84 300 Mississippi Department of Revenue Dor Ms Form

What is the 84 300 Mississippi Department of Revenue DOR MS?

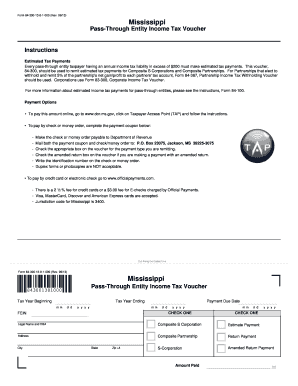

The 84 300 form is a specific document issued by the Mississippi Department of Revenue. It is primarily used for tax purposes, allowing individuals and businesses to report certain financial information. Understanding the purpose of this form is essential for compliance with state tax regulations. It helps ensure that taxpayers fulfill their obligations accurately and on time.

Steps to complete the 84 300 Mississippi Department of Revenue DOR MS

Completing the 84 300 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as income statements and previous tax returns. Next, carefully fill out the form, ensuring all sections are completed with accurate information. After filling it out, review the form for any errors or omissions. Finally, submit the completed form according to the guidelines provided by the Mississippi Department of Revenue.

Legal use of the 84 300 Mississippi Department of Revenue DOR MS

The legal use of the 84 300 form hinges on its compliance with state tax laws. When properly filled out and submitted, this form serves as a legally binding document for tax reporting. It is crucial to adhere to the requirements set forth by the Mississippi Department of Revenue to avoid potential legal issues. Utilizing electronic signature solutions can enhance the form's validity and security during submission.

How to obtain the 84 300 Mississippi Department of Revenue DOR MS

Obtaining the 84 300 form is straightforward. It can be accessed through the official website of the Mississippi Department of Revenue. Additionally, physical copies may be available at local revenue offices. Ensure that you have the most current version of the form to meet all filing requirements.

State-specific rules for the 84 300 Mississippi Department of Revenue DOR MS

Each state has specific regulations governing the use of tax forms, and the 84 300 is no exception. In Mississippi, it is essential to be aware of deadlines for submission, as well as any specific instructions related to the form's completion. Familiarizing yourself with these state-specific rules can help prevent errors and ensure compliance with local tax laws.

Form Submission Methods for the 84 300 Mississippi Department of Revenue DOR MS

The 84 300 form can be submitted through various methods, including online, by mail, or in person. Online submission is often the fastest and most efficient option, allowing for immediate processing. If opting to mail the form, ensure it is sent to the correct address and postmarked by the filing deadline. In-person submissions can be made at designated revenue offices, providing an opportunity for direct assistance if needed.

Quick guide on how to complete 84 300 mississippi department of revenue dor ms

Complete 84 300 Mississippi Department Of Revenue Dor Ms effortlessly on any device

Online document management has gained increasing traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents quickly without unnecessary delays. Manage 84 300 Mississippi Department Of Revenue Dor Ms on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to amend and electronically sign 84 300 Mississippi Department Of Revenue Dor Ms with ease

- Locate 84 300 Mississippi Department Of Revenue Dor Ms and click Access Form to begin.

- Utilize the tools we provide to fulfill your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere moments and holds the same legal status as a conventional wet ink signature.

- Review the details and click on the Finish button to save your amendments.

- Choose how you want to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and electronically sign 84 300 Mississippi Department Of Revenue Dor Ms and guarantee excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 84 300 mississippi department of revenue dor ms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure of airSlate SignNow at the 84 300 feature level?

The pricing for airSlate SignNow varies depending on the features you choose to utilize, including the 84 300 option. Our competitive plans cater to different business needs, ensuring that even small enterprises can have access to advanced signing solutions at an affordable rate.

-

How do the features of airSlate SignNow compare to other eSignature solutions?

airSlate SignNow offers a range of features that stand out against other eSignature solutions, particularly with the 84 300 capabilities. Users benefit from a user-friendly interface, robust security measures, and seamless integrations that streamline document workflows.

-

Can I integrate airSlate SignNow with my existing software systems?

Yes, airSlate SignNow supports various integrations, including popular CRM and document management systems, enhancing the functionality of the 84 300 features. This allows users to maintain their existing workflows while leveraging the full potential of our eSignature tools.

-

What benefits can businesses expect from using airSlate SignNow with the 84 300 platform?

By utilizing airSlate SignNow, businesses can experience improved efficiency and faster turnaround times on document approvals. The 84 300 features provide enhanced tracking and security, ensuring that important documents are managed professionally and securely.

-

Is there a mobile app for airSlate SignNow to use the 84 300 features on the go?

Yes, airSlate SignNow offers a mobile app that allows users to access 84 300 functionalities from their smartphones or tablets. This flexibility ensures that users can manage, send, and sign documents anytime, anywhere, making it convenient for on-the-go professionals.

-

How secure is my data when using airSlate SignNow's 84 300 features?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance measures, ensuring your data remains protected while utilizing the 84 300 features. Our platform adheres to industry standards, giving businesses peace of mind about their sensitive information.

-

What types of documents can be signed using airSlate SignNow with the 84 300 functionalities?

airSlate SignNow supports various document types, including contracts, agreements, and other legal forms, all accessible using the 84 300 features. This versatility allows businesses to handle their documentation efficiently, meeting diverse signing needs effortlessly.

Get more for 84 300 Mississippi Department Of Revenue Dor Ms

- Last will and testament for other persons kansas form

- Notice to beneficiaries of being named in will kansas form

- Estate planning questionnaire and worksheets kansas form

- Document locator and personal information package including burial information form kansas

- Demand to produce copy of will from heir to executor or person in possession of will kansas form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497307777 form

- Bill of sale of automobile and odometer statement kentucky form

- Ky odometer 497307779 form

Find out other 84 300 Mississippi Department Of Revenue Dor Ms

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document