to specific deadlines when filing the Form ST-7 to avoid late fees and penalties. Generally, the form is due on the 20th day of the month following the end of the reporting period. It is advisable to keep track of these dates to ensure timely submission, especially during peak tax seasons.

Form Submission Methods

The Form ST-7 can be submitted through various methods to cater to different business preferences:

- Online Submission: Businesses can file electronically through the Virginia Department of Taxation's online portal.

- Mail Submission: Completed forms can be mailed to the appropriate address provided by the Virginia Department of Taxation.

- In-Person Submission: Businesses may also choose to submit the form in person at their local tax office for immediate processing.

Quick guide on how to complete form st 7 virginia business consumer s use tax return tax virginia

Effortlessly Set Up Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia on Any Device

Managing documents online has become widely embraced by companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, enabling you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly and without setbacks. Handle Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia from any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Alter and Electronically Sign Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia Without Effort

- Locate Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important portions of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes just seconds and holds the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any chosen device. Edit and electronically sign Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia to ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 7 virginia business consumer s use tax return tax virginia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia?

Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia is a document that businesses must file to report and pay consumer use tax on purchased goods. This form ensures compliance with Virginia tax laws and helps businesses avoid penalties. Understanding how to correctly complete this form is essential for maintaining good standing with the state.

-

How can airSlate SignNow help me file Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia?

airSlate SignNow provides an efficient platform for completing and eSigning Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia. With our easy-to-use features, you can quickly fill out the form, obtain necessary approvals, and submit it electronically. This streamlines the filing process and minimizes the risk of errors.

-

What are the benefits of using airSlate SignNow for Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia?

Using airSlate SignNow for Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia offers numerous benefits, including time savings and enhanced accuracy. Our platform keeps all your documents organized and easily accessible, helping you manage your tax obligations seamlessly. Additionally, it increases collaboration between team members through efficient document sharing.

-

What are the pricing options for airSlate SignNow when filing Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia?

airSlate SignNow offers flexible pricing plans starting from a basic package to advanced options, catering to businesses of all sizes. Each plan includes features designed to assist in the efficient handling of documents like Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia. You can choose a plan that best fits your filing needs and budget.

-

Is airSlate SignNow easy to integrate with my existing tools for filing Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia?

Yes, airSlate SignNow is designed to integrate seamlessly with various business applications you may already be using. Whether it's your accounting software or document management system, our integration capabilities ensure that you can file Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia without any disruptions to your workflow. This enhances efficiency and productivity across your operations.

-

Can I track the status of my Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all your documents, including Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia. You'll receive notifications at each stage of the document's lifecycle, allowing you to stay informed and ensure timely submissions. This feature adds a level of transparency and accountability to your tax filing process.

-

What security measures does airSlate SignNow have for filing Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia?

Security is a top priority at airSlate SignNow. We implement advanced encryption and secure servers to protect your sensitive data when filing Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia. Our compliance with industry standards ensures that your information remains confidential and safe from unauthorized access.

Get more for Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia

- Bill of sale with warranty for corporate seller indiana form

- Bill of sale without warranty by individual seller indiana form

- Bill of sale without warranty by corporate seller indiana form

- 13 bankruptcy indiana form

- Chapter 13 plan 497307016 form

- Verification of matrix indiana form

- Verification of creditors matrix indiana form

- Verification of creditors matrix indiana 497307019 form

Find out other Form ST 7 Virginia Business Consumer S Use Tax Return Tax Virginia

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word