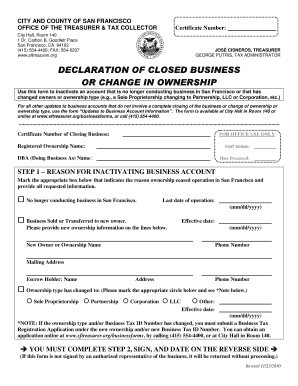

Sftreasurer Form

What is the Sftreasurer

The Sftreasurer is a specific form used primarily for financial reporting and accountability within organizations. It serves as a tool for treasurers to document financial transactions, manage budgets, and ensure compliance with relevant regulations. This form is crucial for maintaining transparency and accuracy in financial operations, making it an essential component for businesses and institutions that require meticulous financial oversight.

How to use the Sftreasurer

Using the Sftreasurer involves several steps to ensure that all necessary information is accurately recorded. Begin by gathering all relevant financial data, including transaction details and budgetary information. Next, fill out the form with precise figures and descriptions. It is important to review the completed form for accuracy before submission. Utilizing digital tools can streamline this process, allowing for easy edits and secure storage of the document.

Steps to complete the Sftreasurer

Completing the Sftreasurer form requires careful attention to detail. Follow these steps for effective completion:

- Gather all necessary financial documents and data.

- Fill in the required fields, ensuring accuracy in all entries.

- Review the form for any errors or omissions.

- Sign the document electronically, if applicable, to validate it.

- Submit the completed form through the designated method, whether online or via mail.

Legal use of the Sftreasurer

The Sftreasurer form must be used in accordance with applicable laws and regulations to ensure its legal validity. Compliance with financial reporting standards and eSignature laws is essential. This includes adhering to the ESIGN Act and UETA, which govern electronic signatures and records. Proper usage not only protects the integrity of the document but also safeguards the organization from potential legal issues.

Key elements of the Sftreasurer

Several key elements are essential for the Sftreasurer form to be effective:

- Accurate Financial Data: All entries must reflect true and current financial information.

- Signature: A valid signature, whether digital or handwritten, is necessary for legal recognition.

- Compliance: Adherence to relevant laws and regulations is critical.

- Documentation: Supporting documents should accompany the form to substantiate the reported figures.

Examples of using the Sftreasurer

The Sftreasurer form can be utilized in various scenarios, such as:

- Documenting annual budgets for nonprofit organizations.

- Tracking financial transactions within corporate entities.

- Preparing financial reports for audits or regulatory compliance.

These examples illustrate the versatility and importance of the Sftreasurer in maintaining financial integrity across different sectors.

Quick guide on how to complete sftreasurer

Quickly Prepare sftreasurer on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly and efficiently. Manage sftreasurer across any platform using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest method to adjust and eSign sftreasurer effortlessly

- Obtain sftreasurer and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your delivery method for the form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you select. Modify and eSign sftreasurer while ensuring outstanding communication throughout the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to sftreasurer

Create this form in 5 minutes!

How to create an eSignature for the sftreasurer

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask sftreasurer

-

What is airSlate SignNow and how does it relate to sftreasurer?

airSlate SignNow is a robust electronic signing solution designed to streamline document workflows. The sftreasurer keyword ties into how airSlate SignNow supports treasurers in managing financial documents effectively, ensuring compliance and security in eSigning.

-

How much does airSlate SignNow cost for users looking for sftreasurer features?

Pricing for airSlate SignNow varies based on the plan selected, but it is designed to be cost-effective for all users, including those needing specialized sftreasurer functionalities. Each plan offers essential features that treasurers can leverage for efficient document management.

-

What features does airSlate SignNow offer for sftreasurer users?

airSlate SignNow provides a range of features including document templates, secure eSigning, and automated workflows, ideal for sftreasurer professionals. These tools help improve accuracy and save time in financial document processing.

-

How can airSlate SignNow benefit my organization as a sftreasurer?

By using airSlate SignNow, sftreasurer professionals can enhance their document handling efficiency and ensure timely approval of critical financial documents. The platform increases transparency and reduces the risk of document errors.

-

Does airSlate SignNow integrate with other software that sftreasurers use?

Yes, airSlate SignNow offers integrations with popular accounting, CRM, and financial platforms that sftreasurers often utilize. This compatibility ensures seamless workflows and improved productivity across your financial operations.

-

Is airSlate SignNow secure for sensitive documents handled by sftreasurer?

Absolutely, airSlate SignNow employs top-tier security measures, including encryption and compliance with industry standards to protect the sensitive documents sftreasurer professionals handle. Your data remains secure throughout the signing process.

-

Can airSlate SignNow be used for international transactions by sftreasurers?

Yes, airSlate SignNow supports international eSigning, making it a great tool for sftreasurers involved in global business transactions. Its user-friendly interface facilitates signings regardless of geographic location.

Get more for sftreasurer

- Estate planning questionnaire and worksheets utah form

- Document locator and personal information package including burial information form utah

- Demand to produce copy of will from heir to executor or person in possession of will utah form

- Chattel mortgage on mobile home virginia form

- Chart workers compensation form

- Witness subpoena statement form

- Va lump form

- Chart foot print form

Find out other sftreasurer

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free

- How To Sign Kentucky Affidavit of Heirship

- Can I Sign Louisiana Affidavit of Heirship

- How To Sign New Jersey Affidavit of Heirship

- Sign Oklahoma Affidavit of Heirship Myself

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament