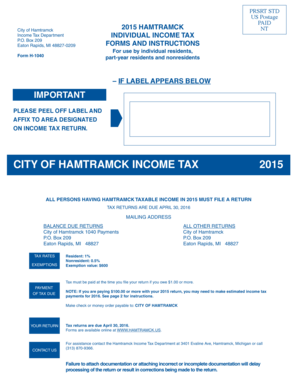

CITY of HAMTRAMCK INCOME TAX Form

What is the City of Hamtramck Income Tax

The City of Hamtramck Income Tax is a municipal tax levied on the income of residents and non-residents who work within the city limits. This tax is essential for funding local services and infrastructure. The tax rate varies depending on whether the taxpayer is a resident or a non-resident, with residents typically facing a higher rate. Understanding this tax is crucial for compliance and financial planning.

Steps to Complete the City of Hamtramck Income Tax

Completing the City of Hamtramck Income Tax form involves several key steps:

- Gather necessary documentation, including W-2 forms, 1099s, and other income statements.

- Access the City of Hamtramck Income Tax form, which can be obtained online or at local government offices.

- Fill out the form accurately, ensuring all income sources are reported and deductions are applied where applicable.

- Review the completed form for accuracy and completeness.

- Submit the form through the preferred method: online, by mail, or in person.

Required Documents

To complete the City of Hamtramck Income Tax form, several documents are necessary:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of additional income, such as rental or investment income.

- Proof of any deductions or credits claimed, such as receipts for business expenses.

Form Submission Methods

The City of Hamtramck Income Tax form can be submitted in various ways, providing flexibility for taxpayers:

- Online: Many residents opt to file electronically, which can streamline the process.

- By Mail: Completed forms can be printed and mailed to the city’s tax office.

- In-Person: Taxpayers can also submit their forms directly at designated city offices.

Penalties for Non-Compliance

Failing to comply with the City of Hamtramck Income Tax regulations can result in significant penalties. These may include:

- Fines for late filing or payment.

- Interest on unpaid taxes, which accumulates over time.

- Potential legal action for persistent non-compliance.

Eligibility Criteria

Eligibility for the City of Hamtramck Income Tax applies to individuals who meet specific criteria:

- Residents of Hamtramck who earn income.

- Non-residents who work within the city limits and earn income.

- Individuals who may have other forms of taxable income, such as business or rental income.

Quick guide on how to complete city of hamtramck income tax

Accomplish CITY OF HAMTRAMCK INCOME TAX effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely archive it online. airSlate SignNow provides you with all the resources necessary to generate, modify, and electronically sign your papers swiftly and without hold-ups. Handle CITY OF HAMTRAMCK INCOME TAX on any device with airSlate SignNow’s Android or iOS applications and enhance any document-focused procedure today.

How to modify and eSign CITY OF HAMTRAMCK INCOME TAX without effort

- Obtain CITY OF HAMTRAMCK INCOME TAX and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to store your modifications.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Modify and eSign CITY OF HAMTRAMCK INCOME TAX and guarantee excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of hamtramck income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CITY OF HAMTRAMCK INCOME TAX and who is subject to it?

The CITY OF HAMTRAMCK INCOME TAX is a tax imposed on individuals and businesses residing or operating within Hamtramck. Residents and non-residents who earn income in the city are subject to this tax, which is used to fund local services and infrastructure. Understanding your obligations can help you navigate your tax responsibilities effectively.

-

How can airSlate SignNow help with filling out CITY OF HAMTRAMCK INCOME TAX forms?

With airSlate SignNow, users can easily fill out CITY OF HAMTRAMCK INCOME TAX forms electronically. The platform provides templates and a user-friendly interface, making the process more efficient and ensuring you don’t miss any important information. Additionally, eSigning features allow for quicker submissions.

-

What are the pricing options for airSlate SignNow related to CITY OF HAMTRAMCK INCOME TAX services?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those related to CITY OF HAMTRAMCK INCOME TAX services. Each plan provides different features, making it easy for you to choose one that fits your budget while ensuring you manage your tax documents efficiently.

-

Is it safe to use airSlate SignNow for eSigning CITY OF HAMTRAMCK INCOME TAX documents?

Yes, using airSlate SignNow for eSigning CITY OF HAMTRAMCK INCOME TAX documents is safe and secure. The platform employs robust encryption and security protocols to protect sensitive information. This ensures that your tax documents are handled with the highest level of security.

-

Can airSlate SignNow integrate with other accounting software for managing CITY OF HAMTRAMCK INCOME TAX?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software, making it easier to manage your CITY OF HAMTRAMCK INCOME TAX documentation and filings. These integrations simplify the tracking of expenses and income, helping you stay organized.

-

What benefits do businesses gain from using airSlate SignNow for CITY OF HAMTRAMCK INCOME TAX?

Businesses can benefit signNowly from using airSlate SignNow for CITY OF HAMTRAMCK INCOME TAX by streamlining their document management. The platform minimizes paperwork, reduces errors, and speeds up the signing process. This efficiency allows businesses to focus more on growth rather than getting bogged down in tax paperwork.

-

How quickly can I submit my CITY OF HAMTRAMCK INCOME TAX paperwork using airSlate SignNow?

With airSlate SignNow, submitting your CITY OF HAMTRAMCK INCOME TAX paperwork can be done quite rapidly. The platform’s intuitive interface and eSigning capabilities allow for quick completion and submission of documents, making it easier for you to meet deadlines and avoid penalties.

Get more for CITY OF HAMTRAMCK INCOME TAX

Find out other CITY OF HAMTRAMCK INCOME TAX

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document